Investing in viticulture land offers tangible assets and potential for long-term value appreciation through vineyard cultivation and wine production profits. Venture capital investment targets high-growth startups with scalable innovations, offering the possibility of substantial financial returns but with higher risk exposure. Explore the unique benefits and challenges of each investment type to determine the best strategy for your portfolio.

Why it is important

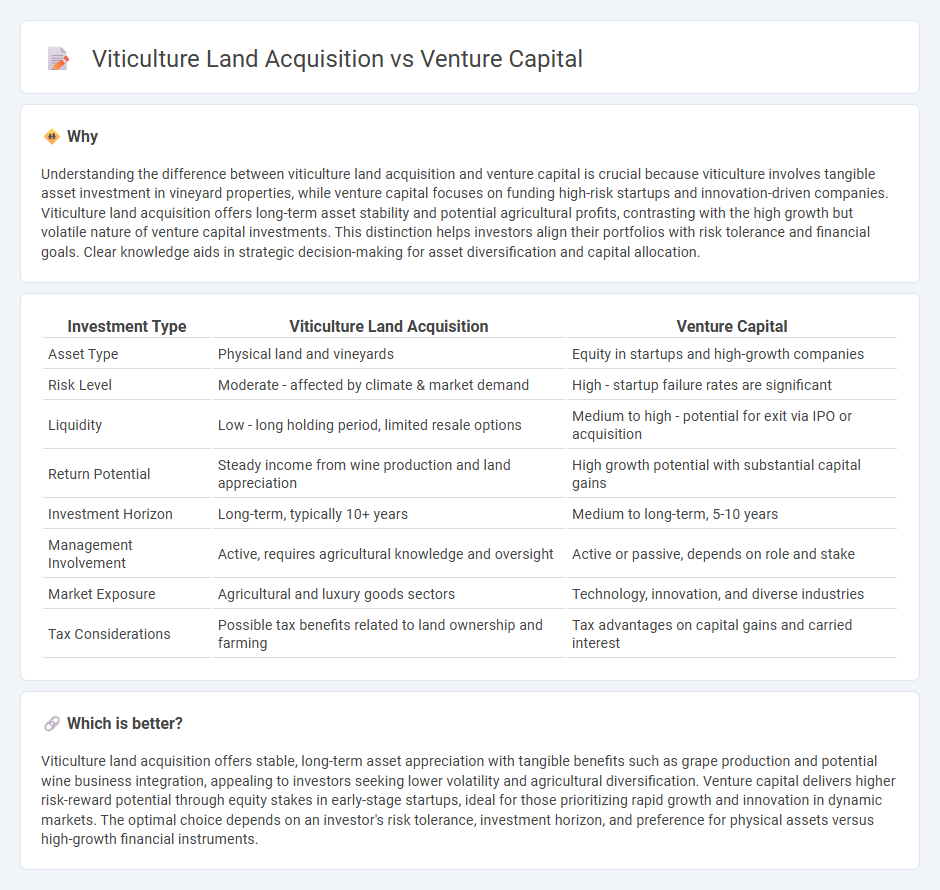

Understanding the difference between viticulture land acquisition and venture capital is crucial because viticulture involves tangible asset investment in vineyard properties, while venture capital focuses on funding high-risk startups and innovation-driven companies. Viticulture land acquisition offers long-term asset stability and potential agricultural profits, contrasting with the high growth but volatile nature of venture capital investments. This distinction helps investors align their portfolios with risk tolerance and financial goals. Clear knowledge aids in strategic decision-making for asset diversification and capital allocation.

Comparison Table

| Investment Type | Viticulture Land Acquisition | Venture Capital |

|---|---|---|

| Asset Type | Physical land and vineyards | Equity in startups and high-growth companies |

| Risk Level | Moderate - affected by climate & market demand | High - startup failure rates are significant |

| Liquidity | Low - long holding period, limited resale options | Medium to high - potential for exit via IPO or acquisition |

| Return Potential | Steady income from wine production and land appreciation | High growth potential with substantial capital gains |

| Investment Horizon | Long-term, typically 10+ years | Medium to long-term, 5-10 years |

| Management Involvement | Active, requires agricultural knowledge and oversight | Active or passive, depends on role and stake |

| Market Exposure | Agricultural and luxury goods sectors | Technology, innovation, and diverse industries |

| Tax Considerations | Possible tax benefits related to land ownership and farming | Tax advantages on capital gains and carried interest |

Which is better?

Viticulture land acquisition offers stable, long-term asset appreciation with tangible benefits such as grape production and potential wine business integration, appealing to investors seeking lower volatility and agricultural diversification. Venture capital delivers higher risk-reward potential through equity stakes in early-stage startups, ideal for those prioritizing rapid growth and innovation in dynamic markets. The optimal choice depends on an investor's risk tolerance, investment horizon, and preference for physical assets versus high-growth financial instruments.

Connection

Viticulture land acquisition attracts venture capital by offering high-growth opportunities in the premium wine market, where land quality directly influences product value and returns. Investors target vineyards with scalable operations and established brand potential, leveraging venture capital to fund expansion, technology integration, and market penetration. This synergy enhances asset appreciation and drives innovation in sustainable viticulture practices, boosting long-term investment performance.

Key Terms

**Venture Capital:**

Venture capital investment prioritizes high-growth startups in technology, healthcare, and fintech sectors, offering scalable returns through equity stakes and active portfolio management. Funds are allocated based on detailed due diligence, market potential, and innovation, with exits via IPOs or acquisitions driving liquidity events. Explore how strategic venture capital funding can accelerate business innovation and maximize investment outcomes.

Equity Stake

Venture capital investments typically involve acquiring an equity stake in high-growth startups, allowing investors to influence company direction and share in future profits. In contrast, viticulture land acquisition often centers on direct ownership of physical assets, with equity stakes reflecting partnership interests in vineyard operations rather than dynamic corporate equity. Explore the key differences in equity structuring and ownership benefits between these two investment approaches to make informed decisions.

Startup Valuation

Startup valuation plays a crucial role in venture capital decisions, impacting the amount of funding and equity stake investors receive. In contrast, viticulture land acquisition relies more on tangible asset valuation, such as soil quality, climate conditions, and potential grape yield. Explore the key differences in valuation methods between venture capital and viticulture land acquisition to understand investment dynamics better.

Source and External Links

What is Venture Capital? - Venture capital supports high-growth companies by transforming ideas into successful products and services.

Fund Your Business - Venture capital typically focuses on high-growth companies, investing in exchange for equity rather than debt.

What is Venture Capital? - Venture capital is a private equity investment supporting startups with potential for rapid growth in exchange for ownership and board involvement.

dowidth.com

dowidth.com