Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them at a profit, leveraging trends and scarcity in the footwear market. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, offering potential returns through interest payments. Explore these investment strategies to understand their risks, rewards, and suitability for your financial goals.

Why it is important

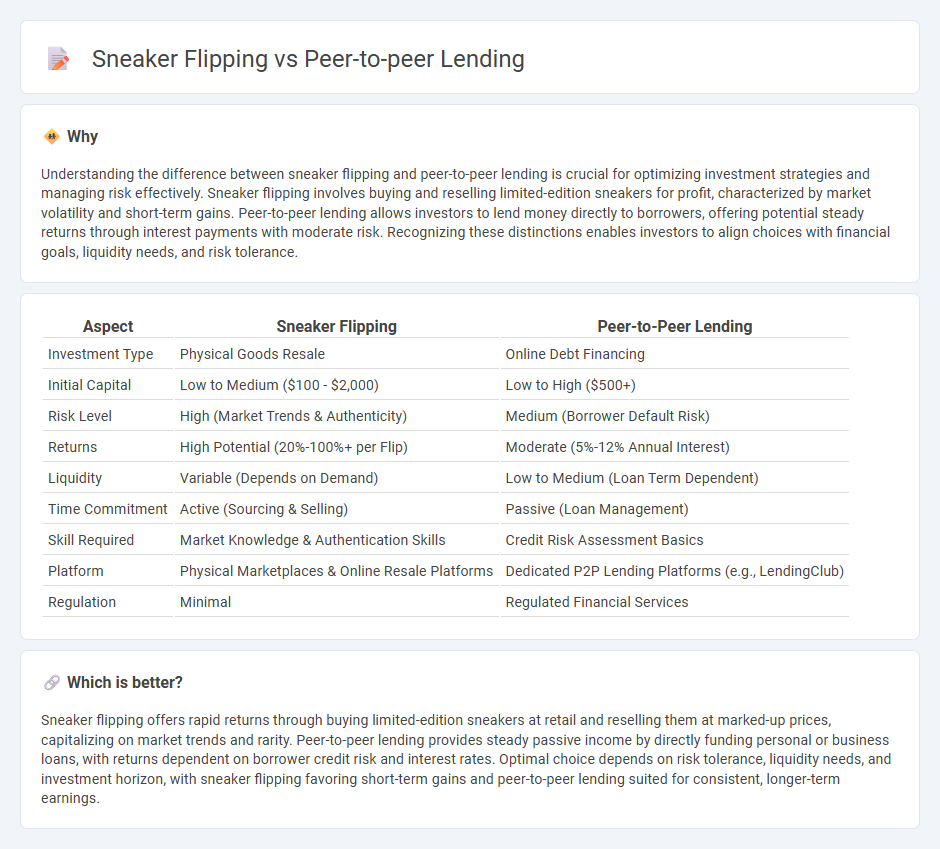

Understanding the difference between sneaker flipping and peer-to-peer lending is crucial for optimizing investment strategies and managing risk effectively. Sneaker flipping involves buying and reselling limited-edition sneakers for profit, characterized by market volatility and short-term gains. Peer-to-peer lending allows investors to lend money directly to borrowers, offering potential steady returns through interest payments with moderate risk. Recognizing these distinctions enables investors to align choices with financial goals, liquidity needs, and risk tolerance.

Comparison Table

| Aspect | Sneaker Flipping | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Physical Goods Resale | Online Debt Financing |

| Initial Capital | Low to Medium ($100 - $2,000) | Low to High ($500+) |

| Risk Level | High (Market Trends & Authenticity) | Medium (Borrower Default Risk) |

| Returns | High Potential (20%-100%+ per Flip) | Moderate (5%-12% Annual Interest) |

| Liquidity | Variable (Depends on Demand) | Low to Medium (Loan Term Dependent) |

| Time Commitment | Active (Sourcing & Selling) | Passive (Loan Management) |

| Skill Required | Market Knowledge & Authentication Skills | Credit Risk Assessment Basics |

| Platform | Physical Marketplaces & Online Resale Platforms | Dedicated P2P Lending Platforms (e.g., LendingClub) |

| Regulation | Minimal | Regulated Financial Services |

Which is better?

Sneaker flipping offers rapid returns through buying limited-edition sneakers at retail and reselling them at marked-up prices, capitalizing on market trends and rarity. Peer-to-peer lending provides steady passive income by directly funding personal or business loans, with returns dependent on borrower credit risk and interest rates. Optimal choice depends on risk tolerance, liquidity needs, and investment horizon, with sneaker flipping favoring short-term gains and peer-to-peer lending suited for consistent, longer-term earnings.

Connection

Sneaker flipping and peer-to-peer lending both represent innovative alternative investment strategies that leverage digital marketplaces to generate returns outside traditional financial markets. Sneaker flipping capitalizes on the resale value of limited-edition footwear, while peer-to-peer lending facilitates direct loans between individuals, offering higher interest rates compared to conventional banking. Both methods rely on market demand, user accessibility, and the growing gig economy to create liquidity and investment opportunities for individual investors.

Key Terms

Peer-to-peer lending:

Peer-to-peer lending offers investors a direct way to lend money to individuals or businesses, bypassing traditional financial institutions, which can result in higher returns and faster loan approval processes. Platforms like LendingClub and Prosper use advanced algorithms to assess borrower risk, promoting a more efficient and transparent lending environment. Discover how peer-to-peer lending can diversify your investment portfolio and generate passive income.

Interest Rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, providing investors with relatively predictable returns based on borrower creditworthiness and loan terms. In contrast, sneaker flipping yields profits through market demand and rarity, often generating variable returns from 10% to over 100% but with higher volatility and no guaranteed interest. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Default Risk

Peer-to-peer lending involves lending money directly to individuals or businesses through online platforms, where default risk is a significant concern, as borrowers may fail to repay loans, impacting investors' returns. Sneaker flipping, the practice of buying limited edition sneakers and reselling them at higher prices, carries minimal default risk since the transaction revolves around tangible goods and market demand fluctuations. To explore deeper insights into managing risk and profitability in both ventures, consider examining detailed market analyses and risk mitigation strategies.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is the practice of lending money to individuals or businesses through online platforms that match lenders and borrowers without traditional financial intermediaries, often offering unsecured loans with varied risk and pricing.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is an online marketplace where individuals or businesses can lend and borrow money directly, typically with higher interest rates than savings accounts but with higher risks, and platforms are often regulated by authorities like the FCA.

PEER-TO-PEER LENDING - NASAA - Peer-to-peer lending is an online financial service enabling unsecured loans funded by individuals, usually ranging from $1,000 to $25,000, serving borrowers who might struggle to get traditional bank loans, with the internet acting as the marketplace for loan matchmaking.

dowidth.com

dowidth.com