Vintage sneaker portfolios capitalize on the growing demand for rare, limited-edition footwear driven by a passionate collector community and increasing market value. NFT art collections represent a digital frontier where blockchain technology assures provenance and scarcity, attracting investors seeking innovative assets. Explore the unique benefits and risks of these alternative investments to diversify your portfolio effectively.

Why it is important

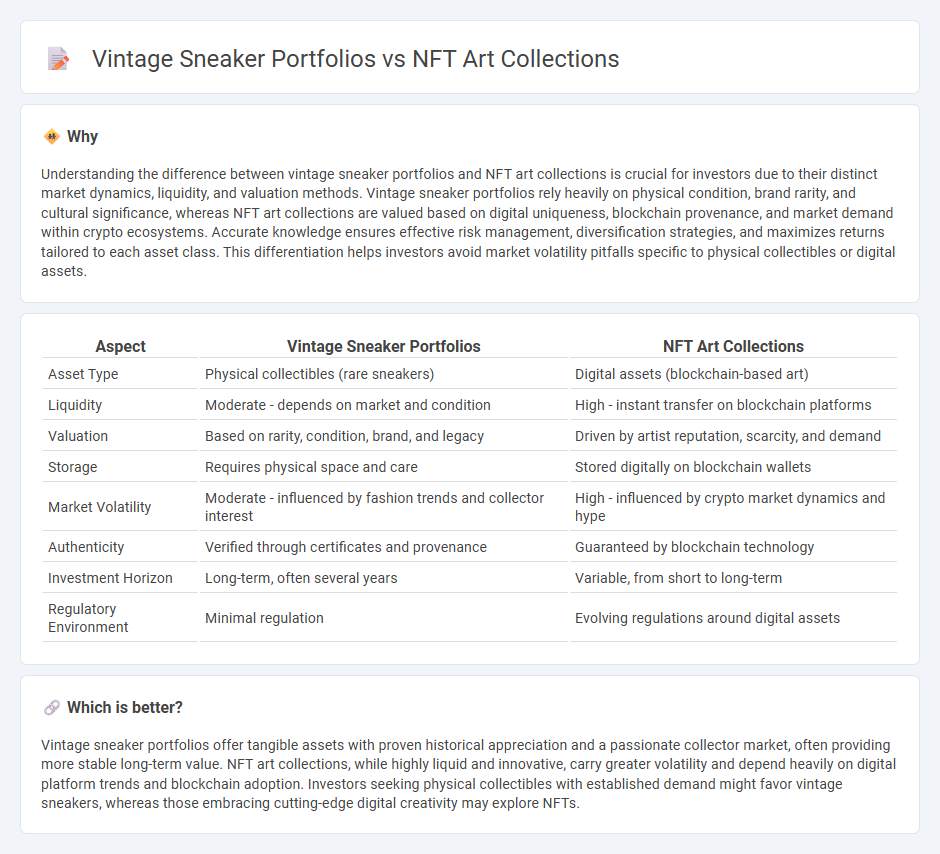

Understanding the difference between vintage sneaker portfolios and NFT art collections is crucial for investors due to their distinct market dynamics, liquidity, and valuation methods. Vintage sneaker portfolios rely heavily on physical condition, brand rarity, and cultural significance, whereas NFT art collections are valued based on digital uniqueness, blockchain provenance, and market demand within crypto ecosystems. Accurate knowledge ensures effective risk management, diversification strategies, and maximizes returns tailored to each asset class. This differentiation helps investors avoid market volatility pitfalls specific to physical collectibles or digital assets.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | NFT Art Collections |

|---|---|---|

| Asset Type | Physical collectibles (rare sneakers) | Digital assets (blockchain-based art) |

| Liquidity | Moderate - depends on market and condition | High - instant transfer on blockchain platforms |

| Valuation | Based on rarity, condition, brand, and legacy | Driven by artist reputation, scarcity, and demand |

| Storage | Requires physical space and care | Stored digitally on blockchain wallets |

| Market Volatility | Moderate - influenced by fashion trends and collector interest | High - influenced by crypto market dynamics and hype |

| Authenticity | Verified through certificates and provenance | Guaranteed by blockchain technology |

| Investment Horizon | Long-term, often several years | Variable, from short to long-term |

| Regulatory Environment | Minimal regulation | Evolving regulations around digital assets |

Which is better?

Vintage sneaker portfolios offer tangible assets with proven historical appreciation and a passionate collector market, often providing more stable long-term value. NFT art collections, while highly liquid and innovative, carry greater volatility and depend heavily on digital platform trends and blockchain adoption. Investors seeking physical collectibles with established demand might favor vintage sneakers, whereas those embracing cutting-edge digital creativity may explore NFTs.

Connection

Vintage sneaker portfolios and NFT art collections both serve as alternative investment assets that capitalize on cultural trends and digital scarcity. Each market relies on provenance, rarity, and authentication to drive value, with blockchain technology increasingly used to verify ownership and authenticity in NFTs. Investors diversify by leveraging the strong collector communities and speculative potential inherent in both physical vintage items and digital art tokens.

Key Terms

Liquidity

NFT art collections offer greater liquidity through blockchain marketplaces enabling instant transactions, contrasting with vintage sneaker portfolios that depend on niche reselling platforms with slower sales cycles. The highly liquid NFT market attracts investors seeking quick returns and flexibility, while vintage sneakers provide tangible assets with potential for long-term value appreciation. Explore deeper insights on liquidity dynamics between these two investment classes.

Provenance

NFT art collections and vintage sneaker portfolios both emphasize provenance as a key factor in establishing authenticity and value. Blockchain technology guarantees immutability and transparent ownership records for NFTs, while physical inspection and documented purchase history validate genuine vintage sneakers. Explore how provenance shapes investment strategies in these evolving asset classes.

Market Volatility

NFT art collections experience significant market volatility due to their reliance on digital trends and investor sentiment, causing rapid price fluctuations influenced by platform popularity and blockchain developments. Vintage sneaker portfolios tend to exhibit more stable value growth because of their limited supply, brand heritage, and strong collector demand, though they remain susceptible to shifts in fashion and cultural relevance. Explore further insights to understand how market dynamics differently shape these investment categories.

Source and External Links

WheelHouse Art NFT Collection - Offers an exclusive collection of digital NFT artwork minted on Polygon, available for purchase without cryptocurrency and resellable on OpenSea.

NFT Art Collection - Features a collection of 77 unique NFT art pieces inspired by nostalgia, sensuality, physics, mystery, and space, available on OpenSea.

AI Art NFT Collection - Includes a variety of AI-generated NFT artworks available for purchase, with themes such as expressionism, impressionism, and landscapes.

dowidth.com

dowidth.com