Synthetic positions replicate the payoff of an underlying asset by combining options, enabling traders to simulate long or short stock positions with limited capital. Butterfly spreads involve buying and selling multiple options at different strike prices, designed to profit from minimal price movement and low volatility. Explore the distinct strategies and risk profiles to enhance your trading toolkit.

Why it is important

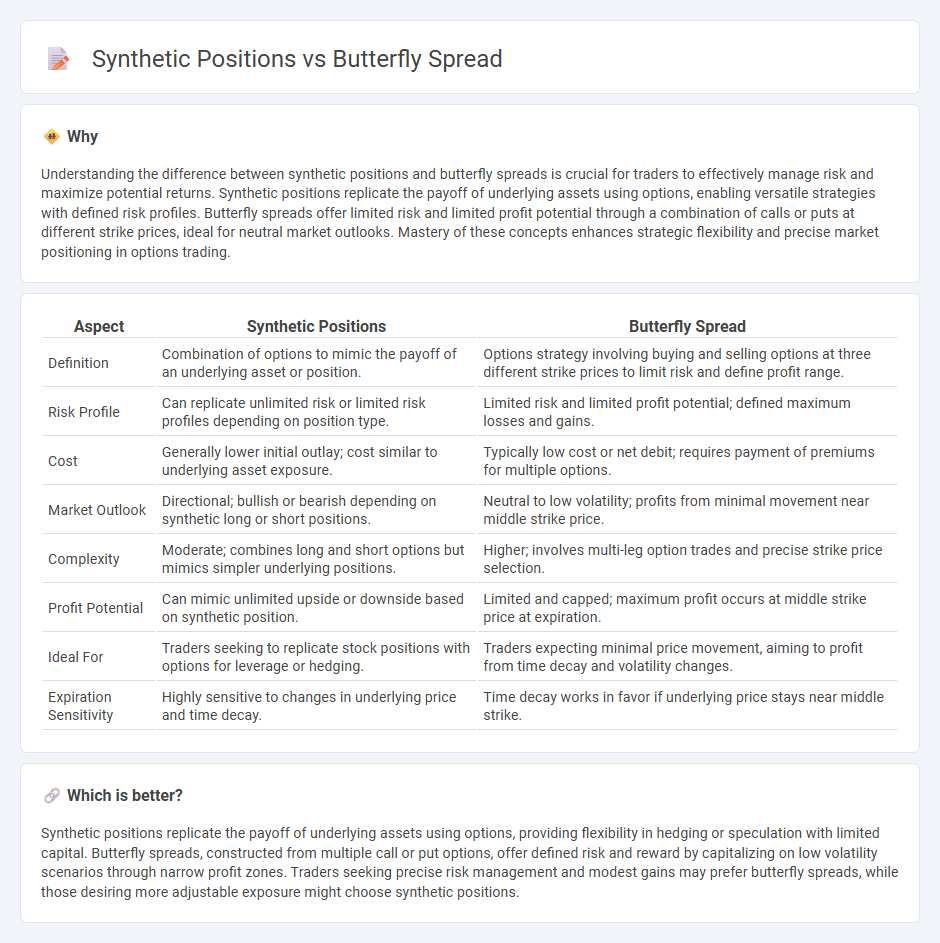

Understanding the difference between synthetic positions and butterfly spreads is crucial for traders to effectively manage risk and maximize potential returns. Synthetic positions replicate the payoff of underlying assets using options, enabling versatile strategies with defined risk profiles. Butterfly spreads offer limited risk and limited profit potential through a combination of calls or puts at different strike prices, ideal for neutral market outlooks. Mastery of these concepts enhances strategic flexibility and precise market positioning in options trading.

