Collectible sneakers have surged as tangible assets with historical appreciation trends, while cryptocurrencies offer high volatility and digital liquidity. Both markets attract investors seeking diversification, with sneakers providing physical value and cryptocurrencies enabling borderless transactions. Discover the key factors to consider before investing in these emerging asset classes.

Why it is important

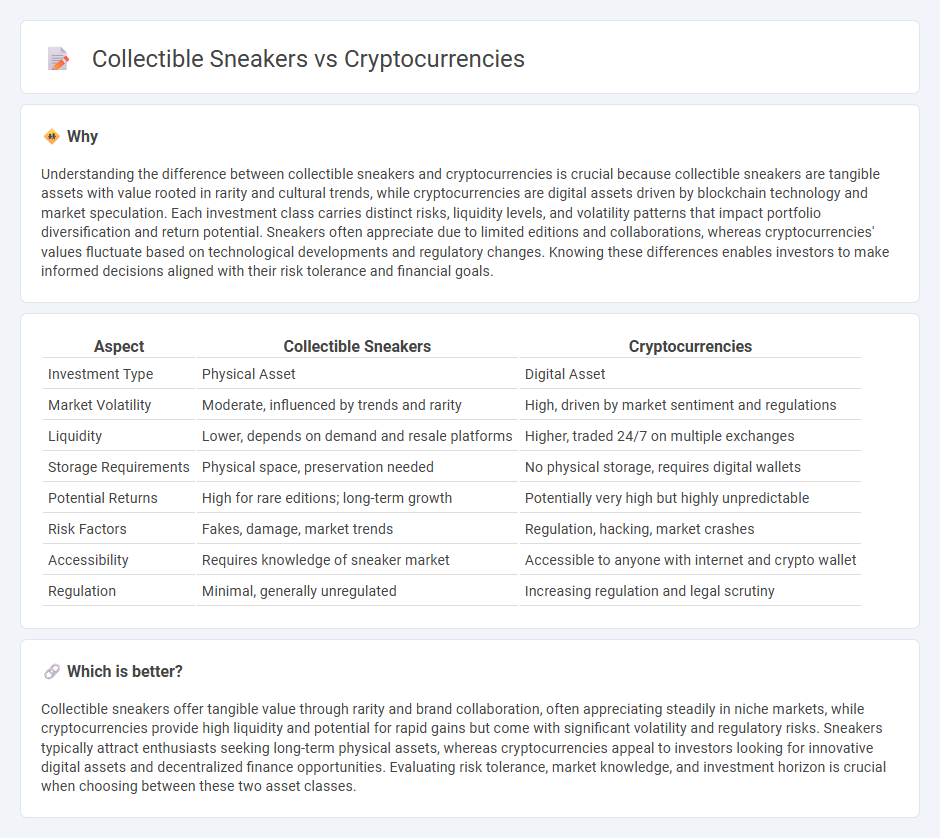

Understanding the difference between collectible sneakers and cryptocurrencies is crucial because collectible sneakers are tangible assets with value rooted in rarity and cultural trends, while cryptocurrencies are digital assets driven by blockchain technology and market speculation. Each investment class carries distinct risks, liquidity levels, and volatility patterns that impact portfolio diversification and return potential. Sneakers often appreciate due to limited editions and collaborations, whereas cryptocurrencies' values fluctuate based on technological developments and regulatory changes. Knowing these differences enables investors to make informed decisions aligned with their risk tolerance and financial goals.

Comparison Table

| Aspect | Collectible Sneakers | Cryptocurrencies |

|---|---|---|

| Investment Type | Physical Asset | Digital Asset |

| Market Volatility | Moderate, influenced by trends and rarity | High, driven by market sentiment and regulations |

| Liquidity | Lower, depends on demand and resale platforms | Higher, traded 24/7 on multiple exchanges |

| Storage Requirements | Physical space, preservation needed | No physical storage, requires digital wallets |

| Potential Returns | High for rare editions; long-term growth | Potentially very high but highly unpredictable |

| Risk Factors | Fakes, damage, market trends | Regulation, hacking, market crashes |

| Accessibility | Requires knowledge of sneaker market | Accessible to anyone with internet and crypto wallet |

| Regulation | Minimal, generally unregulated | Increasing regulation and legal scrutiny |

Which is better?

Collectible sneakers offer tangible value through rarity and brand collaboration, often appreciating steadily in niche markets, while cryptocurrencies provide high liquidity and potential for rapid gains but come with significant volatility and regulatory risks. Sneakers typically attract enthusiasts seeking long-term physical assets, whereas cryptocurrencies appeal to investors looking for innovative digital assets and decentralized finance opportunities. Evaluating risk tolerance, market knowledge, and investment horizon is crucial when choosing between these two asset classes.

Connection

Collectible sneakers and cryptocurrencies intersect through blockchain technology, which authenticates and tracks sneaker ownership via non-fungible tokens (NFTs). This convergence creates a digital marketplace where investors trade limited-edition sneakers as digital assets, leveraging cryptocurrency for transactions. The fusion of these markets enhances liquidity and introduces novel investment opportunities within the broader alternative asset class.

Key Terms

Volatility

Cryptocurrencies exhibit extreme volatility due to market speculation, regulatory changes, and technological advancements, often experiencing price swings exceeding 10% daily. Collectible sneakers, while subject to market trends and brand releases, typically demonstrate more stable value appreciation tied to limited editions and cultural demand. Explore deeper insights into how volatility impacts investment strategies in these contrasting asset classes.

Liquidity

Cryptocurrencies offer high liquidity with 24/7 global trading on multiple exchanges, enabling quick buy and sell actions at real-time market prices. Collectible sneakers, while potentially lucrative, have lower liquidity due to limited resale platforms and longer transaction times influenced by physical inspection and authentication processes. Explore the nuances of liquidity in these markets to make informed investment decisions.

Authenticity

Authenticity verification in cryptocurrencies relies on blockchain technology, ensuring transparent, immutable transaction records and eliminating counterfeit risks. Collectible sneakers demand physical authentication methods such as serial numbers, holograms, and expert appraisals to confirm provenance and prevent fakes. Explore detailed comparisons of authenticity assurance in these two markets to understand their security strengths better.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system that uses cryptography and a decentralized public ledger (blockchain) to enable peer-to-peer transactions without the need for banks or central authorities, with Bitcoin being the first and most well-known example.

Cryptocurrency - Wikipedia - Cryptocurrencies are digital currencies based on computer networks without central oversight, using blockchain technology for secure, verifiable transactions, and while there are thousands of cryptocurrencies today, Bitcoin remains the original and most prominent.

How Does Cryptocurrency Work? A Beginner's Guide - Coursera - Cryptocurrencies offer fast, low-cost, global transactions through blockchain technology, but lack government backing or insurance, requiring users to store digital assets in wallets secured by private keys.

dowidth.com

dowidth.com