Collectible sneakers have surged in value due to limited releases and cultural significance, offering investors unique assets with high liquidity in niche markets. Jewelry remains a classic investment, prized for its intrinsic material value, timeless appeal, and ability to retain worth across economic cycles. Explore the distinct advantages and market trends of both to make informed investment decisions.

Why it is important

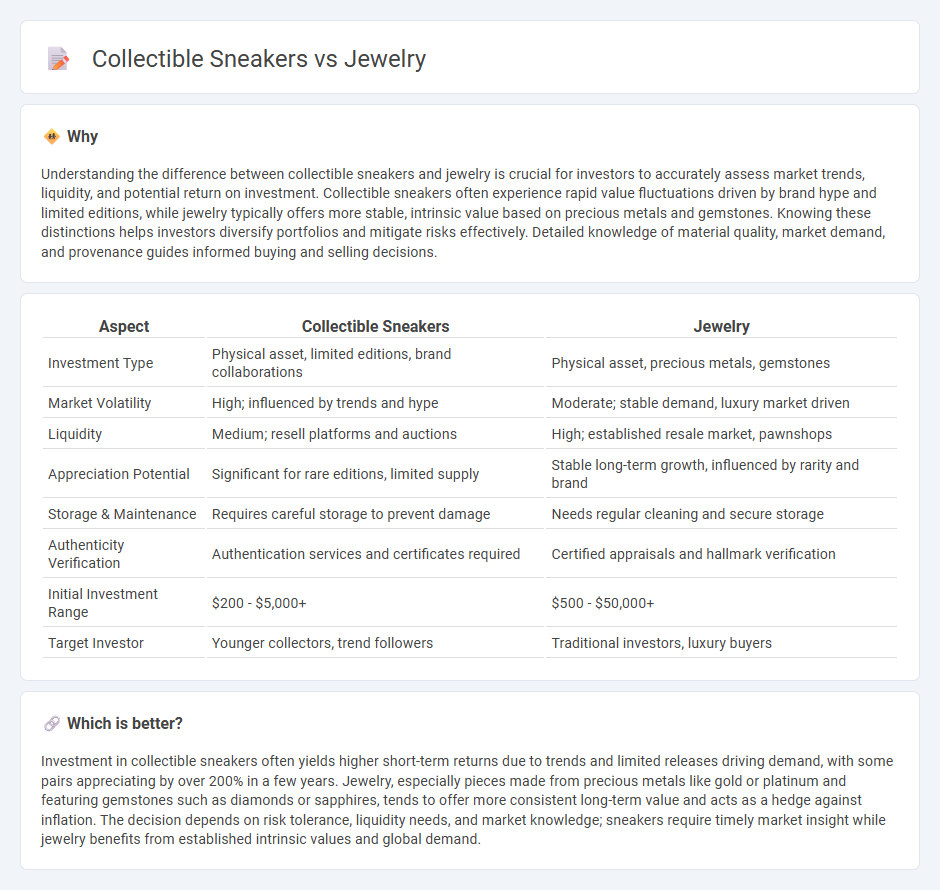

Understanding the difference between collectible sneakers and jewelry is crucial for investors to accurately assess market trends, liquidity, and potential return on investment. Collectible sneakers often experience rapid value fluctuations driven by brand hype and limited editions, while jewelry typically offers more stable, intrinsic value based on precious metals and gemstones. Knowing these distinctions helps investors diversify portfolios and mitigate risks effectively. Detailed knowledge of material quality, market demand, and provenance guides informed buying and selling decisions.

Comparison Table

| Aspect | Collectible Sneakers | Jewelry |

|---|---|---|

| Investment Type | Physical asset, limited editions, brand collaborations | Physical asset, precious metals, gemstones |

| Market Volatility | High; influenced by trends and hype | Moderate; stable demand, luxury market driven |

| Liquidity | Medium; resell platforms and auctions | High; established resale market, pawnshops |

| Appreciation Potential | Significant for rare editions, limited supply | Stable long-term growth, influenced by rarity and brand |

| Storage & Maintenance | Requires careful storage to prevent damage | Needs regular cleaning and secure storage |

| Authenticity Verification | Authentication services and certificates required | Certified appraisals and hallmark verification |

| Initial Investment Range | $200 - $5,000+ | $500 - $50,000+ |

| Target Investor | Younger collectors, trend followers | Traditional investors, luxury buyers |

Which is better?

Investment in collectible sneakers often yields higher short-term returns due to trends and limited releases driving demand, with some pairs appreciating by over 200% in a few years. Jewelry, especially pieces made from precious metals like gold or platinum and featuring gemstones such as diamonds or sapphires, tends to offer more consistent long-term value and acts as a hedge against inflation. The decision depends on risk tolerance, liquidity needs, and market knowledge; sneakers require timely market insight while jewelry benefits from established intrinsic values and global demand.

Connection

Collectible sneakers and jewelry both serve as alternative investment assets that appreciate in value due to rarity, brand prestige, and cultural significance. Limited edition sneakers from iconic brands like Nike or Adidas can parallel high-end jewelry from luxury designers in generating strong secondary market demand. Investors capitalize on trends, exclusivity, and authenticity to secure long-term returns in these non-traditional investment categories.

Key Terms

Authenticity

Authenticity in jewelry is ensured through hallmarking, certified gemstones, and professional appraisals, guaranteeing value and trust. Collectible sneakers rely on limited editions, original packaging, and verification via QR codes or RFID tags to confirm genuineness and combat counterfeiting. Discover how advances in authentication technology are revolutionizing both industries.

Market Liquidity

Jewelry markets exhibit high liquidity due to consistent demand, established resale channels, and inherent value in precious metals and gemstones. Collectible sneakers show variable liquidity, influenced by brand hype, limited editions, and trend cycles, often requiring niche marketplaces and active community engagement. Explore these dynamics further to understand investment potential and market behavior.

Provenance

Provenance plays a crucial role in determining the value of both jewelry and collectible sneakers, as documented history authenticates originality and rarity. Jewelry provenance often includes detailed records of gemstones, designers, and previous ownership by notable figures, while collectible sneakers rely on limited editions, collaboration details, and verified transaction history. Explore the significance of provenance in luxury and sneaker markets to better understand investment potential.

Source and External Links

Women's Jewelry Sale - Kate Spade Outlet - Designer jewelry including earrings, necklaces, and bracelets are available at discounted prices, offering versatile styles from dainty to bold to suit different moods and occasions with free shipping over $50.

Silver and Gold Jewelry | Trending Jewelry Styles | Uncommon James - Offers a broad collection of gold and silver jewelry with options for personalized necklaces, statement earrings, and stackable rings and bracelets, including sale items for layered looks and ear stacks.

Tiffany & Co. US | Luxury Jewelry, Gifts & Accessories Since 1837 - Features luxury jewelry crafted with world-class diamonds and exceptional craftsmanship, representing timeless elegance from a heritage brand dating back nearly two centuries.

dowidth.com

dowidth.com