Rare whisky bottles trading offers significant investment potential due to their limited availability, increasing global demand, and historically high appreciation rates, often outperforming traditional assets like antique furniture. Antique furniture investments rely heavily on craftsmanship, provenance, and market trends, but typically experience slower liquidity and variable price growth compared to rare whisky. Explore deeper insights to determine which asset aligns best with your investment goals.

Why it is important

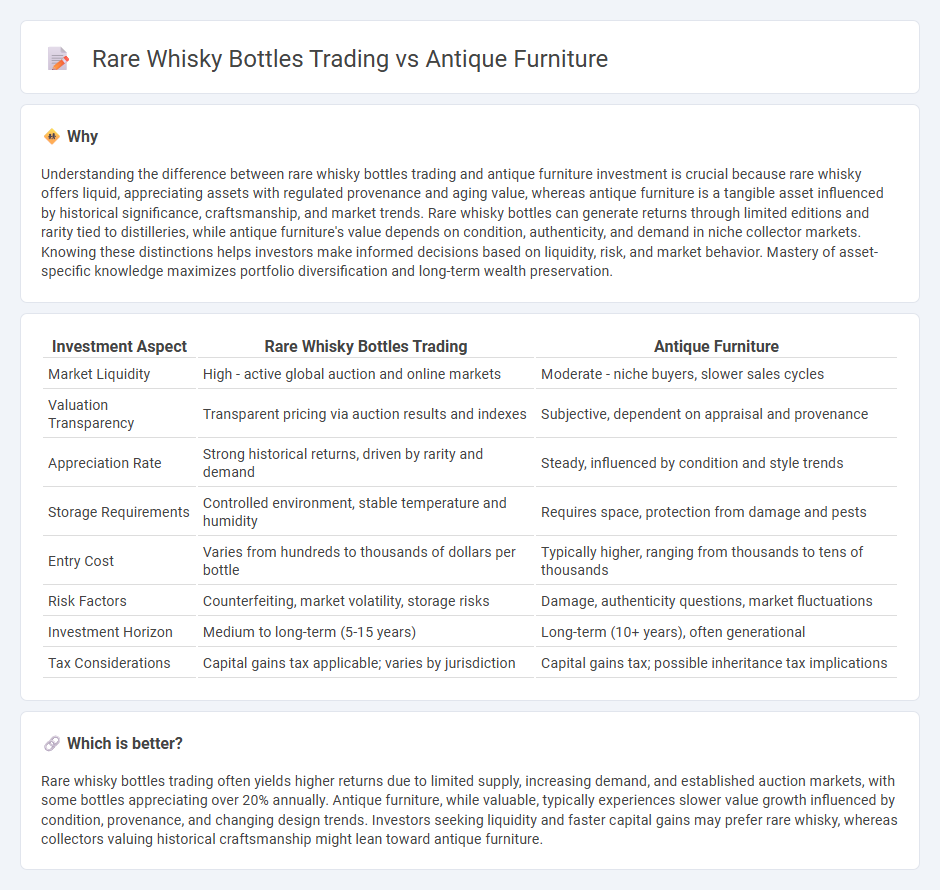

Understanding the difference between rare whisky bottles trading and antique furniture investment is crucial because rare whisky offers liquid, appreciating assets with regulated provenance and aging value, whereas antique furniture is a tangible asset influenced by historical significance, craftsmanship, and market trends. Rare whisky bottles can generate returns through limited editions and rarity tied to distilleries, while antique furniture's value depends on condition, authenticity, and demand in niche collector markets. Knowing these distinctions helps investors make informed decisions based on liquidity, risk, and market behavior. Mastery of asset-specific knowledge maximizes portfolio diversification and long-term wealth preservation.

Comparison Table

| Investment Aspect | Rare Whisky Bottles Trading | Antique Furniture |

|---|---|---|

| Market Liquidity | High - active global auction and online markets | Moderate - niche buyers, slower sales cycles |

| Valuation Transparency | Transparent pricing via auction results and indexes | Subjective, dependent on appraisal and provenance |

| Appreciation Rate | Strong historical returns, driven by rarity and demand | Steady, influenced by condition and style trends |

| Storage Requirements | Controlled environment, stable temperature and humidity | Requires space, protection from damage and pests |

| Entry Cost | Varies from hundreds to thousands of dollars per bottle | Typically higher, ranging from thousands to tens of thousands |

| Risk Factors | Counterfeiting, market volatility, storage risks | Damage, authenticity questions, market fluctuations |

| Investment Horizon | Medium to long-term (5-15 years) | Long-term (10+ years), often generational |

| Tax Considerations | Capital gains tax applicable; varies by jurisdiction | Capital gains tax; possible inheritance tax implications |

Which is better?

Rare whisky bottles trading often yields higher returns due to limited supply, increasing demand, and established auction markets, with some bottles appreciating over 20% annually. Antique furniture, while valuable, typically experiences slower value growth influenced by condition, provenance, and changing design trends. Investors seeking liquidity and faster capital gains may prefer rare whisky, whereas collectors valuing historical craftsmanship might lean toward antique furniture.

Connection

Rare whisky bottles and antique furniture share intrinsic value as alternative investment assets, both appreciated for their rarity, craftsmanship, and historical significance. Collectors and investors often seek these items for their potential to appreciate over time, driven by scarcity and demand within specialized markets. The trading of such luxury collectibles frequently involves auction houses and private sales, where provenance and condition critically influence asset valuation.

Key Terms

Provenance

Provenance plays a crucial role in both antique furniture and rare whisky bottles trading by establishing authenticity, historical significance, and value. Detailed documentation and verifiable ownership history enhance market confidence and drive higher prices in auctions and private sales. Explore more about how provenance impacts the valuation process in these collectible markets.

Authentication

Authentication remains the cornerstone in trading both antique furniture and rare whisky bottles, ensuring provenance and avoiding counterfeits. Experts utilize advanced techniques such as carbon dating for wood and spectroscopic analysis for whisky to validate authenticity. Explore comprehensive guides to master authentication methods and elevate your trading expertise.

Market Liquidity

Antique furniture markets often experience lower liquidity due to high transaction costs and the niche buyer base, while rare whisky bottle trading benefits from a growing global collector network and more frequent sales on specialized auction platforms. The rarity and provenance of whisky bottles can drive quicker turnover and price discovery compared to the slower, more personalized sales process of antique furniture. Explore our detailed analysis to understand how market liquidity impacts valuation and investment strategies in both asset classes.

Source and External Links

Vintage / Antique Furniture - Antique furniture is typically defined as pieces that are at least 100 years old, distinct from vintage items which may be newer but still show character and history.

Vintage Furniture - Offers unique one-of-a-kind antique and vintage pieces such as Brutalist pine tables and Scandinavian chairs from the early to mid-20th century, emphasizing craftsmanship and rare designs.

Furniture - Features a variety of antique furniture items like oak washstands, distressed buffets, and vintage dressers available for purchase, showcasing diverse styles and sizes for collectors and decorators.

dowidth.com

dowidth.com