Whisky cask investment offers a unique opportunity for capital growth through the appreciation of rare aged spirits, often outperforming traditional assets due to limited supply and increasing global demand. Wine investment, on the other hand, combines tangible asset value with portfolio diversification, driven by vintage quality, provenance, and auction performance. Discover the key differences and potential returns by exploring the Whisky cask versus Wine investment landscape in detail.

Why it is important

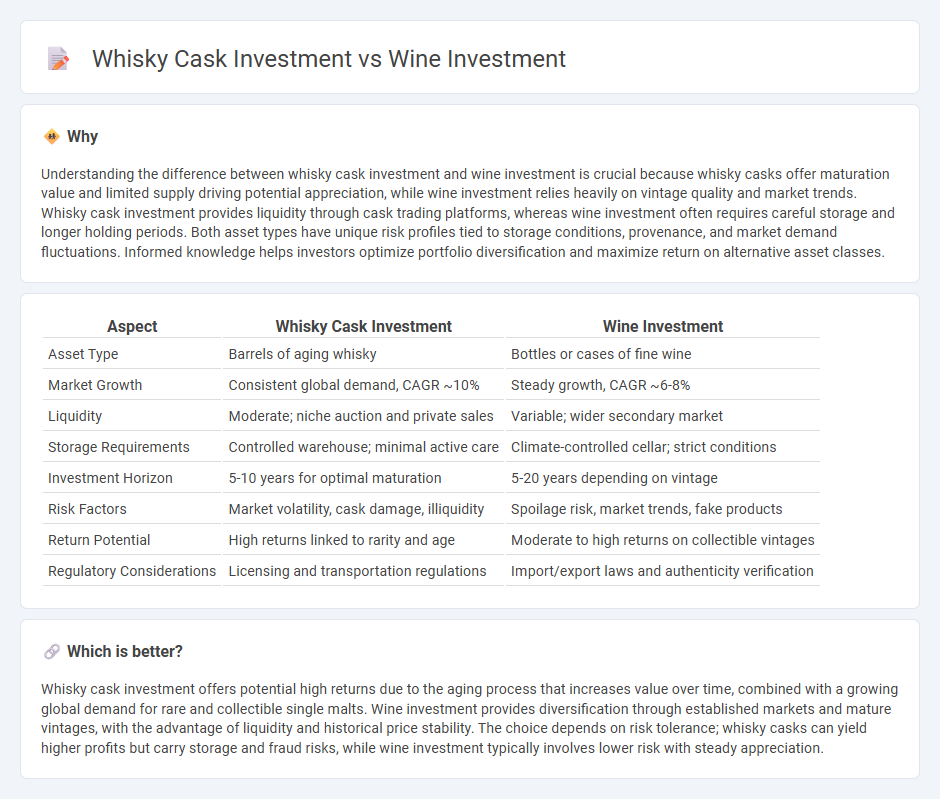

Understanding the difference between whisky cask investment and wine investment is crucial because whisky casks offer maturation value and limited supply driving potential appreciation, while wine investment relies heavily on vintage quality and market trends. Whisky cask investment provides liquidity through cask trading platforms, whereas wine investment often requires careful storage and longer holding periods. Both asset types have unique risk profiles tied to storage conditions, provenance, and market demand fluctuations. Informed knowledge helps investors optimize portfolio diversification and maximize return on alternative asset classes.

Comparison Table

| Aspect | Whisky Cask Investment | Wine Investment |

|---|---|---|

| Asset Type | Barrels of aging whisky | Bottles or cases of fine wine |

| Market Growth | Consistent global demand, CAGR ~10% | Steady growth, CAGR ~6-8% |

| Liquidity | Moderate; niche auction and private sales | Variable; wider secondary market |

| Storage Requirements | Controlled warehouse; minimal active care | Climate-controlled cellar; strict conditions |

| Investment Horizon | 5-10 years for optimal maturation | 5-20 years depending on vintage |

| Risk Factors | Market volatility, cask damage, illiquidity | Spoilage risk, market trends, fake products |

| Return Potential | High returns linked to rarity and age | Moderate to high returns on collectible vintages |

| Regulatory Considerations | Licensing and transportation regulations | Import/export laws and authenticity verification |

Which is better?

Whisky cask investment offers potential high returns due to the aging process that increases value over time, combined with a growing global demand for rare and collectible single malts. Wine investment provides diversification through established markets and mature vintages, with the advantage of liquidity and historical price stability. The choice depends on risk tolerance; whisky casks can yield higher profits but carry storage and fraud risks, while wine investment typically involves lower risk with steady appreciation.

Connection

Whisky cask investment and wine investment both capitalize on the aging process, where maturation enhances value and quality over time, appealing to collectors and connoisseurs seeking tangible assets. These alternative investments leverage scarcity and provenance, with limited editions and rare vintages driving market demand and price appreciation. Both markets exhibit increasing interest from global investors aiming for portfolio diversification beyond traditional stocks and bonds.

Key Terms

Provenance

Provenance plays a crucial role in both wine investment and whisky cask investment, as it authenticates origin, quality, and ownership history, directly impacting market value. Wine provenance often includes vineyard details, vintage year, and storage conditions, while whisky casks emphasize distillery, age, and previous cask use. Discover how understanding provenance can enhance your returns in these alternative investments.

Maturation

Whisky cask investment benefits from continuous aging in oak barrels, enhancing complexity and value over time through the maturation process. Wine investment, particularly in fine wines, relies on optimal cellar conditions to mature and develop flavors, with peak value typically tied to vintage quality and aging potential. Explore detailed comparisons of maturation effects on market performance and investment returns to make an informed decision.

Liquidity

Wine investment offers relatively higher liquidity due to established secondary markets and auction platforms, enabling quicker sales compared to whisky casks, which often require longer holding periods and may have fewer buyers. Whisky cask investment can provide substantial returns but involves complexities in valuation and limited opportunities for rapid resale. Explore detailed comparisons of market dynamics and exit strategies to make an informed choice.

Source and External Links

Getting Started with Wine Investments | Wine Folly - Wine investment focuses on buying fine Bordeaux and Grand Cru Burgundy wines, which are prestigious and start at $600 per bottle; important factors include buying by the case, ensuring provenance, and considering other collectible wines like Napa Cabernet and tete de cuvee Champagne for long-term value.

Wine Investment | Investing in Fine Wines - Cru Wine - Fine wine is a stable, tangible asset with attractive historical performance, low correlation to traditional markets, and strong global demand; Cru Wine offers tailored portfolio management, bonded and insured storage, and transparency for global investors with over PS20 million under management.

The ten things you need to know about wine investment - Tim Atkin - Wine should be viewed as a medium- to long-term investment held mostly in bonded warehouses to avoid VAT and duty until sale, with awareness of storage costs and limited liquidity compared to stocks; provenance and careful selection are crucial to protect investment value.

dowidth.com

dowidth.com