Comparison Table

| Aspect | Synthetic Positions | Butterfly Spread |

|---|---|---|

| Definition | Combination of options to mimic the payoff of an underlying asset or position. | Options strategy involving buying and selling options at three different strike prices to limit risk and define profit range. |

| Risk Profile | Can replicate unlimited risk or limited risk profiles depending on position type. | Limited risk and limited profit potential; defined maximum losses and gains. |

| Cost | Generally lower initial outlay; cost similar to underlying asset exposure. | Typically low cost or net debit; requires payment of premiums for multiple options. |

| Market Outlook | Directional; bullish or bearish depending on synthetic long or short positions. | Neutral to low volatility; profits from minimal movement near middle strike price. |

| Complexity | Moderate; combines long and short options but mimics simpler underlying positions. | Higher; involves multi-leg option trades and precise strike price selection. |

| Profit Potential | Can mimic unlimited upside or downside based on synthetic position. | Limited and capped; maximum profit occurs at middle strike price at expiration. |

| Ideal For | Traders seeking to replicate stock positions with options for leverage or hedging. | Traders expecting minimal price movement, aiming to profit from time decay and volatility changes. |

| Expiration Sensitivity | Highly sensitive to changes in underlying price and time decay. | Time decay works in favor if underlying price stays near middle strike. |

Which is better?

Synthetic positions replicate the payoff of underlying assets using options, providing flexibility in hedging or speculation with limited capital. Butterfly spreads, constructed from multiple call or put options, offer defined risk and reward by capitalizing on low volatility scenarios through narrow profit zones. Traders seeking precise risk management and modest gains may prefer butterfly spreads, while those desiring more adjustable exposure might choose synthetic positions.

Connection

Synthetic positions replicate the payoff of an asset by combining options contracts, creating exposure similar to owning the underlying security without directly purchasing it. Butterfly spreads involve simultaneously buying and selling options at different strike prices, designed to capitalize on minimal price movement and limited risk. Both strategies utilize options to manage risk and optimize potential returns by structuring positions that reflect specific market outlooks.

Key Terms

Call Option

A butterfly spread using call options involves buying one call at a lower strike, selling two calls at a middle strike, and buying one call at a higher strike to capitalize on minimal price movement within a defined range. Synthetic positions replicate similar payoff structures through combinations of options and underlying assets, often providing more flexibility or capital efficiency depending on market views. Explore the nuances of call option strategies and synthetic positions to optimize your trading approach.

Put Option

A butterfly spread using put options involves purchasing and selling puts at three different strike prices, creating a limited risk, limited profit strategy centered around a specific price target. Synthetic positions with puts replicate the payoff of other derivative structures, such as combining a long put with a short call or stock to mimic a forward contract's payoff. Explore detailed strategies and examples to deepen your understanding of put option spreads and synthetic positions.

Strike Price

Butterfly spreads utilize three strike prices, typically equidistant, to create a limited risk and limited profit strategy centered around the middle strike price, optimizing payoff when the underlying asset closes near this strike at expiration. Synthetic positions replicate option strategies using underlying assets and options to mimic payoff profiles, often involving a combination of long and short options at varying strike prices to achieve a similar risk-reward balance as traditional spreads. Explore detailed strike price configurations and practical applications to enhance your options trading strategies.

Source and External Links

Understanding the butterfly spread option strategy - Saxo Bank - A butterfly spread is an advanced, defined-risk options strategy that uses three sets of options (buy one lower strike, sell two middle strike, buy one higher strike) to profit mainly when the underlying asset's price remains stable at the middle strike price at expiration, often used in low-volatility environments.

Mastering Butterfly Spread - Number Analytics - This strategy involves buying and selling three call or put options with the same expiration but different strike prices, designed to profit within a specific price range; it includes long and short butterfly spreads to suit expectations of low or high volatility.

Long Butterfly Spread | tastylive - A long butterfly spread performs best when the underlying asset price is exactly at the middle strike price at expiration, involving selling the middle strikes and buying the wings, thereby limiting both maximum profit and maximum loss within defined strike prices.

dowidth.com

dowidth.com