Sports team ownership shares offer investors unique opportunities for capital appreciation, fan-driven brand value, and exclusive access to team-related revenues. Gold and precious metals provide a strong hedge against inflation, currency volatility, and economic uncertainties through their intrinsic value and liquidity. Explore the distinct benefits and risks associated with both asset classes to enhance your diversified investment portfolio.

Why it is important

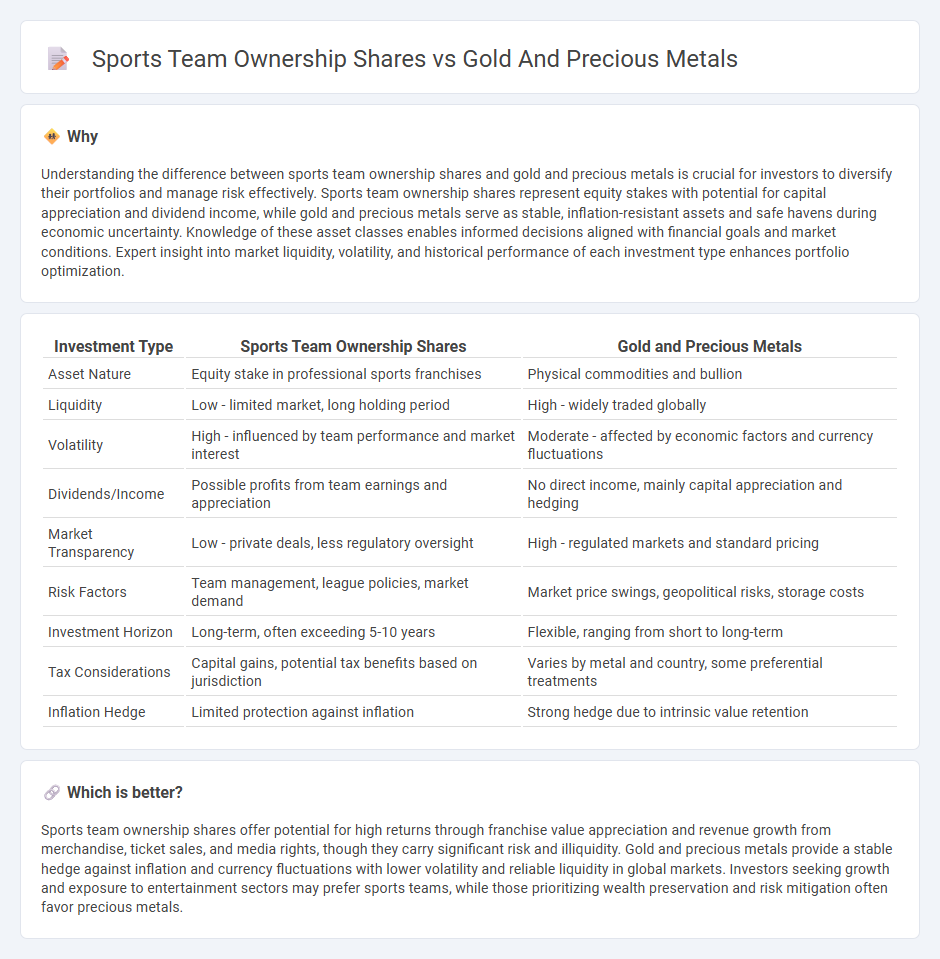

Understanding the difference between sports team ownership shares and gold and precious metals is crucial for investors to diversify their portfolios and manage risk effectively. Sports team ownership shares represent equity stakes with potential for capital appreciation and dividend income, while gold and precious metals serve as stable, inflation-resistant assets and safe havens during economic uncertainty. Knowledge of these asset classes enables informed decisions aligned with financial goals and market conditions. Expert insight into market liquidity, volatility, and historical performance of each investment type enhances portfolio optimization.

Comparison Table

| Investment Type | Sports Team Ownership Shares | Gold and Precious Metals |

|---|---|---|

| Asset Nature | Equity stake in professional sports franchises | Physical commodities and bullion |

| Liquidity | Low - limited market, long holding period | High - widely traded globally |

| Volatility | High - influenced by team performance and market interest | Moderate - affected by economic factors and currency fluctuations |

| Dividends/Income | Possible profits from team earnings and appreciation | No direct income, mainly capital appreciation and hedging |

| Market Transparency | Low - private deals, less regulatory oversight | High - regulated markets and standard pricing |

| Risk Factors | Team management, league policies, market demand | Market price swings, geopolitical risks, storage costs |

| Investment Horizon | Long-term, often exceeding 5-10 years | Flexible, ranging from short to long-term |

| Tax Considerations | Capital gains, potential tax benefits based on jurisdiction | Varies by metal and country, some preferential treatments |

| Inflation Hedge | Limited protection against inflation | Strong hedge due to intrinsic value retention |

Which is better?

Sports team ownership shares offer potential for high returns through franchise value appreciation and revenue growth from merchandise, ticket sales, and media rights, though they carry significant risk and illiquidity. Gold and precious metals provide a stable hedge against inflation and currency fluctuations with lower volatility and reliable liquidity in global markets. Investors seeking growth and exposure to entertainment sectors may prefer sports teams, while those prioritizing wealth preservation and risk mitigation often favor precious metals.

Connection

Sports team ownership shares offer investors diversified portfolios that hedge against market volatility, similarly to gold and precious metals, which act as tangible assets preserving wealth during economic uncertainty. Both asset classes attract high-net-worth individuals seeking long-term value appreciation and protection against inflation. They provide liquidity options while balancing risk through ownership in physical collectibles or equity stakes in exclusive franchises.

Key Terms

Gold and precious metals:

Gold and precious metals serve as tangible assets with intrinsic value, historically acting as a hedge against inflation and market volatility, unlike sports team ownership shares which hinge on market performance and revenue generation. Gold's liquidity and widespread acceptance in global markets make it a reliable store of wealth, whereas sports team shares carry risks tied to team performance, management decisions, and fan engagement. Explore further the strategic advantages and investment potential of gold and precious metals in diversified portfolios.

Bullion

Bullion, as a form of gold and precious metals investment, offers tangible asset security and intrinsic value that can hedge against inflation and market volatility, unlike sports team ownership shares which carry higher risk and less liquidity. The bullion market is deeply influenced by global economic indicators, geopolitical stability, and currency fluctuations, making it a preferred choice for long-term wealth preservation. Discover how bullion can enhance your investment portfolio and provide balanced exposure beyond traditional sports franchise shares.

Spot Price

Gold and precious metals are valued based on their spot price, reflecting real-time market demand and supply dynamics in global commodities trading. Sports team ownership shares, however, derive value from franchise profitability, brand equity, and league revenue-sharing agreements, leading to less volatility compared to the spot price of metals. Explore detailed comparisons to understand how spot price influences investment strategies in both sectors.

Source and External Links

Gold and Precious Metals Fund (USERX) - The fund seeks capital appreciation, inflation protection, and income by investing in gold and precious metals, highlighting gold's high value amid economic uncertainty and the growing potential of silver and platinum in 2025.

Precious Metals - Gold Spot Prices - Live spot prices and market data for gold, silver, platinum, palladium, and rhodium with updates reflecting current trading and trends in precious metals markets.

Pacific Precious Metals(tm) - #1 Gold Dealer in SF Bay Area - Trusted dealer offering gold, silver, and platinum bullion for purchase online and in physical stores, specializing in customer service and investment portfolio development.

dowidth.com

dowidth.com