Sports card fractionalization allows investors to own a portion of rare physical collectible cards, providing liquidity and accessibility in the traditional memorabilia market. NFT fractionalization offers digital asset ownership through blockchain technology, enabling secure and transparent trades of unique sports-related tokens. Explore how these innovative investment methods are reshaping the future of sports collectibles by learning more about their advantages and risks.

Why it is important

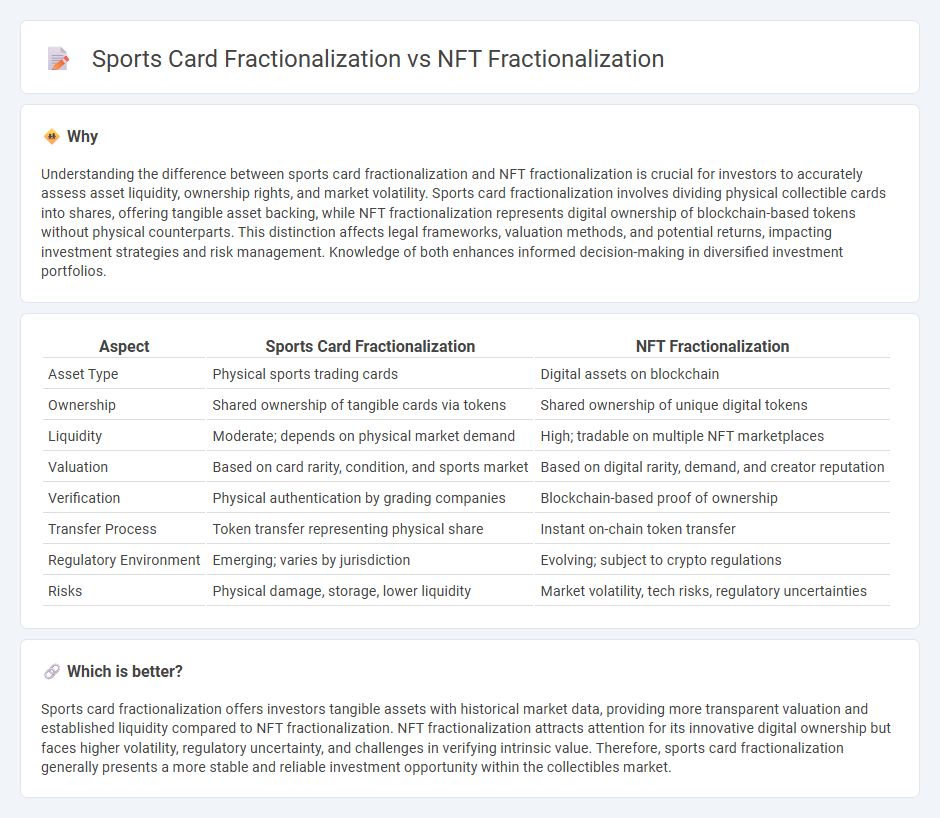

Understanding the difference between sports card fractionalization and NFT fractionalization is crucial for investors to accurately assess asset liquidity, ownership rights, and market volatility. Sports card fractionalization involves dividing physical collectible cards into shares, offering tangible asset backing, while NFT fractionalization represents digital ownership of blockchain-based tokens without physical counterparts. This distinction affects legal frameworks, valuation methods, and potential returns, impacting investment strategies and risk management. Knowledge of both enhances informed decision-making in diversified investment portfolios.

Comparison Table

| Aspect | Sports Card Fractionalization | NFT Fractionalization |

|---|---|---|

| Asset Type | Physical sports trading cards | Digital assets on blockchain |

| Ownership | Shared ownership of tangible cards via tokens | Shared ownership of unique digital tokens |

| Liquidity | Moderate; depends on physical market demand | High; tradable on multiple NFT marketplaces |

| Valuation | Based on card rarity, condition, and sports market | Based on digital rarity, demand, and creator reputation |

| Verification | Physical authentication by grading companies | Blockchain-based proof of ownership |

| Transfer Process | Token transfer representing physical share | Instant on-chain token transfer |

| Regulatory Environment | Emerging; varies by jurisdiction | Evolving; subject to crypto regulations |

| Risks | Physical damage, storage, lower liquidity | Market volatility, tech risks, regulatory uncertainties |

Which is better?

Sports card fractionalization offers investors tangible assets with historical market data, providing more transparent valuation and established liquidity compared to NFT fractionalization. NFT fractionalization attracts attention for its innovative digital ownership but faces higher volatility, regulatory uncertainty, and challenges in verifying intrinsic value. Therefore, sports card fractionalization generally presents a more stable and reliable investment opportunity within the collectibles market.

Connection

Sports card fractionalization and NFT fractionalization both leverage blockchain technology to divide high-value digital or physical assets into smaller, tradable shares, increasing accessibility and liquidity for investors. By tokenizing ownership, these fractional models enable multiple investors to participate in the sports memorabilia market without needing to purchase entire cards or NFTs outright. This innovative approach democratizes investment opportunities while maintaining provenance and security through decentralized ledgers.

Key Terms

Ownership Shares

NFT fractionalization allows multiple investors to own a percentage of a digital asset secured by blockchain technology, ensuring transparent and immutable ownership records. Sports card fractionalization divides the value of a physical collectible into shares, often relying on third-party custodianship and appraisal services to validate authenticity and ownership. Explore the differences in ownership structures and benefits by learning more about fractional ownership in digital versus physical collectibles.

Liquidity

NFT fractionalization enhances liquidity by enabling multiple investors to own portions of high-value digital assets, facilitating easier buying and selling on blockchain marketplaces. Sports card fractionalization improves liquidity by allowing collectors to invest in shares of rare physical cards, expanding access to a broader market without the need for full ownership. Explore how these fractionalization methods unlock liquidity in unique asset classes and impact investment strategies.

Valuation

NFT fractionalization enables precise valuation by dividing unique digital assets into smaller, tradable tokens, reflecting real-time market demand and blockchain transparency. Sports card fractionalization leverages physical asset authenticity and historical sales data to estimate value, often influenced by grading and player popularity. Explore the nuances of valuation methods to understand which fractionalization approach best suits your investment strategy.

Source and External Links

A Deep Dive Into The World of Fractionalized NFTs - Webisoft - NFT fractionalization is the process of dividing a single high-value NFT into many smaller fractions, each representing partial ownership, allowing multiple people to collectively own and trade shares of the original NFT.

Fractional NFTs Boost Accessibility and Liquidity of Crypto - Hedera - Fractional NFTs lock the original NFT in a smart contract that mints fungible tokens as fractional shares, lowering entry barriers so more people can buy partial stakes and increasing liquidity of the asset on secondary markets.

Understanding the benefits of fractional ownership in NFTs - Coinbase - Fractional NFTs use smart contracts to split a unique NFT into ERC-20 tokens, making ownership more accessible, improving market liquidity, and enabling price discovery, though owners should be mindful of regulatory and governance considerations.

dowidth.com

dowidth.com