Royalty stream investing offers unique cash flow potential by earning a percentage of revenue from intellectual property or natural resources, unlike bond investing which provides fixed interest payments based on loan agreements. While bonds are generally considered lower-risk with predictable returns, royalty streams can yield higher returns tied directly to the success of specific assets but involve greater market variability. Discover deeper insights on how these investment options compare and which aligns best with your financial goals.

Why it is important

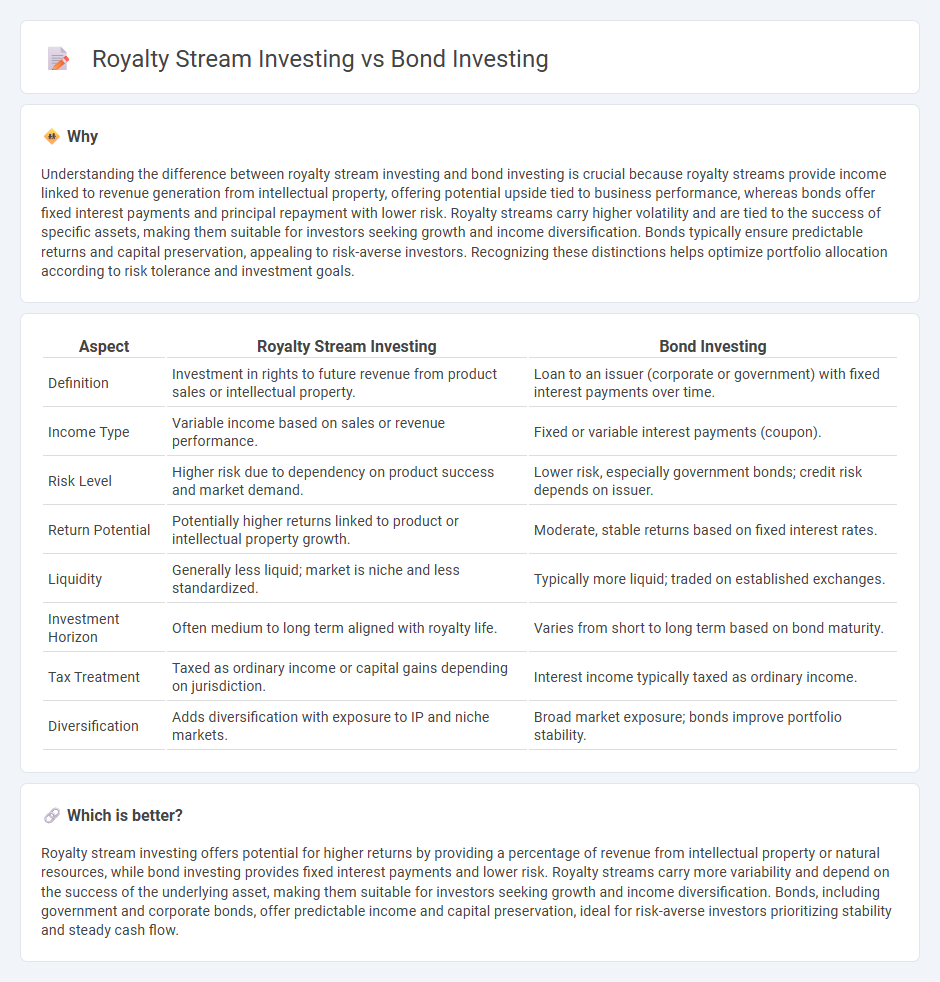

Understanding the difference between royalty stream investing and bond investing is crucial because royalty streams provide income linked to revenue generation from intellectual property, offering potential upside tied to business performance, whereas bonds offer fixed interest payments and principal repayment with lower risk. Royalty streams carry higher volatility and are tied to the success of specific assets, making them suitable for investors seeking growth and income diversification. Bonds typically ensure predictable returns and capital preservation, appealing to risk-averse investors. Recognizing these distinctions helps optimize portfolio allocation according to risk tolerance and investment goals.

Comparison Table

| Aspect | Royalty Stream Investing | Bond Investing |

|---|---|---|

| Definition | Investment in rights to future revenue from product sales or intellectual property. | Loan to an issuer (corporate or government) with fixed interest payments over time. |

| Income Type | Variable income based on sales or revenue performance. | Fixed or variable interest payments (coupon). |

| Risk Level | Higher risk due to dependency on product success and market demand. | Lower risk, especially government bonds; credit risk depends on issuer. |

| Return Potential | Potentially higher returns linked to product or intellectual property growth. | Moderate, stable returns based on fixed interest rates. |

| Liquidity | Generally less liquid; market is niche and less standardized. | Typically more liquid; traded on established exchanges. |

| Investment Horizon | Often medium to long term aligned with royalty life. | Varies from short to long term based on bond maturity. |

| Tax Treatment | Taxed as ordinary income or capital gains depending on jurisdiction. | Interest income typically taxed as ordinary income. |

| Diversification | Adds diversification with exposure to IP and niche markets. | Broad market exposure; bonds improve portfolio stability. |

Which is better?

Royalty stream investing offers potential for higher returns by providing a percentage of revenue from intellectual property or natural resources, while bond investing provides fixed interest payments and lower risk. Royalty streams carry more variability and depend on the success of the underlying asset, making them suitable for investors seeking growth and income diversification. Bonds, including government and corporate bonds, offer predictable income and capital preservation, ideal for risk-averse investors prioritizing stability and steady cash flow.

Connection

Royalty stream investing and bond investing both offer investors predictable income streams through contractual agreements, with royalties providing payments based on revenue generation and bonds delivering fixed interest payments. Both investment types involve assessing risk related to the issuer's financial stability and market performance to ensure consistent returns. This connection makes them attractive for portfolio diversification and stable cash flow management in fixed-income investment strategies.

Key Terms

Principal (Bond)

Bonds guarantee the return of principal at maturity, providing investors with a fixed, predictable repayment amount, which minimizes capital loss risk. In contrast, royalty stream investing typically offers variable returns tied to revenue or production levels without guaranteed principal repayment, increasing potential risk and reward. Explore the distinctions further to determine which investment aligns with your financial goals.

Coupon Rate (Bond)

The coupon rate on bonds represents the fixed annual interest paid to investors based on the bond's face value, typically expressed as a percentage, providing predictable income streams. Royalty stream investing, unlike bonds, generates income based on a percentage of revenue or production, which can fluctuate and potentially offer higher returns but with varying risk profiles. Explore the nuances of coupon rates and royalty streams to better evaluate your investment options.

Revenue Share (Royalty Stream)

Revenue share royalty stream investing offers a direct stake in a company's top-line income, providing investors with periodic payments linked to actual sales rather than fixed interest like bonds. Unlike bonds, which have predetermined interest rates and maturity dates, royalty streams fluctuate with business performance, often delivering higher yields during growth phases. Explore the benefits and risks of revenue share investments to determine if they align with your financial goals.

Source and External Links

Bonds 101: The What and Why of Bond Investing - PIMCO - Bonds are fixed income investments representing loans investors make to governments, companies, or other entities, which pay periodic interest (coupons) and return the principal at maturity, helping issuers raise capital for various activities.

What is a Bond and How do they Work? - Vanguard - Bonds are loans to issuers who pay interest (coupon) periodically and return the face value at maturity, with bond prices fluctuating on secondary markets affecting the yield and potential buying or selling decisions.

The Basics of Investing In Bonds - Bonds involve lending money to governments or companies at a fixed interest rate for a specific period, with prices varying in secondary markets according to interest rate changes, and can be bought through brokers, funds, or government platforms.

dowidth.com

dowidth.com