Royalty stream investing generates passive income by acquiring rights to a portion of revenue from intellectual property, such as music or patents, ensuring consistent cash flow without ownership risks. Peer-to-peer lending connects individual borrowers with investors willing to lend funds at agreed interest rates, offering potential high returns but carrying credit risk and platform dependency. Explore the differences in risk, return, and liquidity to determine which investment suits your financial goals best.

Why it is important

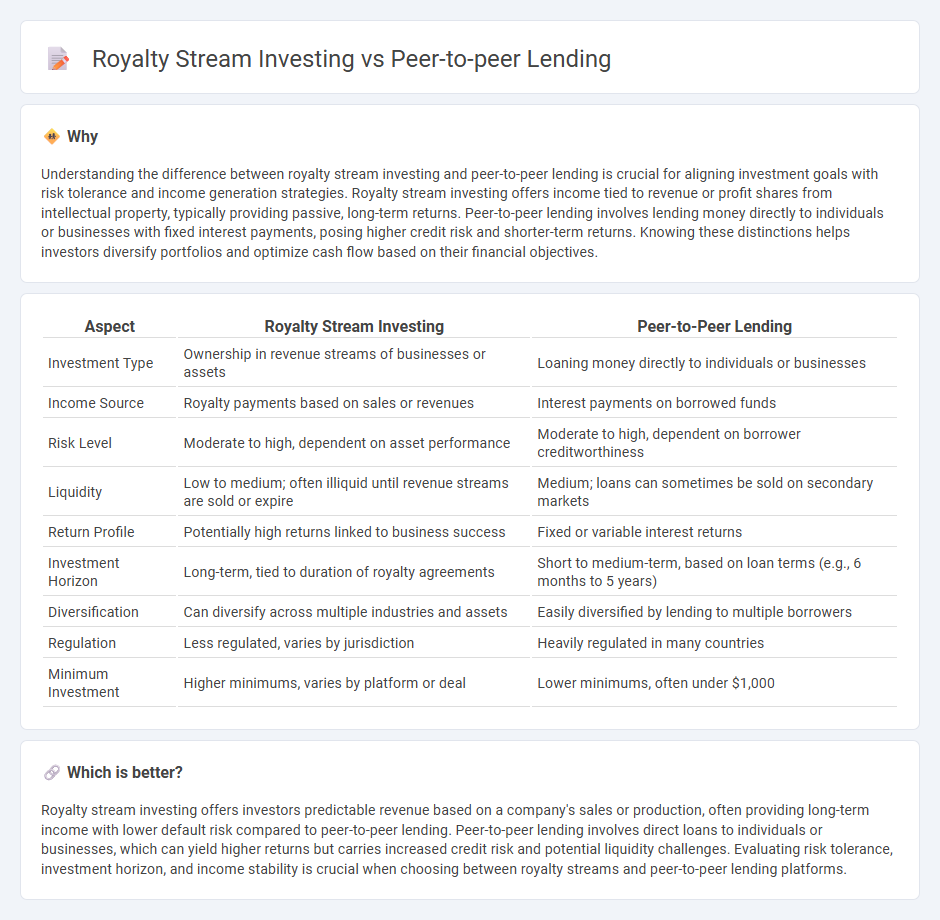

Understanding the difference between royalty stream investing and peer-to-peer lending is crucial for aligning investment goals with risk tolerance and income generation strategies. Royalty stream investing offers income tied to revenue or profit shares from intellectual property, typically providing passive, long-term returns. Peer-to-peer lending involves lending money directly to individuals or businesses with fixed interest payments, posing higher credit risk and shorter-term returns. Knowing these distinctions helps investors diversify portfolios and optimize cash flow based on their financial objectives.

Comparison Table

| Aspect | Royalty Stream Investing | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Ownership in revenue streams of businesses or assets | Loaning money directly to individuals or businesses |

| Income Source | Royalty payments based on sales or revenues | Interest payments on borrowed funds |

| Risk Level | Moderate to high, dependent on asset performance | Moderate to high, dependent on borrower creditworthiness |

| Liquidity | Low to medium; often illiquid until revenue streams are sold or expire | Medium; loans can sometimes be sold on secondary markets |

| Return Profile | Potentially high returns linked to business success | Fixed or variable interest returns |

| Investment Horizon | Long-term, tied to duration of royalty agreements | Short to medium-term, based on loan terms (e.g., 6 months to 5 years) |

| Diversification | Can diversify across multiple industries and assets | Easily diversified by lending to multiple borrowers |

| Regulation | Less regulated, varies by jurisdiction | Heavily regulated in many countries |

| Minimum Investment | Higher minimums, varies by platform or deal | Lower minimums, often under $1,000 |

Which is better?

Royalty stream investing offers investors predictable revenue based on a company's sales or production, often providing long-term income with lower default risk compared to peer-to-peer lending. Peer-to-peer lending involves direct loans to individuals or businesses, which can yield higher returns but carries increased credit risk and potential liquidity challenges. Evaluating risk tolerance, investment horizon, and income stability is crucial when choosing between royalty streams and peer-to-peer lending platforms.

Connection

Royalty stream investing and peer-to-peer lending both provide alternative investment opportunities that generate passive income through direct asset or loan-backed cash flows. They connect by offering investors access to diversified revenue streams outside traditional equity and bond markets, often through digital platforms enabling fractional ownership and lending. These strategies enhance portfolio yields by tapping into real-world economic activities such as intellectual property royalties and consumer or business loans.

Key Terms

Platform risk

Peer-to-peer lending platforms often face higher platform risk due to borrower defaults and platform insolvency, which can directly impact investor returns. Royalty stream investing generally offers more stable cash flows backed by intellectual property or revenue-generating assets, reducing exposure to platform-specific failures. Explore detailed risk assessments to understand how platform risk affects your investment strategy.

Repayment structure

Peer-to-peer lending offers fixed periodic repayments based on loan terms, ensuring predictable income streams for investors, while royalty stream investing provides returns tied to the revenue or sales performance of a business, introducing variable cash flows. P2P lending's repayment structure typically involves principal and interest payments over a set term, contrasting with royalty streams that fluctuate with operational success. Explore the nuances of repayment structures to determine the best fit for your investment goals.

Revenue share

Peer-to-peer lending involves individuals lending money directly to borrowers in exchange for principal and interest repayments over time, with returns linked to borrower repayments rather than revenue share. Royalty stream investing grants investors a percentage of a company's revenue, aligning returns directly with business performance and offering potentially variable income based on sales. Explore the unique benefits and risks of revenue share models in these investment options to make an informed choice.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer lending allows individuals to borrow and lend money directly through specialized online platforms without involving banks, often offering flexible terms and competitive rates for borrowers and investment opportunities for lenders.

Peer-to-peer lending - Wikipedia - P2P lending is an alternative financial service where online platforms match lenders with borrowers, offering unsecured or secured loans, with services including credit checks and loan servicing provided by the platform.

Peer to peer lending: what you need to know - Peer-to-peer lending operates like a marketplace for loans, connecting lenders and borrowers, with typically higher interest rates than savings accounts and a risk profile reflecting potential borrower default.

dowidth.com

dowidth.com