Fractionalized art investment involves purchasing shares of valuable artworks, allowing investors to diversify portfolios with high-value assets without full ownership, while wine investment focuses on acquiring collectible wines expected to appreciate over time. Art investments offer liquidity through digital marketplaces, but wine requires careful storage and expertise to maximize returns. Discover which investment strategy aligns best with your financial goals and risk appetite.

Why it is important

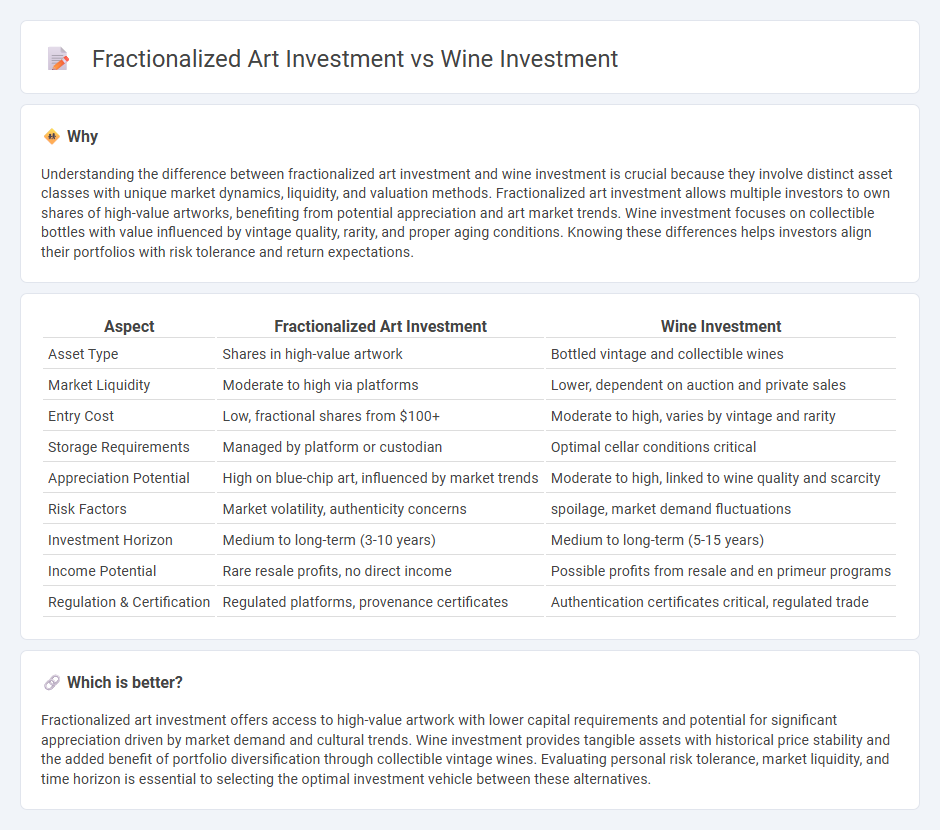

Understanding the difference between fractionalized art investment and wine investment is crucial because they involve distinct asset classes with unique market dynamics, liquidity, and valuation methods. Fractionalized art investment allows multiple investors to own shares of high-value artworks, benefiting from potential appreciation and art market trends. Wine investment focuses on collectible bottles with value influenced by vintage quality, rarity, and proper aging conditions. Knowing these differences helps investors align their portfolios with risk tolerance and return expectations.

Comparison Table

| Aspect | Fractionalized Art Investment | Wine Investment |

|---|---|---|

| Asset Type | Shares in high-value artwork | Bottled vintage and collectible wines |

| Market Liquidity | Moderate to high via platforms | Lower, dependent on auction and private sales |

| Entry Cost | Low, fractional shares from $100+ | Moderate to high, varies by vintage and rarity |

| Storage Requirements | Managed by platform or custodian | Optimal cellar conditions critical |

| Appreciation Potential | High on blue-chip art, influenced by market trends | Moderate to high, linked to wine quality and scarcity |

| Risk Factors | Market volatility, authenticity concerns | spoilage, market demand fluctuations |

| Investment Horizon | Medium to long-term (3-10 years) | Medium to long-term (5-15 years) |

| Income Potential | Rare resale profits, no direct income | Possible profits from resale and en primeur programs |

| Regulation & Certification | Regulated platforms, provenance certificates | Authentication certificates critical, regulated trade |

Which is better?

Fractionalized art investment offers access to high-value artwork with lower capital requirements and potential for significant appreciation driven by market demand and cultural trends. Wine investment provides tangible assets with historical price stability and the added benefit of portfolio diversification through collectible vintage wines. Evaluating personal risk tolerance, market liquidity, and time horizon is essential to selecting the optimal investment vehicle between these alternatives.

Connection

Fractionalized art investment and wine investment both allow investors to acquire shares in high-value, tangible assets, enabling portfolio diversification with relatively lower capital. These investment types leverage a growing market trend of tokenization and fractional ownership, making luxury assets more accessible and liquid. Both sectors benefit from expert appraisal and market performance data to guide investor decisions and maximize returns.

Key Terms

Asset Liquidity

Wine investment offers moderate liquidity as bottles can be sold through auctions, specialized dealers, or wine exchanges, but market demand and vintage quality influence sale speed. Fractionalized art investment provides increased liquidity by enabling investors to buy and sell shares in high-value artworks on digital platforms, creating a broader market and quicker transaction times. Explore how these distinct liquidity features impact portfolio diversification and risk management in asset investments.

Provenance Verification

Wine investment relies heavily on provenance verification through detailed documentation such as purchase receipts, bottling records, and storage history to authenticate vintage quality and origin. Fractionalized art investment utilizes blockchain technology to securely record and track provenance, ensuring transparency and reducing fraud risk in ownership history. Explore how these provenance verification methods impact investment security and value in both markets.

Market Regulation

Wine investment operates within established regulatory frameworks including certification, provenance verification, and compliance with alcohol distribution laws, ensuring transparency and investor protection. Fractionalized art investment is subject to evolving securities regulations, as tokens representing ownership stakes require adherence to financial market rules and anti-fraud measures. Discover more about how regulatory landscapes shape these unique investment opportunities.

Source and External Links

Wine Collector's Guide to Investing | Cult Wines United States - Investment-grade wines typically come from renowned regions such as Bordeaux, Burgundy, and Champagne, and the market functions through auctions, private sales, and online platforms offering tools for investors, with key factors being region, vintage, and producer.

Getting Started with Wine Investments | Wine Folly - Investment wines should be age-worthy and in demand; fine Bordeaux, Grand Cru Burgundy, Napa Cabernet Sauvignon, and tete de cuvee Champagnes are popular, and provenance and wine insurance are essential considerations for investors.

Wine Investment | Investing in Fine Wines - Cru Wine - Fine wine is a stable, tangible asset class with strong historical performance and low correlation to traditional markets, offering tailored portfolio management, insured bonded storage, and global client support.

dowidth.com

dowidth.com