Investing in wine cask aging offers a tangible asset that appreciates over time through the maturation process, influenced by factors such as grape quality and barrel conditions. Stock investments provide liquidity and the potential for dividends, but are subject to market volatility and economic shifts. Explore the comparative benefits and risks of wine cask aging versus stocks to diversify your investment portfolio effectively.

Why it is important

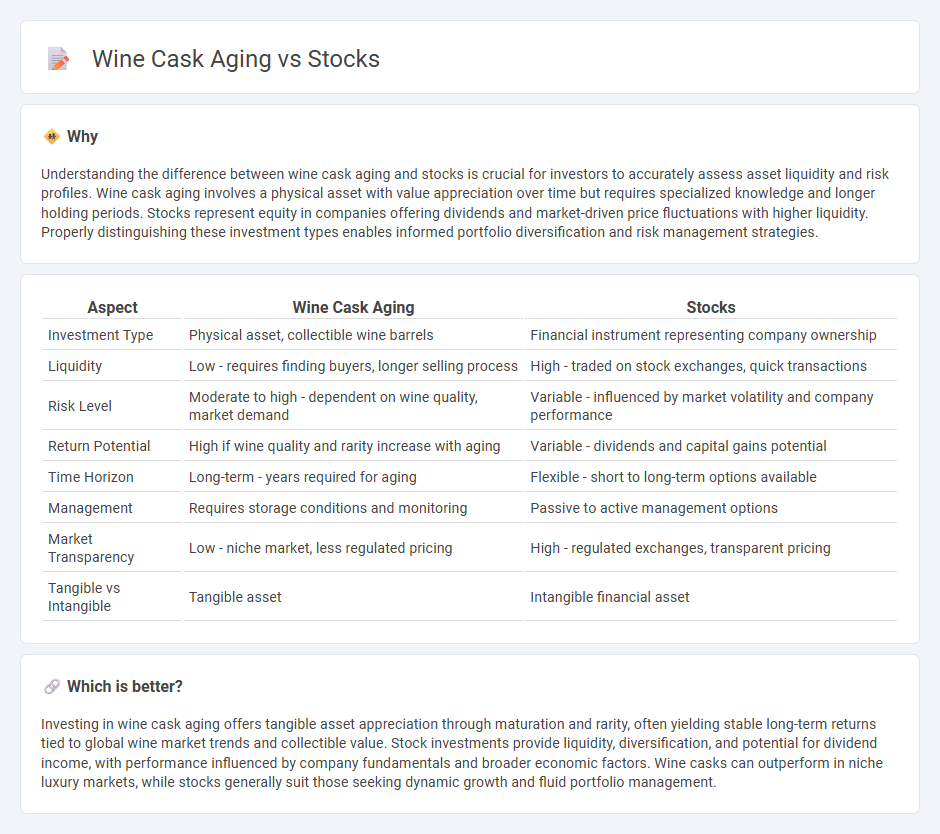

Understanding the difference between wine cask aging and stocks is crucial for investors to accurately assess asset liquidity and risk profiles. Wine cask aging involves a physical asset with value appreciation over time but requires specialized knowledge and longer holding periods. Stocks represent equity in companies offering dividends and market-driven price fluctuations with higher liquidity. Properly distinguishing these investment types enables informed portfolio diversification and risk management strategies.

Comparison Table

| Aspect | Wine Cask Aging | Stocks |

|---|---|---|

| Investment Type | Physical asset, collectible wine barrels | Financial instrument representing company ownership |

| Liquidity | Low - requires finding buyers, longer selling process | High - traded on stock exchanges, quick transactions |

| Risk Level | Moderate to high - dependent on wine quality, market demand | Variable - influenced by market volatility and company performance |

| Return Potential | High if wine quality and rarity increase with aging | Variable - dividends and capital gains potential |

| Time Horizon | Long-term - years required for aging | Flexible - short to long-term options available |

| Management | Requires storage conditions and monitoring | Passive to active management options |

| Market Transparency | Low - niche market, less regulated pricing | High - regulated exchanges, transparent pricing |

| Tangible vs Intangible | Tangible asset | Intangible financial asset |

Which is better?

Investing in wine cask aging offers tangible asset appreciation through maturation and rarity, often yielding stable long-term returns tied to global wine market trends and collectible value. Stock investments provide liquidity, diversification, and potential for dividend income, with performance influenced by company fundamentals and broader economic factors. Wine casks can outperform in niche luxury markets, while stocks generally suit those seeking dynamic growth and fluid portfolio management.

Connection

Wine cask aging and stocks are connected through the concept of investment in assets that appreciate over time due to rarity and quality. Investing in aged wine casks offers diversification similar to stocks, as both can yield significant returns influenced by market demand and scarcity. The aging process enhances the wine's value, akin to how strong company fundamentals drive stock price growth.

Key Terms

Liquidity

Stocks offer high liquidity, providing investors the ability to quickly buy or sell shares on public markets, with average daily trading volumes often exceeding millions of shares. In contrast, wine cask aging represents a highly illiquid asset, requiring years of maturation before potential sale and limited secondary market activity. Explore the nuances of liquidity differences between stocks and wine cask investments to refine your portfolio strategy.

Volatility

Stocks exhibit high volatility due to market fluctuations, influenced by economic indicators, geopolitical events, and investor sentiment, resulting in rapid price changes within short periods. Wine cask aging, by contrast, offers low volatility as the value appreciation occurs gradually over years, driven by factors like provenance, vintage, and storage conditions. Explore the distinct risk profiles and investment potentials of stocks versus wine cask aging to make informed financial decisions.

Time Horizon

Stocks benefit from compounding returns over extended time horizons, typically requiring years or decades to realize significant growth and capital appreciation. In contrast, wine cask aging offers a shorter, more tangible timeline, often ranging from 3 to 10 years, where the maturation process directly enhances flavor and value. Explore the intricate dynamics of investment time horizons between stocks and wine cask aging to optimize your portfolio strategy.

Source and External Links

Stocks | Investor.gov - Stocks are ownership shares in a company and come mainly in two types: common stock, which offers voting rights and dividends, and preferred stock, which has dividend priority but usually no voting rights; stocks can be further classified by growth, income, value, and company size categories.

Stocks | FINRA.org - Common stocks represent ownership with variable dividends and price volatility, while preferred stocks provide fixed dividends with less price fluctuation and priority in dividends and bankruptcy payment after bondholders.

Google Finance - Stock Market Prices, Real-time Quotes & Business News - Google Finance offers real-time stock quotes, international market data, financial news, and analytics to support informed trading and investment decisions.

dowidth.com

dowidth.com