Wine investing offers asset diversification through tangible collectibles with potential for appreciation based on vintage quality and market rarity, whereas venture capital involves funding early-stage startups with high growth prospects but increased risk of loss. Both strategies require detailed market analysis and risk management but appeal to different investor profiles seeking either stable long-term gains or rapid capital growth. Explore the nuances of wine investing versus venture capital to determine which aligns with your financial goals.

Why it is important

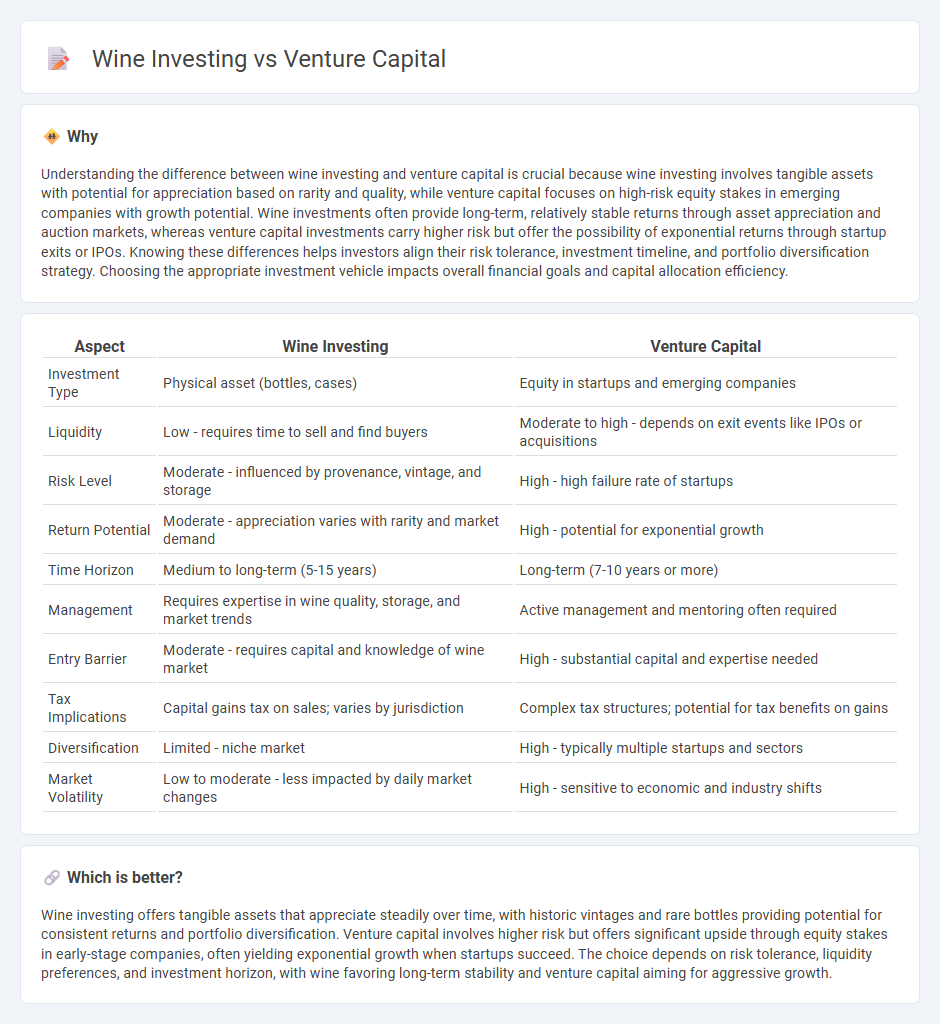

Understanding the difference between wine investing and venture capital is crucial because wine investing involves tangible assets with potential for appreciation based on rarity and quality, while venture capital focuses on high-risk equity stakes in emerging companies with growth potential. Wine investments often provide long-term, relatively stable returns through asset appreciation and auction markets, whereas venture capital investments carry higher risk but offer the possibility of exponential returns through startup exits or IPOs. Knowing these differences helps investors align their risk tolerance, investment timeline, and portfolio diversification strategy. Choosing the appropriate investment vehicle impacts overall financial goals and capital allocation efficiency.

Comparison Table

| Aspect | Wine Investing | Venture Capital |

|---|---|---|

| Investment Type | Physical asset (bottles, cases) | Equity in startups and emerging companies |

| Liquidity | Low - requires time to sell and find buyers | Moderate to high - depends on exit events like IPOs or acquisitions |

| Risk Level | Moderate - influenced by provenance, vintage, and storage | High - high failure rate of startups |

| Return Potential | Moderate - appreciation varies with rarity and market demand | High - potential for exponential growth |

| Time Horizon | Medium to long-term (5-15 years) | Long-term (7-10 years or more) |

| Management | Requires expertise in wine quality, storage, and market trends | Active management and mentoring often required |

| Entry Barrier | Moderate - requires capital and knowledge of wine market | High - substantial capital and expertise needed |

| Tax Implications | Capital gains tax on sales; varies by jurisdiction | Complex tax structures; potential for tax benefits on gains |

| Diversification | Limited - niche market | High - typically multiple startups and sectors |

| Market Volatility | Low to moderate - less impacted by daily market changes | High - sensitive to economic and industry shifts |

Which is better?

Wine investing offers tangible assets that appreciate steadily over time, with historic vintages and rare bottles providing potential for consistent returns and portfolio diversification. Venture capital involves higher risk but offers significant upside through equity stakes in early-stage companies, often yielding exponential growth when startups succeed. The choice depends on risk tolerance, liquidity preferences, and investment horizon, with wine favoring long-term stability and venture capital aiming for aggressive growth.

Connection

Wine investing and venture capital share a focus on high-growth asset classes with strong return potential through market appreciation and scarcity. Both require deep industry knowledge and risk assessment to identify undervalued opportunities that can yield significant financial gains. By leveraging expertise and market trends, investors in wine and venture capital aim to diversify portfolios and achieve long-term capital growth.

Key Terms

**Venture Capital:**

Venture capital involves investing in early-stage startups with high growth potential, offering significant returns but accompanied by substantial risk and illiquidity. Unlike wine investing, which relies on asset appreciation through aging and market demand, venture capital requires active involvement, due diligence, and often longer capital lock-in periods. Explore the nuances of venture capital and how it can diversify and amplify your investment portfolio.

Equity

Venture capital investing focuses on acquiring equity stakes in early-stage startups with high growth potential, aiming for substantial returns through company valuation increases or IPOs. Wine investing involves purchasing bottles or collections as tangible assets, with value influenced by rarity, vintage, and market demand rather than equity ownership. Explore the nuances of equity roles and market performance in both investment types to expand your portfolio strategy.

Startup

Investing in startups through venture capital offers high-growth potential fueled by innovation and market disruption, whereas wine investing relies on the appreciation of rare vintages and collector demand for physical assets. Venture capital funding targets early-stage companies with scalable business models and market traction, contrasting with wine's dependency on rarity, aging, and provenance. Explore the dynamics of startup investing and how venture capital can drive portfolio diversification and returns.

Source and External Links

What is Venture Capital? - Venture capital is a form of funding that transforms ideas and research into high-growth companies by providing risk capital with long-term investment horizons, often partnering closely with entrepreneurs for strategic guidance and operational support.

Fund your business | U.S. Small Business Administration - Venture capital generally targets high-growth startups, providing equity investment rather than loans, involving investors who often take board seats and actively participate in company growth through rounds of financing.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups working on innovative, high-risk technologies by acquiring equity stakes, with investors expecting liquidity events like M&A or IPO over long-term periods, usually spreading investments to manage risk.

dowidth.com

dowidth.com