Patent monetization involves generating revenue by licensing or selling patented technologies, enabling inventors or companies to capitalize on intellectual property assets. Franchise investment focuses on purchasing the rights to operate a business model proven for success, providing a structured path to entrepreneurship with established brand recognition. Explore how each strategy maximizes returns and fits different investment goals.

Why it is important

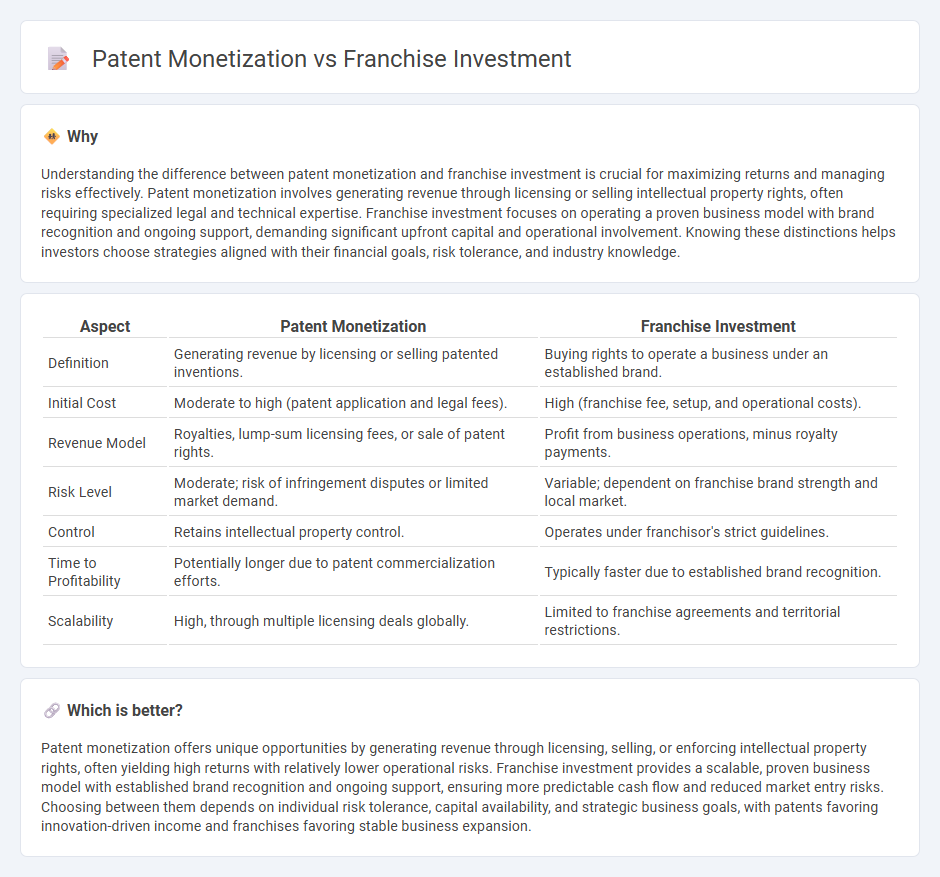

Understanding the difference between patent monetization and franchise investment is crucial for maximizing returns and managing risks effectively. Patent monetization involves generating revenue through licensing or selling intellectual property rights, often requiring specialized legal and technical expertise. Franchise investment focuses on operating a proven business model with brand recognition and ongoing support, demanding significant upfront capital and operational involvement. Knowing these distinctions helps investors choose strategies aligned with their financial goals, risk tolerance, and industry knowledge.

Comparison Table

| Aspect | Patent Monetization | Franchise Investment |

|---|---|---|

| Definition | Generating revenue by licensing or selling patented inventions. | Buying rights to operate a business under an established brand. |

| Initial Cost | Moderate to high (patent application and legal fees). | High (franchise fee, setup, and operational costs). |

| Revenue Model | Royalties, lump-sum licensing fees, or sale of patent rights. | Profit from business operations, minus royalty payments. |

| Risk Level | Moderate; risk of infringement disputes or limited market demand. | Variable; dependent on franchise brand strength and local market. |

| Control | Retains intellectual property control. | Operates under franchisor's strict guidelines. |

| Time to Profitability | Potentially longer due to patent commercialization efforts. | Typically faster due to established brand recognition. |

| Scalability | High, through multiple licensing deals globally. | Limited to franchise agreements and territorial restrictions. |

Which is better?

Patent monetization offers unique opportunities by generating revenue through licensing, selling, or enforcing intellectual property rights, often yielding high returns with relatively lower operational risks. Franchise investment provides a scalable, proven business model with established brand recognition and ongoing support, ensuring more predictable cash flow and reduced market entry risks. Choosing between them depends on individual risk tolerance, capital availability, and strategic business goals, with patents favoring innovation-driven income and franchises favoring stable business expansion.

Connection

Patent monetization transforms intellectual property into revenue streams by licensing or selling patented innovations, providing robust assets for franchise investment. Franchise investment leverages these patented technologies to gain competitive advantages, brand differentiation, and enhanced market value. Integrating patent monetization strategies strengthens franchise portfolios, fueling growth and investor confidence.

Key Terms

Royalty

Franchise investment generates royalties through ongoing franchise fees and product sales, leveraging brand equity and operational systems to ensure steady revenue streams. Patent monetization involves licensing intellectual property rights, where royalties are earned based on the usage or commercialization of patented technology, often yielding high-margin returns. Explore the strategic differences and benefits between franchise royalties and patent licensing to optimize your revenue model.

Intellectual Property (IP)

Franchise investment involves leveraging established brand IP rights to expand business operations through franchisee partnerships, generating recurring revenue streams while maintaining brand control. Patent monetization focuses on extracting value from patented inventions via licensing agreements, sales, or litigation, capitalizing on exclusive IP protection to secure competitive advantage and revenue. Explore how optimizing IP strategies in franchising and patent monetization can enhance your business growth potential.

Brand Equity

Franchise investment leverages brand equity by expanding a recognized brand's reach through licensed operators, ensuring consistent brand experience and customer trust. Patent monetization capitalizes on intangible assets by licensing or selling innovations but may not directly enhance consumer-facing brand value. Explore deeper insights into how these strategies impact brand equity and business growth.

Source and External Links

A Consumer's Guide to Buying a Franchise - Offers a comprehensive overview of what to consider when investing in a franchise, including initial fees, ongoing royalties, advertising contributions, and the responsibilities of franchisees.

FranShares - Passive Franchise Investing - Enables individuals to invest in franchises starting at $500, offering passive income through profit distributions and potential appreciation in franchise value, with operations managed by professionals.

Franchise Opportunities By Investment Requirement - Provides a searchable directory of franchise opportunities categorized by investment level, helping prospective investors match their budget and goals with suitable franchise options.

dowidth.com

dowidth.com