Royalty streaming provides investors with ongoing revenue by purchasing a percentage of future earnings from intellectual property or natural resources, offering predictable cash flow and reduced risk compared to traditional equity stakes. Angel investing involves providing capital directly to early-stage startups in exchange for equity, which carries higher risk but the potential for significant returns if the company succeeds. Explore the nuances of royalty streaming and angel investing to determine which strategy aligns best with your investment goals.

Why it is important

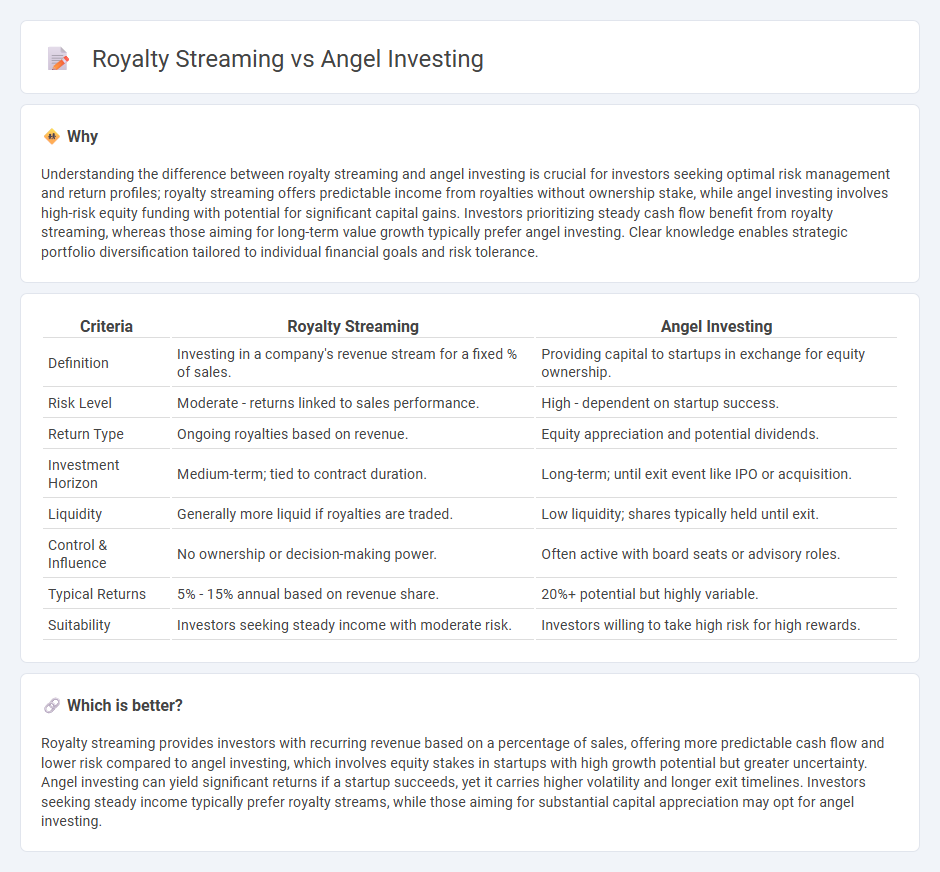

Understanding the difference between royalty streaming and angel investing is crucial for investors seeking optimal risk management and return profiles; royalty streaming offers predictable income from royalties without ownership stake, while angel investing involves high-risk equity funding with potential for significant capital gains. Investors prioritizing steady cash flow benefit from royalty streaming, whereas those aiming for long-term value growth typically prefer angel investing. Clear knowledge enables strategic portfolio diversification tailored to individual financial goals and risk tolerance.

Comparison Table

| Criteria | Royalty Streaming | Angel Investing |

|---|---|---|

| Definition | Investing in a company's revenue stream for a fixed % of sales. | Providing capital to startups in exchange for equity ownership. |

| Risk Level | Moderate - returns linked to sales performance. | High - dependent on startup success. |

| Return Type | Ongoing royalties based on revenue. | Equity appreciation and potential dividends. |

| Investment Horizon | Medium-term; tied to contract duration. | Long-term; until exit event like IPO or acquisition. |

| Liquidity | Generally more liquid if royalties are traded. | Low liquidity; shares typically held until exit. |

| Control & Influence | No ownership or decision-making power. | Often active with board seats or advisory roles. |

| Typical Returns | 5% - 15% annual based on revenue share. | 20%+ potential but highly variable. |

| Suitability | Investors seeking steady income with moderate risk. | Investors willing to take high risk for high rewards. |

Which is better?

Royalty streaming provides investors with recurring revenue based on a percentage of sales, offering more predictable cash flow and lower risk compared to angel investing, which involves equity stakes in startups with high growth potential but greater uncertainty. Angel investing can yield significant returns if a startup succeeds, yet it carries higher volatility and longer exit timelines. Investors seeking steady income typically prefer royalty streams, while those aiming for substantial capital appreciation may opt for angel investing.

Connection

Royalty streaming and angel investing both provide alternative funding methods for startups and early-stage companies, allowing investors to generate returns based on revenue streams rather than traditional equity stakes. Royalty streaming offers investors a percentage of ongoing revenue, aligning interests with the company's sales performance, while angel investing involves providing capital in exchange for equity ownership and potential future valuation growth. Both strategies mitigate risk by diversifying investment portfolios with early access to emerging businesses and flexible return structures.

Key Terms

Equity Ownership

Angel investing involves acquiring equity ownership in startups or early-stage companies, providing investors with voting rights and potential for significant capital appreciation. Royalty streaming offers investors a percentage of future revenue without ownership or control, ensuring steady cash flow but limited influence over company decisions. Explore the differences in returns, risks, and control between these investment models to determine the best fit for your portfolio.

Royalty Payments

Royalty payments deliver consistent income streams by allowing investors to earn a percentage of revenues from intellectual property or natural resources. Unlike angel investing, which relies on equity and potential company growth, royalty streaming minimizes risk with predictable, long-term cash flows tied to specific assets. Explore the benefits and mechanisms of royalty payments to enhance your diversified investment strategy.

Exit Strategy

Angel investing typically involves equity ownership, offering potential high returns through an exit strategy such as acquisition or IPO, making it suitable for investors seeking long-term capital appreciation. Royalty streaming provides steady, recurring revenue by purchasing rights to a portion of a company's future sales, with less emphasis on exit events and more on consistent cash flow. Explore the nuances of these investment strategies to determine which aligns best with your financial goals and risk tolerance.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves wealthy individuals providing capital to startups in exchange for equity or convertible debt, often bridging the funding gap between initial family/friend investments and institutional rounds, while also mentoring founders and offering valuable networks.

Demystifying Angel Investing - Angel Capital Association - Angel investing is a way to generate high returns by funding promising startups, also offering tax incentives and the chance to make economic impact and build a financial legacy through community and professional angel networks.

Angel Investors - The Hartford Insurance - Angel investors are wealthy private individuals who use their own money to invest in startups in exchange for equity, often providing smaller amounts more patiently than venture capitalists and helping with mentoring and management to support growth until an exit strategy is realized.

dowidth.com

dowidth.com