Royalty streaming offers investors a fixed percentage of revenue generated by a company's product or service, providing steady cash flow without ownership dilution. Equity investment involves purchasing shares, granting partial ownership and potential capital gains tied to business growth. Explore the unique benefits and risks of royalty streaming versus equity investment to make informed financial decisions.

Why it is important

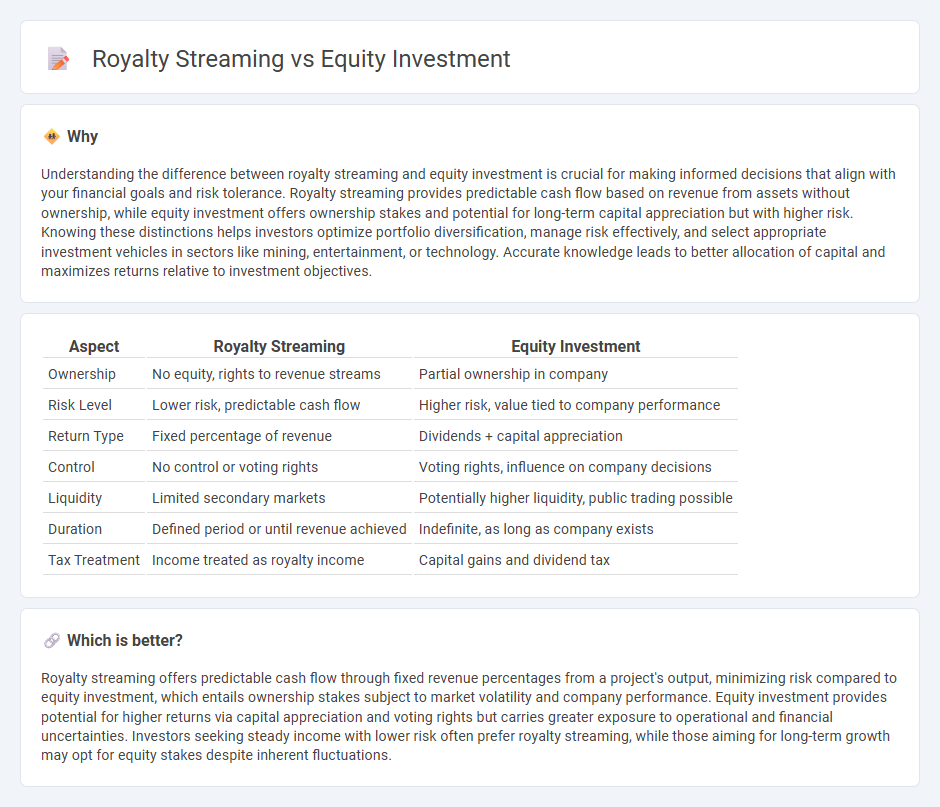

Understanding the difference between royalty streaming and equity investment is crucial for making informed decisions that align with your financial goals and risk tolerance. Royalty streaming provides predictable cash flow based on revenue from assets without ownership, while equity investment offers ownership stakes and potential for long-term capital appreciation but with higher risk. Knowing these distinctions helps investors optimize portfolio diversification, manage risk effectively, and select appropriate investment vehicles in sectors like mining, entertainment, or technology. Accurate knowledge leads to better allocation of capital and maximizes returns relative to investment objectives.

Comparison Table

| Aspect | Royalty Streaming | Equity Investment |

|---|---|---|

| Ownership | No equity, rights to revenue streams | Partial ownership in company |

| Risk Level | Lower risk, predictable cash flow | Higher risk, value tied to company performance |

| Return Type | Fixed percentage of revenue | Dividends + capital appreciation |

| Control | No control or voting rights | Voting rights, influence on company decisions |

| Liquidity | Limited secondary markets | Potentially higher liquidity, public trading possible |

| Duration | Defined period or until revenue achieved | Indefinite, as long as company exists |

| Tax Treatment | Income treated as royalty income | Capital gains and dividend tax |

Which is better?

Royalty streaming offers predictable cash flow through fixed revenue percentages from a project's output, minimizing risk compared to equity investment, which entails ownership stakes subject to market volatility and company performance. Equity investment provides potential for higher returns via capital appreciation and voting rights but carries greater exposure to operational and financial uncertainties. Investors seeking steady income with lower risk often prefer royalty streaming, while those aiming for long-term growth may opt for equity stakes despite inherent fluctuations.

Connection

Royalty streaming offers investors a steady cash flow by purchasing rights to future revenues, while equity investment provides ownership stakes with potential for capital gains. Both investment types are connected through their focus on generating returns from asset performance, balancing risk and reward differently. This connection enables diversified portfolios by combining predictable income streams from royalties with growth potential from equity stakes.

Key Terms

Ownership (Equity)

Equity investment involves acquiring ownership shares in a company, granting investors voting rights and potential dividends based on company performance. Royalty streaming, on the other hand, provides investors with a percentage of revenue generated from specific assets without conferring ownership or control. Explore the detailed distinctions and financial implications of both investment approaches to make informed decisions.

Ongoing Payments (Royalty)

Royalty streaming provides ongoing payments based on a percentage of revenue generated from a project or asset, offering continuous cash flow linked to production performance. Unlike equity investment, which yields returns through ownership appreciation and dividends, royalty streams deliver predictable income without equity dilution or management control. Explore detailed comparisons to understand which model aligns best with your investment goals and risk tolerance.

Exit Strategy

Equity investment provides ownership and potential capital gains upon exit through IPOs or acquisitions, appealing to investors seeking long-term appreciation. Royalty streaming offers steady cash flow from revenue without ownership, with exit options often limited to secondary market sales or contract transfers. Explore detailed comparisons of exit strategies for informed investment decisions.

Source and External Links

What is equity investment? (A guide to understanding it) - Equity investment involves purchasing shares to obtain a stake in companies, with potential returns through capital gains and dividends, featuring benefits like liquidity, limited liability, voting rights, and opportunities for diversification.

What Are Equities or Equity Investments? - Equities, or stocks, provide investors access to company ownership with benefits including reward potential from business growth, dividend income, portfolio diversification, and accessibility through various investment channels.

Equity Investments | International Finance Corporation (IFC) - IFC invests in companies by taking equity stakes ranging typically from 5% to 20%, providing growth capital and encouraging broader share ownership to support local capital market development.

dowidth.com

dowidth.com