Rare whisky bottles trading offers unique tangible asset diversification with potential for substantial appreciation driven by scarcity and collector demand, contrasting with private equity's focus on direct investments in private companies for long-term capital growth. This alternative asset class can provide portfolio balance through lower correlation with traditional financial markets and the allure of cultural heritage valuation. Explore more about how rare whisky trading compares to private equity in boosting your investment strategy.

Why it is important

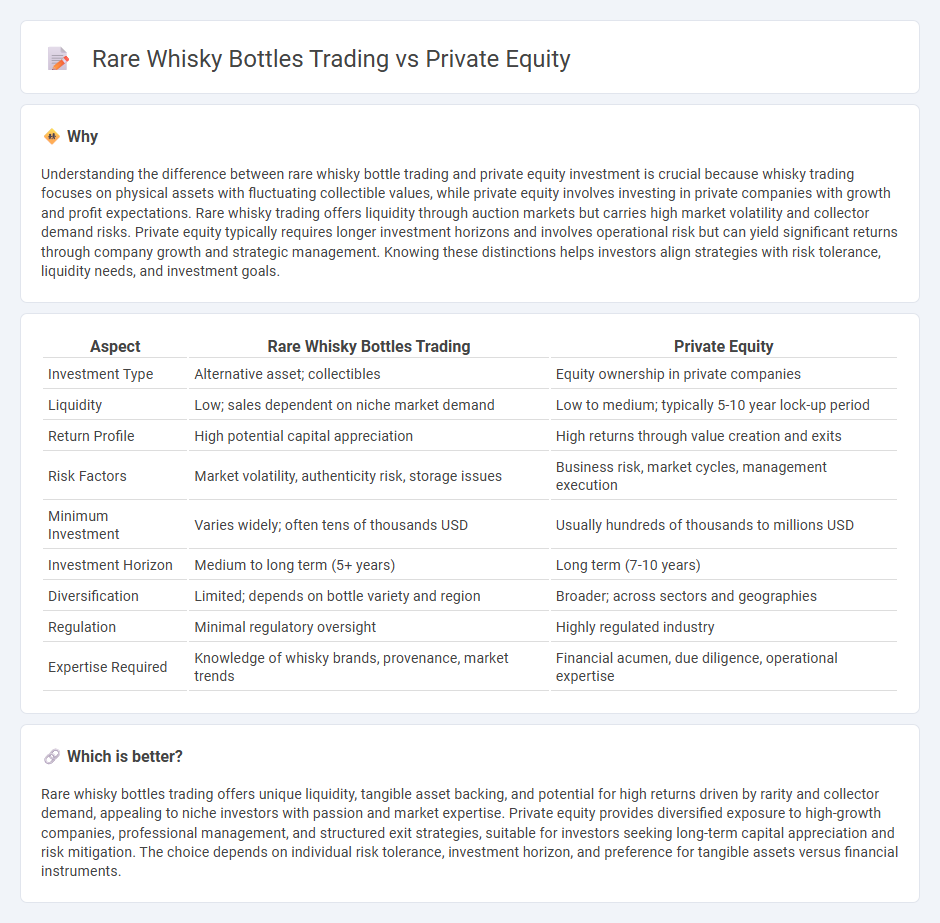

Understanding the difference between rare whisky bottle trading and private equity investment is crucial because whisky trading focuses on physical assets with fluctuating collectible values, while private equity involves investing in private companies with growth and profit expectations. Rare whisky trading offers liquidity through auction markets but carries high market volatility and collector demand risks. Private equity typically requires longer investment horizons and involves operational risk but can yield significant returns through company growth and strategic management. Knowing these distinctions helps investors align strategies with risk tolerance, liquidity needs, and investment goals.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Private Equity |

|---|---|---|

| Investment Type | Alternative asset; collectibles | Equity ownership in private companies |

| Liquidity | Low; sales dependent on niche market demand | Low to medium; typically 5-10 year lock-up period |

| Return Profile | High potential capital appreciation | High returns through value creation and exits |

| Risk Factors | Market volatility, authenticity risk, storage issues | Business risk, market cycles, management execution |

| Minimum Investment | Varies widely; often tens of thousands USD | Usually hundreds of thousands to millions USD |

| Investment Horizon | Medium to long term (5+ years) | Long term (7-10 years) |

| Diversification | Limited; depends on bottle variety and region | Broader; across sectors and geographies |

| Regulation | Minimal regulatory oversight | Highly regulated industry |

| Expertise Required | Knowledge of whisky brands, provenance, market trends | Financial acumen, due diligence, operational expertise |

Which is better?

Rare whisky bottles trading offers unique liquidity, tangible asset backing, and potential for high returns driven by rarity and collector demand, appealing to niche investors with passion and market expertise. Private equity provides diversified exposure to high-growth companies, professional management, and structured exit strategies, suitable for investors seeking long-term capital appreciation and risk mitigation. The choice depends on individual risk tolerance, investment horizon, and preference for tangible assets versus financial instruments.

Connection

Rare whisky bottles trading and private equity intersect through asset diversification and high-value alternative investments. Collectors and investors leverage the whisky market's robust growth, driven by scarcity and provenance, to enhance portfolio returns similar to private equity strategies focused on unique, appreciating assets. This fusion enables capital appreciation by combining tangible luxury assets with structured investment practices, attracting investors seeking both passion and profitability.

Key Terms

Ownership Structure

Private equity typically involves pooled investments from multiple shareholders structured as limited partnerships, offering investors limited liability and professional fund management. In contrast, rare whisky bottles trading centers on direct ownership of physical assets, where collectors or investors individually hold bottles that may appreciate in value over time. Explore the nuances of ownership structures in these distinct investment avenues to understand their impact on liquidity and risk.

Liquidity

Private equity investments often face limited liquidity, with funds typically locked in for several years before investors can exit through IPOs or acquisitions. Rare whisky bottles offer a more liquid alternative, enabling collectors to trade on specialized auction platforms with quicker turnaround times and growing market demand. Explore the advantages of each asset class to determine which liquidity profile best suits your investment goals.

Valuation Methods

Private equity valuation predominantly relies on discounted cash flow (DCF) analysis, comparable company multiples, and precedent transaction multiples to estimate enterprise value based on financial performance and market conditions. In contrast, rare whisky bottles trading valuation hinges on factors such as provenance, age, rarity, auction prices, and collector demand, often requiring expertise in market trends and authentication to determine bottle worth. Explore detailed methodologies and market insights to enhance understanding of valuation strategies in both sectors.

Source and External Links

What is Private Equity - Private equity provides medium to long-term finance in return for an equity stake in potentially high-growth unquoted companies, often supporting management buyouts and buy-ins.

Private Equity - Private equity involves an investment manager raising funds from institutional investors to purchase equity stakes in private companies using a mix of equity and debt financing.

Private Equity: What You Need to Know - Private equity strategies involve investing in non-publicly traded companies, where fund managers enhance portfolio performance by strengthening management, acquiring new businesses, and optimizing operations.

dowidth.com

dowidth.com