Whale watching shares offer investors unique exposure to the ecotourism sector with potential for niche market growth, while mutual funds provide diversified portfolios that mitigate risk across various asset classes. Understanding the differences in liquidity, risk profile, and expected returns is crucial for making informed investment decisions. Explore the advantages and considerations of each option to determine the best fit for your financial goals.

Why it is important

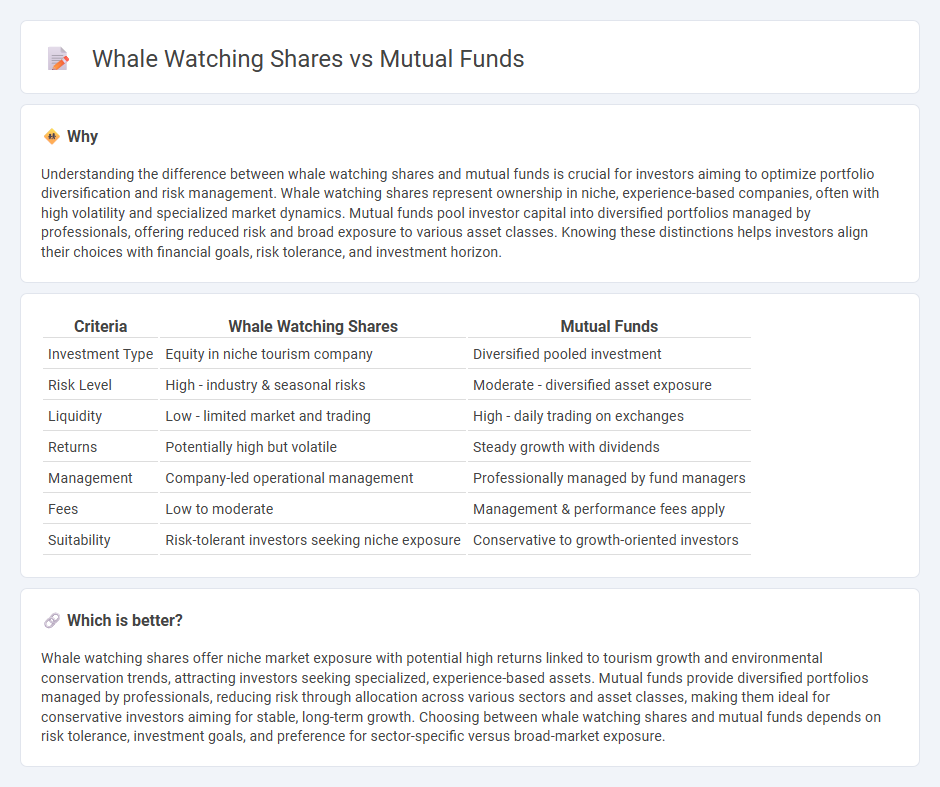

Understanding the difference between whale watching shares and mutual funds is crucial for investors aiming to optimize portfolio diversification and risk management. Whale watching shares represent ownership in niche, experience-based companies, often with high volatility and specialized market dynamics. Mutual funds pool investor capital into diversified portfolios managed by professionals, offering reduced risk and broad exposure to various asset classes. Knowing these distinctions helps investors align their choices with financial goals, risk tolerance, and investment horizon.

Comparison Table

| Criteria | Whale Watching Shares | Mutual Funds |

|---|---|---|

| Investment Type | Equity in niche tourism company | Diversified pooled investment |

| Risk Level | High - industry & seasonal risks | Moderate - diversified asset exposure |

| Liquidity | Low - limited market and trading | High - daily trading on exchanges |

| Returns | Potentially high but volatile | Steady growth with dividends |

| Management | Company-led operational management | Professionally managed by fund managers |

| Fees | Low to moderate | Management & performance fees apply |

| Suitability | Risk-tolerant investors seeking niche exposure | Conservative to growth-oriented investors |

Which is better?

Whale watching shares offer niche market exposure with potential high returns linked to tourism growth and environmental conservation trends, attracting investors seeking specialized, experience-based assets. Mutual funds provide diversified portfolios managed by professionals, reducing risk through allocation across various sectors and asset classes, making them ideal for conservative investors aiming for stable, long-term growth. Choosing between whale watching shares and mutual funds depends on risk tolerance, investment goals, and preference for sector-specific versus broad-market exposure.

Connection

Whale watching shares represent investments in companies operating whale watching tours, offering niche market exposure within the tourism sector. Mutual funds may include these shares to diversify portfolios with eco-tourism assets, blending conservation interests and potential growth. This connection leverages the increasing demand for sustainable travel investments within broader fund strategies.

Key Terms

Diversification

Mutual funds offer extensive diversification by pooling investments across various asset classes, industries, and geographic regions, reducing overall portfolio risk. In contrast, whale watching shares typically represent a niche investment with limited diversification, making them more susceptible to market volatility and sector-specific downturns. Explore further to understand how diversification strategies impact your investment portfolio's stability and growth potential.

Liquidity

Mutual funds offer high liquidity with the ability to buy or sell shares on any business day, providing quick access to invested capital. Whale watching shares, often tied to niche industries or smaller companies, may experience lower trading volumes, resulting in limited liquidity and potentially higher price volatility. Explore the liquidity features and risks of both investment options to make informed financial decisions.

Market Influence

Mutual funds aggregate investments from multiple shareholders, deploying capital across diversified assets to stabilize market fluctuations and generate steady returns. Whale watching shares, typically issued by niche eco-tourism companies, reflect concentrated market influence driven by tourism trends and environmental policies. Explore the comparative impact of these investment types on market dynamics and portfolio diversification strategies.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered open-end investment companies that pool money from many investors to invest in stocks, bonds, and other securities, offering professional management, diversification, low minimum investments, and liquidity.

Mutual fund - Wikipedia - Mutual funds pool money to purchase securities and are categorized by principal investments and management style; they provide economies of scale, diversification, liquidity, professional management, and are regulated by government bodies.

Understanding mutual funds - Charles Schwab - Mutual funds offer diversification, professional management, low costs due to bulk transaction handling, and convenience by pooling money with other investors to buy a broad mix of assets including stocks, bonds, and commodities.

dowidth.com

dowidth.com