Sports memorabilia trading offers enthusiasts tangible assets like signed jerseys and rare cards with historical significance and potential for high appreciation based on athlete fame and event rarity. Wine investing involves acquiring fine wines known for aging qualities, provenance, and limited production, with values influenced by vintage, vineyard reputation, and storage conditions. Explore the unique benefits and risks of each to identify the best fit for your investment portfolio.

Why it is important

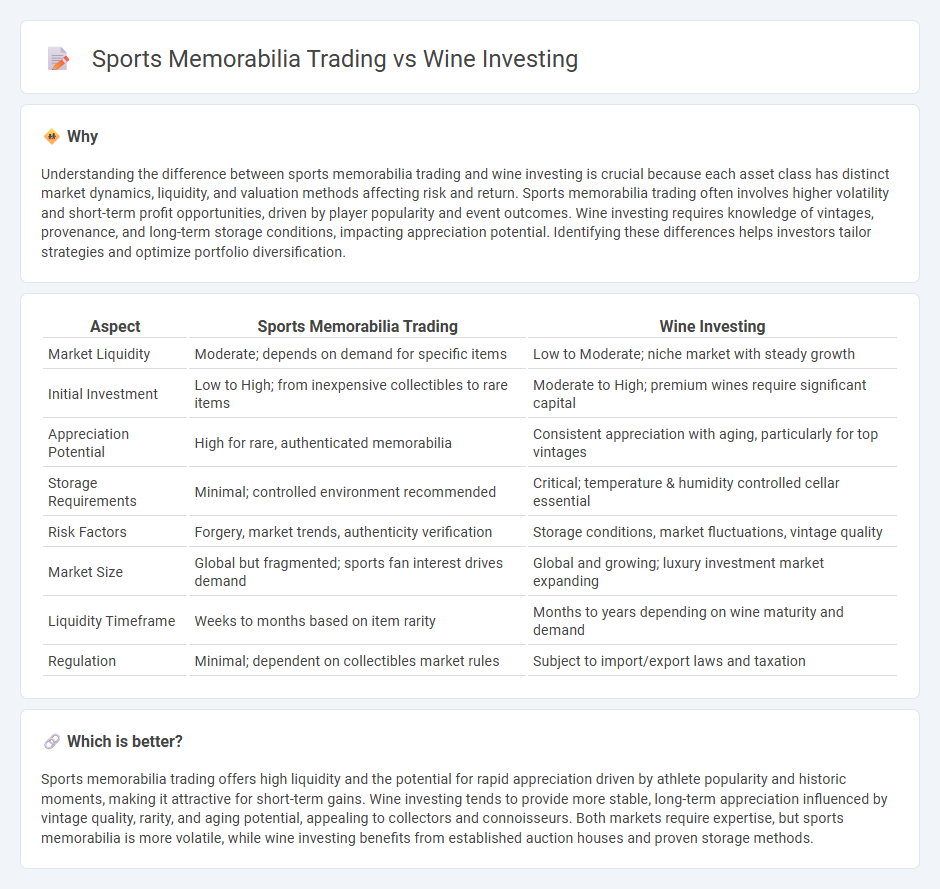

Understanding the difference between sports memorabilia trading and wine investing is crucial because each asset class has distinct market dynamics, liquidity, and valuation methods affecting risk and return. Sports memorabilia trading often involves higher volatility and short-term profit opportunities, driven by player popularity and event outcomes. Wine investing requires knowledge of vintages, provenance, and long-term storage conditions, impacting appreciation potential. Identifying these differences helps investors tailor strategies and optimize portfolio diversification.

Comparison Table

| Aspect | Sports Memorabilia Trading | Wine Investing |

|---|---|---|

| Market Liquidity | Moderate; depends on demand for specific items | Low to Moderate; niche market with steady growth |

| Initial Investment | Low to High; from inexpensive collectibles to rare items | Moderate to High; premium wines require significant capital |

| Appreciation Potential | High for rare, authenticated memorabilia | Consistent appreciation with aging, particularly for top vintages |

| Storage Requirements | Minimal; controlled environment recommended | Critical; temperature & humidity controlled cellar essential |

| Risk Factors | Forgery, market trends, authenticity verification | Storage conditions, market fluctuations, vintage quality |

| Market Size | Global but fragmented; sports fan interest drives demand | Global and growing; luxury investment market expanding |

| Liquidity Timeframe | Weeks to months based on item rarity | Months to years depending on wine maturity and demand |

| Regulation | Minimal; dependent on collectibles market rules | Subject to import/export laws and taxation |

Which is better?

Sports memorabilia trading offers high liquidity and the potential for rapid appreciation driven by athlete popularity and historic moments, making it attractive for short-term gains. Wine investing tends to provide more stable, long-term appreciation influenced by vintage quality, rarity, and aging potential, appealing to collectors and connoisseurs. Both markets require expertise, but sports memorabilia is more volatile, while wine investing benefits from established auction houses and proven storage methods.

Connection

Sports memorabilia trading and wine investing both leverage the principles of rarity, provenance, and emotional value to drive market demand and asset appreciation. Collectors and investors seek authenticated items or vintages with verified history, enhancing their desirability and price potential in niche markets. These investment forms also benefit from growing global interest and the appeal of tangible assets that combine passion with financial return.

Key Terms

Wine investing:

Wine investing offers a unique blend of cultural value and financial return, with rare vintages from Bordeaux and Burgundy appreciating steadily over decades. This asset class benefits from limited supply, aging potential, and established global auction markets, making it a resilient choice compared to the fluctuating demand in sports memorabilia. Explore the nuances and financial strategies behind wine investing to maximize portfolio diversification and long-term gains.

Provenance

Provenance plays a crucial role in wine investing by verifying origin, vintage, and authenticity, which directly influences market value and collector confidence. In sports memorabilia trading, provenance is equally vital to confirm item legitimacy and historical significance, often traced through certificates, player signatures, and documented ownership history. Explore detailed strategies to authenticate assets and maximize returns in both markets.

Vintage

Vintage wine investing offers tangible asset appreciation driven by rarity, provenance, and aging potential, often yielding steady returns through global auction markets and private sales. Sports memorabilia trading focuses on vintage items like autographed jerseys and game-used equipment, where authenticity, player significance, and historical context dictate value spikes in collector communities and specialty auctions. Explore comprehensive strategies and market trends to optimize your portfolio in these unique vintage asset classes.

Source and External Links

Understanding Online Wine Investments And Investing Platforms - Online wine investing offers a unique way to diversify portfolios with managed digital platforms providing personalized portfolios, strong returns, and secure storage exempt from duty and VAT, with key advice highlighting diversification across regions and grape varietals.

Getting Started with Wine Investments | Wine Folly - Investing in wine typically focuses on fine Bordeaux, Grand Cru Burgundy, Napa Cabernet Sauvignon, and flagship wines with attention to provenance, storage, and insurance, and may also include cult wines known for strong recent returns.

Evaluating the Investment Performance of Fine Wine: Returns and ... - Fine wine investing has averaged about 10% annual returns since 1988, with more consistent gains over 5+ years and market downturns often presenting buying opportunities for investors believing in wine's long-term appreciation fundamentals.

dowidth.com

dowidth.com