Sports memorabilia investment captures value through rare collectibles and historic significance, often appreciating steadily based on athlete performance and market trends. Startup investment offers dynamic growth potential tied to innovation, scalability, and industry disruption, but includes higher risk and longer time horizons. Explore the distinct advantages and challenges of each investment type to determine the best fit for your portfolio.

Why it is important

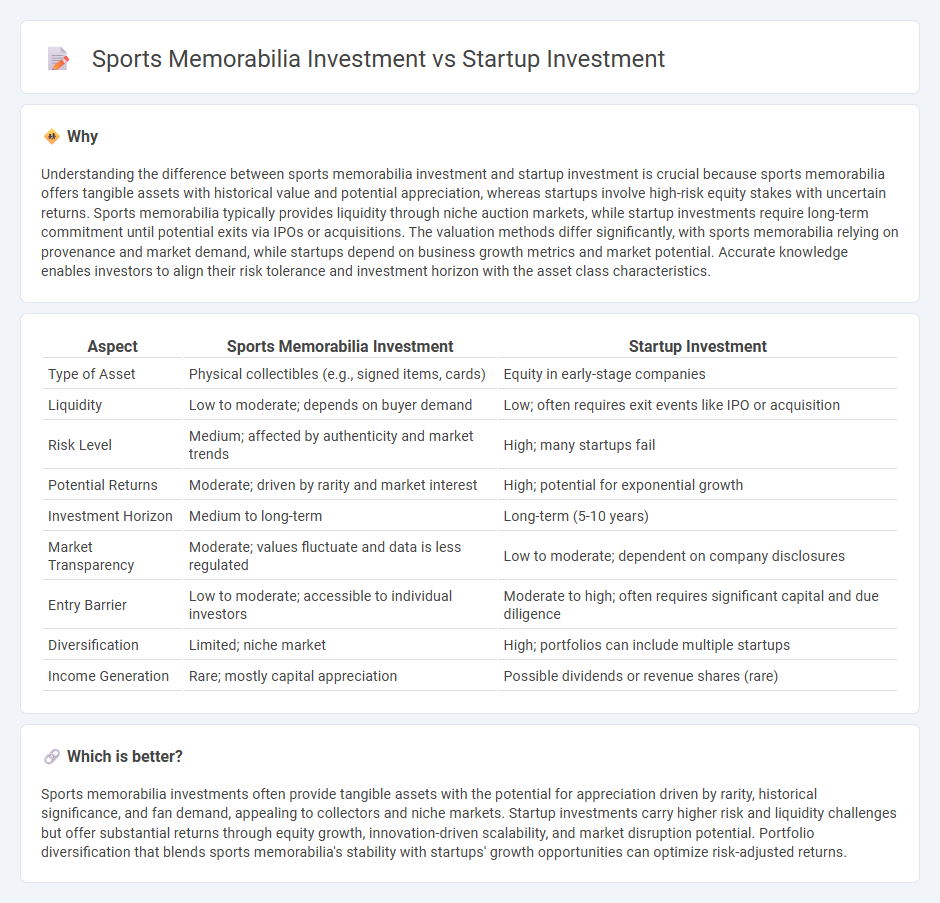

Understanding the difference between sports memorabilia investment and startup investment is crucial because sports memorabilia offers tangible assets with historical value and potential appreciation, whereas startups involve high-risk equity stakes with uncertain returns. Sports memorabilia typically provides liquidity through niche auction markets, while startup investments require long-term commitment until potential exits via IPOs or acquisitions. The valuation methods differ significantly, with sports memorabilia relying on provenance and market demand, while startups depend on business growth metrics and market potential. Accurate knowledge enables investors to align their risk tolerance and investment horizon with the asset class characteristics.

Comparison Table

| Aspect | Sports Memorabilia Investment | Startup Investment |

|---|---|---|

| Type of Asset | Physical collectibles (e.g., signed items, cards) | Equity in early-stage companies |

| Liquidity | Low to moderate; depends on buyer demand | Low; often requires exit events like IPO or acquisition |

| Risk Level | Medium; affected by authenticity and market trends | High; many startups fail |

| Potential Returns | Moderate; driven by rarity and market interest | High; potential for exponential growth |

| Investment Horizon | Medium to long-term | Long-term (5-10 years) |

| Market Transparency | Moderate; values fluctuate and data is less regulated | Low to moderate; dependent on company disclosures |

| Entry Barrier | Low to moderate; accessible to individual investors | Moderate to high; often requires significant capital and due diligence |

| Diversification | Limited; niche market | High; portfolios can include multiple startups |

| Income Generation | Rare; mostly capital appreciation | Possible dividends or revenue shares (rare) |

Which is better?

Sports memorabilia investments often provide tangible assets with the potential for appreciation driven by rarity, historical significance, and fan demand, appealing to collectors and niche markets. Startup investments carry higher risk and liquidity challenges but offer substantial returns through equity growth, innovation-driven scalability, and market disruption potential. Portfolio diversification that blends sports memorabilia's stability with startups' growth opportunities can optimize risk-adjusted returns.

Connection

Sports memorabilia investment and startup investment both rely on identifying niche markets with high growth potential and passionate communities. Both asset classes require thorough research, understanding market trends, and evaluating intangible value factors such as brand strength, rarity, and future demand. The intersection lies in their ability to diversify portfolios by offering alternative investments that blend emotional appeal with financial growth opportunities.

Key Terms

**Startup investment:**

Startup investment offers the potential for high returns through equity stakes in innovative companies often operating in technology, healthcare, or sustainability sectors. Unlike sports memorabilia, startup investments provide opportunities for active portfolio diversification and involvement in emerging markets and scalable business models. Explore key advantages and risks associated with startup funding to make informed investment decisions.

Equity

Startup investment offers equity stakes that provide ownership and potential high returns tied to company growth, often requiring thorough due diligence and risk tolerance. Sports memorabilia investment, while less traditional, doesn't offer equity but provides value appreciation through rarity and market demand in collectibles. Explore the nuanced differences in investment strategies to determine which aligns best with your financial goals and risk appetite.

Valuation

Startup investment valuation relies heavily on projected cash flows, market potential, and scalability, often determined through methods like discounted cash flow (DCF) or venture capital multiples. Sports memorabilia valuation depends on rarity, historical significance, athlete popularity, and condition, with prices fluctuating based on collector demand and authenticity verification. Explore detailed comparisons and expert insights to understand which investment aligns best with your financial goals.

Source and External Links

Fund your business | U.S. Small Business Administration - Venture capital investors provide funding for startups in exchange for equity, usually gaining board seats and a role in company decisions, focusing on high-growth companies with potential for high returns in multiple rounds of investment.

Startup Fundraising: How to Raise Capital for Your Startup - Startups should choose funding types based on their stage, starting with angel investors or accelerators early on and progressing to larger seed and Series A rounds involving professional investors requiring proven traction and readiness.

StartEngine: Invest in Startups Online - StartEngine allows everyday individuals to invest in startups through equity crowdfunding with regulated limits on investment amounts based on income and net worth, offering opportunities for non-accredited and accredited investors to own stakes in early-stage companies.

dowidth.com

dowidth.com