Private credit funds offer direct lending to companies with flexible terms and often higher returns, while public credit funds invest in easily tradable securities with greater liquidity and regulatory oversight. Private credit tends to target middle-market firms, providing customized financing solutions, whereas public credit focuses on investment-grade bonds in the open market. Explore the benefits and risks of both to determine the best fit for your investment strategy.

Why it is important

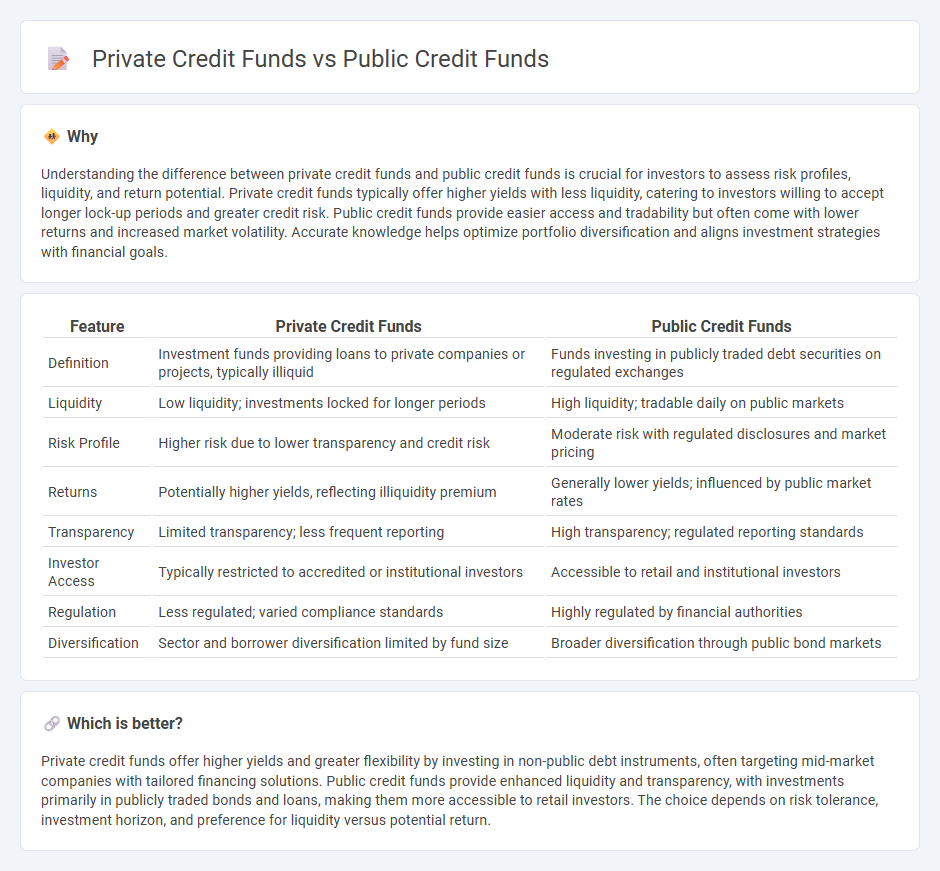

Understanding the difference between private credit funds and public credit funds is crucial for investors to assess risk profiles, liquidity, and return potential. Private credit funds typically offer higher yields with less liquidity, catering to investors willing to accept longer lock-up periods and greater credit risk. Public credit funds provide easier access and tradability but often come with lower returns and increased market volatility. Accurate knowledge helps optimize portfolio diversification and aligns investment strategies with financial goals.

Comparison Table

| Feature | Private Credit Funds | Public Credit Funds |

|---|---|---|

| Definition | Investment funds providing loans to private companies or projects, typically illiquid | Funds investing in publicly traded debt securities on regulated exchanges |

| Liquidity | Low liquidity; investments locked for longer periods | High liquidity; tradable daily on public markets |

| Risk Profile | Higher risk due to lower transparency and credit risk | Moderate risk with regulated disclosures and market pricing |

| Returns | Potentially higher yields, reflecting illiquidity premium | Generally lower yields; influenced by public market rates |

| Transparency | Limited transparency; less frequent reporting | High transparency; regulated reporting standards |

| Investor Access | Typically restricted to accredited or institutional investors | Accessible to retail and institutional investors |

| Regulation | Less regulated; varied compliance standards | Highly regulated by financial authorities |

| Diversification | Sector and borrower diversification limited by fund size | Broader diversification through public bond markets |

Which is better?

Private credit funds offer higher yields and greater flexibility by investing in non-public debt instruments, often targeting mid-market companies with tailored financing solutions. Public credit funds provide enhanced liquidity and transparency, with investments primarily in publicly traded bonds and loans, making them more accessible to retail investors. The choice depends on risk tolerance, investment horizon, and preference for liquidity versus potential return.

Connection

Private credit funds and public credit funds are connected through their shared focus on debt investment opportunities, providing capital to borrowers outside traditional bank lending channels. Both fund types contribute to the credit market by offering diverse risk-return profiles, with private credit funds typically investing in non-publicly traded debt and public credit funds focusing on bonds and syndicated loans. This interplay facilitates liquidity and capital flow across private and public markets, enhancing overall market efficiency and access to credit.

Key Terms

Liquidity

Public credit funds offer higher liquidity through daily or weekly redemption options, making them suitable for investors requiring flexible access to their capital. Private credit funds typically have longer lock-up periods, often ranging from 3 to 7 years, limiting liquidity but potentially providing higher returns due to less frequent redemptions. To explore the implications of liquidity on investment strategies in public versus private credit funds, learn more here.

Regulation

Public credit funds operate under strict regulatory frameworks such as the Investment Company Act of 1940 and Securities Act of 1933, ensuring transparency and investor protection through mandatory disclosures and periodic reporting. Private credit funds, often exempt from these extensive regulations, benefit from greater operational flexibility and faster deal execution but may involve higher risks and less liquidity for investors. Explore detailed regulatory distinctions and investment implications to better understand how these frameworks impact fund strategies.

Transparency

Public credit funds offer higher transparency through regulated disclosures and reporting requirements mandated by financial authorities, ensuring investors have access to detailed information on portfolio composition and risk metrics. Private credit funds, in contrast, often operate with less regulatory oversight, resulting in limited transparency and reduced visibility into underlying assets and performance data. Explore further to understand the implications of these transparency differences on risk assessment and investment strategy.

Source and External Links

Private Credit vs Public Credit - Public credit refers to debt instruments like corporate bonds traded on public markets accessible to both institutional and retail investors, while private credit involves direct lending by private funds to companies outside public markets, typically less liquid but offering customized terms.

Public Credit | CPP Investments - Public credit investments encompass investment and sub-investment grade corporate bonds and credit instruments globally, including ETFs, credit default swaps, and structured assets, managed by specialized teams.

Private Credit | MFA - Private credit funds provide direct loans to businesses through private deals, supporting job creation and economic growth, with multi-year capital commitments offering stability and protection against liquidity risks.

dowidth.com

dowidth.com