Psychedelic stocks have gained attention due to increasing research and potential breakthroughs in mental health treatments, offering high-growth opportunities but with significant regulatory risks. Renewable energy stocks benefit from global shifts toward sustainability, government incentives, and advancements in technology, presenting stable long-term investment potential. Explore these dynamic sectors further to understand their unique market drivers and growth prospects.

Why it is important

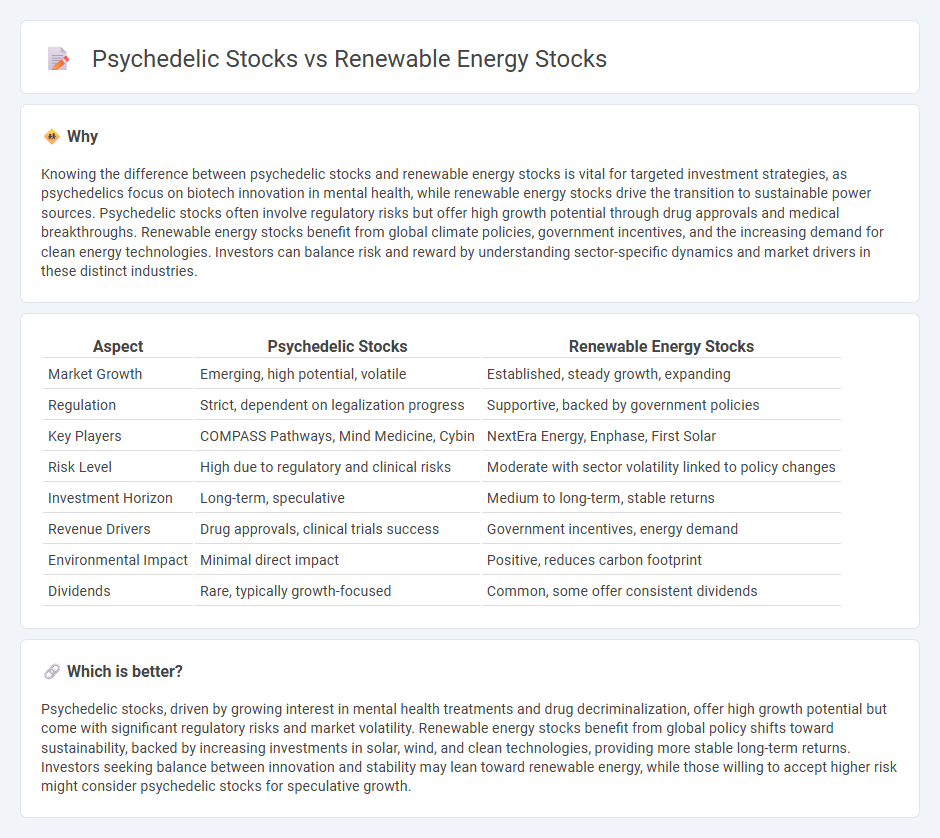

Knowing the difference between psychedelic stocks and renewable energy stocks is vital for targeted investment strategies, as psychedelics focus on biotech innovation in mental health, while renewable energy stocks drive the transition to sustainable power sources. Psychedelic stocks often involve regulatory risks but offer high growth potential through drug approvals and medical breakthroughs. Renewable energy stocks benefit from global climate policies, government incentives, and the increasing demand for clean energy technologies. Investors can balance risk and reward by understanding sector-specific dynamics and market drivers in these distinct industries.

Comparison Table

| Aspect | Psychedelic Stocks | Renewable Energy Stocks |

|---|---|---|

| Market Growth | Emerging, high potential, volatile | Established, steady growth, expanding |

| Regulation | Strict, dependent on legalization progress | Supportive, backed by government policies |

| Key Players | COMPASS Pathways, Mind Medicine, Cybin | NextEra Energy, Enphase, First Solar |

| Risk Level | High due to regulatory and clinical risks | Moderate with sector volatility linked to policy changes |

| Investment Horizon | Long-term, speculative | Medium to long-term, stable returns |

| Revenue Drivers | Drug approvals, clinical trials success | Government incentives, energy demand |

| Environmental Impact | Minimal direct impact | Positive, reduces carbon footprint |

| Dividends | Rare, typically growth-focused | Common, some offer consistent dividends |

Which is better?

Psychedelic stocks, driven by growing interest in mental health treatments and drug decriminalization, offer high growth potential but come with significant regulatory risks and market volatility. Renewable energy stocks benefit from global policy shifts toward sustainability, backed by increasing investments in solar, wind, and clean technologies, providing more stable long-term returns. Investors seeking balance between innovation and stability may lean toward renewable energy, while those willing to accept higher risk might consider psychedelic stocks for speculative growth.

Connection

Psychedelic stocks and renewable energy stocks are connected through their shared appeal to socially responsible and impact-driven investors seeking long-term growth in emerging sectors. Both industries focus on innovative solutions addressing global challenges--mental health advancements for psychedelics and climate change mitigation for renewables--attracting investor interest in transformative technologies. Market trends show increasing allocation of capital to these sectors within ESG and sustainable investment portfolios, highlighting their intertwined potential.

Key Terms

Market Volatility

Renewable energy stocks exhibit market volatility influenced by government policies, technological advancements, and shifting consumer preferences, often benefiting from global initiatives for carbon reduction. Psychedelic stocks are highly volatile due to regulatory uncertainties, early-stage clinical trial outcomes, and evolving mental health treatment landscapes. Explore detailed analyses to understand the risk factors and growth potential within these dynamic sectors.

Regulatory Environment

Renewable energy stocks benefit from supportive regulatory environments, including government subsidies, tax incentives, and mandates for clean energy transitions that drive market growth. Psychedelic stocks face evolving but uncertain regulatory landscapes, with shifting legality around medical use and research approvals that create higher volatility. Explore the latest regulatory updates to better understand the market dynamics affecting both sectors.

Growth Potential

Renewable energy stocks demonstrate strong growth potential driven by global shifts toward sustainable power sources and government incentives promoting clean energy adoption. Psychedelic stocks gain momentum from increasing research into mental health treatments and expanding regulatory acceptance, offering high-risk, high-reward investment opportunities. Explore detailed market analyses to understand which sector aligns with your growth investment strategy.

Source and External Links

Our Top Picks for Investing in US Renewable Energy - Morningstar - Recommended stocks include First Solar (FSLR), a leader in thin-film solar technology with a fair value estimate of $168, and Brookfield Renewable Partners (BEP), which has a diversified global clean energy portfolio and targets 12%-15% returns.

Top 5 Renewable Energy Stocks to Watch for July 2025 - NerdWallet - Lists renewable energy utility stocks like Eco Wave Power Global (WAVE), Constellation Energy (CEG), and Clearway Energy (CWEN/CWEN-A) showing significant annual performance gains ranging from approximately 15% to 75%.

Best green energy stocks to watch - IG - Highlights leading green energy stocks such as NextEra Energy (NEE), Tesla (TSLA), First Solar (FSLR), and Brookfield Renewable Partners (BEP), with NextEra known for its large wind and solar assets, and Tesla for its solar panels and energy storage solutions.

dowidth.com

dowidth.com