Perpetual swaps offer traders continuous exposure to asset price movements without an expiration date, often featuring high leverage and funding rate mechanisms to maintain price alignment with the underlying asset. Binary options provide a fixed payout based on a yes/no outcome within a predetermined timeframe, making them simpler but typically higher-risk derivatives with capped returns. Explore the nuances and risk-reward profiles of these trading instruments to optimize your strategy.

Why it is important

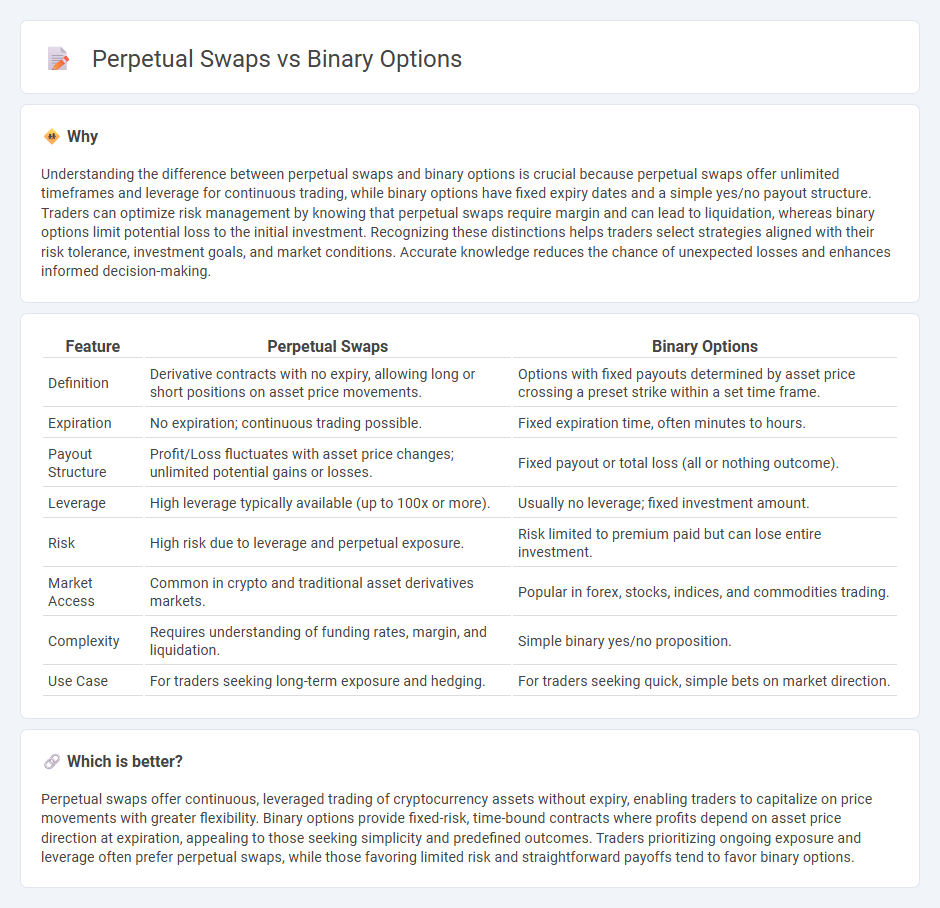

Understanding the difference between perpetual swaps and binary options is crucial because perpetual swaps offer unlimited timeframes and leverage for continuous trading, while binary options have fixed expiry dates and a simple yes/no payout structure. Traders can optimize risk management by knowing that perpetual swaps require margin and can lead to liquidation, whereas binary options limit potential loss to the initial investment. Recognizing these distinctions helps traders select strategies aligned with their risk tolerance, investment goals, and market conditions. Accurate knowledge reduces the chance of unexpected losses and enhances informed decision-making.

Comparison Table

| Feature | Perpetual Swaps | Binary Options |

|---|---|---|

| Definition | Derivative contracts with no expiry, allowing long or short positions on asset price movements. | Options with fixed payouts determined by asset price crossing a preset strike within a set time frame. |

| Expiration | No expiration; continuous trading possible. | Fixed expiration time, often minutes to hours. |

| Payout Structure | Profit/Loss fluctuates with asset price changes; unlimited potential gains or losses. | Fixed payout or total loss (all or nothing outcome). |

| Leverage | High leverage typically available (up to 100x or more). | Usually no leverage; fixed investment amount. |

| Risk | High risk due to leverage and perpetual exposure. | Risk limited to premium paid but can lose entire investment. |

| Market Access | Common in crypto and traditional asset derivatives markets. | Popular in forex, stocks, indices, and commodities trading. |

| Complexity | Requires understanding of funding rates, margin, and liquidation. | Simple binary yes/no proposition. |

| Use Case | For traders seeking long-term exposure and hedging. | For traders seeking quick, simple bets on market direction. |

Which is better?

Perpetual swaps offer continuous, leveraged trading of cryptocurrency assets without expiry, enabling traders to capitalize on price movements with greater flexibility. Binary options provide fixed-risk, time-bound contracts where profits depend on asset price direction at expiration, appealing to those seeking simplicity and predefined outcomes. Traders prioritizing ongoing exposure and leverage often prefer perpetual swaps, while those favoring limited risk and straightforward payoffs tend to favor binary options.

Connection

Perpetual swaps and binary options are connected through their role as derivative instruments in trading, allowing investors to speculate on asset price movements without owning the underlying asset. Perpetual swaps offer continuous exposure with no expiry, often used for leverage trading in cryptocurrency markets, while binary options provide fixed payouts based on asset price direction within a set timeframe. Both instruments enable traders to hedge risk or amplify potential returns by predicting market trends.

Key Terms

Expiry (Binary Options)

Binary options feature a fixed expiry time, allowing traders to predict asset price direction within a specific time frame. Perpetual swaps lack an expiry date, enabling positions to remain open indefinitely with funding rates applied periodically. Explore the detailed mechanisms and trading strategies behind expiry in binary options to enhance your market approach.

Leverage (Perpetual Swaps)

Perpetual swaps offer high leverage, often up to 100x, enabling traders to amplify gains but also increasing the risk of significant losses. Unlike binary options, where risk and reward are fixed and predetermined, perpetual swaps allow continuous exposure with adjustable margin requirements. Explore the advantages and risks of leverage in perpetual swaps to enhance your trading strategy.

Settlement Mechanism

Binary options settle at a fixed expiration time with a predetermined payout based on the asset price meeting a specific condition, providing clear and immediate results. Perpetual swaps use a continuous mark-to-market settlement mechanism with periodic funding payments to maintain price parity with the underlying asset, allowing for indefinite holding without expiry. Discover the key differences in risk and strategy by exploring detailed settlement mechanisms further.

Source and External Links

Dukascopy Bank SA: What are Binary Options and How to Trade? - Binary options, also called digital or fixed-return options, are financial instruments that let you predict whether the price of an asset will be above or below a certain level at a specified time, resulting in a fixed payout if correct and loss of investment if wrong.

BinaryOptions.net: How to Succeed with Binary Options Trading Online 2025 - Binary options are trades with a yes/no outcome, where common types include Up/Down, In/Out (Range), Touch/No Touch, and Ladder options, each offering different ways to bet on asset price movements within a set timeframe.

Investor.gov: Binary Options - A binary option is an options contract where the payout depends entirely on a yes/no proposition about an asset's price at expiration, offering a predetermined cash amount or nothing at all, with no right to buy or sell the underlying asset.

dowidth.com

dowidth.com