Royalty streaming and venture capital represent distinct investment strategies with unique risk and return profiles. Royalty streaming offers investors a steady income stream by purchasing rights to future revenue, often in mining or music industries, while venture capital provides equity funding to early-stage companies with high growth potential but greater risk. Explore further to understand which investment approach aligns best with your financial goals.

Why it is important

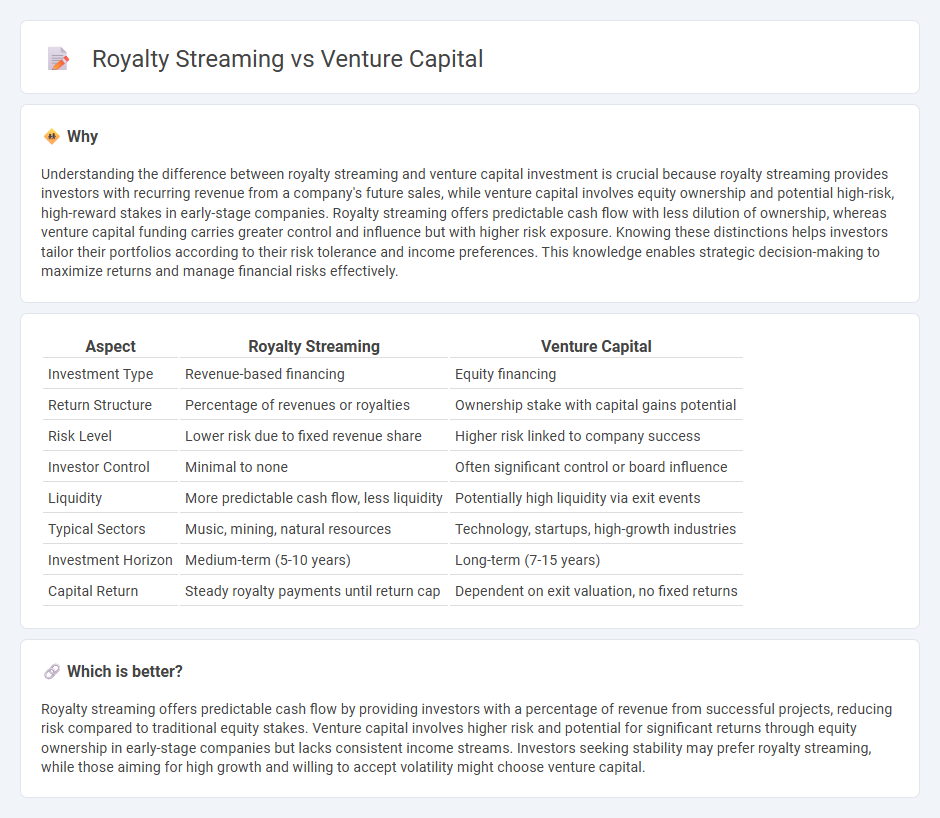

Understanding the difference between royalty streaming and venture capital investment is crucial because royalty streaming provides investors with recurring revenue from a company's future sales, while venture capital involves equity ownership and potential high-risk, high-reward stakes in early-stage companies. Royalty streaming offers predictable cash flow with less dilution of ownership, whereas venture capital funding carries greater control and influence but with higher risk exposure. Knowing these distinctions helps investors tailor their portfolios according to their risk tolerance and income preferences. This knowledge enables strategic decision-making to maximize returns and manage financial risks effectively.

Comparison Table

| Aspect | Royalty Streaming | Venture Capital |

|---|---|---|

| Investment Type | Revenue-based financing | Equity financing |

| Return Structure | Percentage of revenues or royalties | Ownership stake with capital gains potential |

| Risk Level | Lower risk due to fixed revenue share | Higher risk linked to company success |

| Investor Control | Minimal to none | Often significant control or board influence |

| Liquidity | More predictable cash flow, less liquidity | Potentially high liquidity via exit events |

| Typical Sectors | Music, mining, natural resources | Technology, startups, high-growth industries |

| Investment Horizon | Medium-term (5-10 years) | Long-term (7-15 years) |

| Capital Return | Steady royalty payments until return cap | Dependent on exit valuation, no fixed returns |

Which is better?

Royalty streaming offers predictable cash flow by providing investors with a percentage of revenue from successful projects, reducing risk compared to traditional equity stakes. Venture capital involves higher risk and potential for significant returns through equity ownership in early-stage companies but lacks consistent income streams. Investors seeking stability may prefer royalty streaming, while those aiming for high growth and willing to accept volatility might choose venture capital.

Connection

Royalty streaming and venture capital are connected through their shared focus on funding innovative projects and startups, with royalty streaming providing upfront capital in exchange for a percentage of future revenue, while venture capital involves equity investment with potential for significant returns. Both investment models mitigate risk by diversifying portfolios across emerging companies, particularly in industries like technology, healthcare, and natural resources. Their complementary financing approaches enable startups to scale operations and accelerate growth without immediate debt obligations.

Key Terms

Equity Ownership

Venture capital offers direct equity ownership, allowing investors to acquire a significant stake and influence in companies, typically early-stage startups, with the potential for high returns through growth and exit events. Royalty streaming provides investors with a percentage of revenue or sales without ownership dilution or voting rights, offering a steady cash flow but limited control over business decisions. Explore how equity ownership differences impact investment strategies and risk profiles for better-informed decisions.

Royalty Payments

Royalty streaming provides investors with recurring revenue streams linked directly to the sales or production outputs of assets, offering predictable cash flows unlike the high-risk equity stakes common in venture capital. This model reduces financial exposure by securing a percentage of royalties without diluting ownership or requiring active management involvement. Explore the benefits of royalty payments in generating stable investment returns and learn how this alternative funding mechanism compares to traditional venture capital.

Exit Strategy

Venture capital exits primarily occur through initial public offerings (IPOs) or acquisitions, offering investors potential high returns but with significant risk and longer timelines. Royalty streaming provides recurring revenue streams based on a percentage of sales or production, allowing for predictable cash flows and potential earlier returns without ownership dilution. Explore more to understand how each exit strategy aligns with your investment goals and risk tolerance.

Source and External Links

What is Venture Capital? - Venture capital is funding that turns ideas and basic research into high-growth companies by providing risk capital, strategic guidance, and operational support to startups, often over a long investment horizon of five to ten years or more.

Fund your business | U.S. Small Business Administration - Venture capital typically invests capital in high-growth companies in exchange for equity and active involvement, helping startups scale by providing funding rounds tied to business milestones, with investors often seeking board seats and some control.

What is venture capital? - Silicon Valley Bank - Venture capital is a type of private equity supporting early-stage companies with rapid growth potential by giving investors ownership stakes and access to managerial expertise, crucial for startups that cannot access traditional loans or capital markets.

dowidth.com

dowidth.com