Investing in sports team ownership shares offers a unique opportunity to combine passion for athletics with potential financial returns, often involving higher risk and less liquidity compared to traditional assets. Exchange-traded funds (ETFs) provide diversified exposure to a broad range of sectors with greater liquidity and typically lower volatility, making them accessible for long-term wealth accumulation. Explore the distinct advantages and considerations of sports team shares versus ETFs to determine the best fit for your investment portfolio.

Why it is important

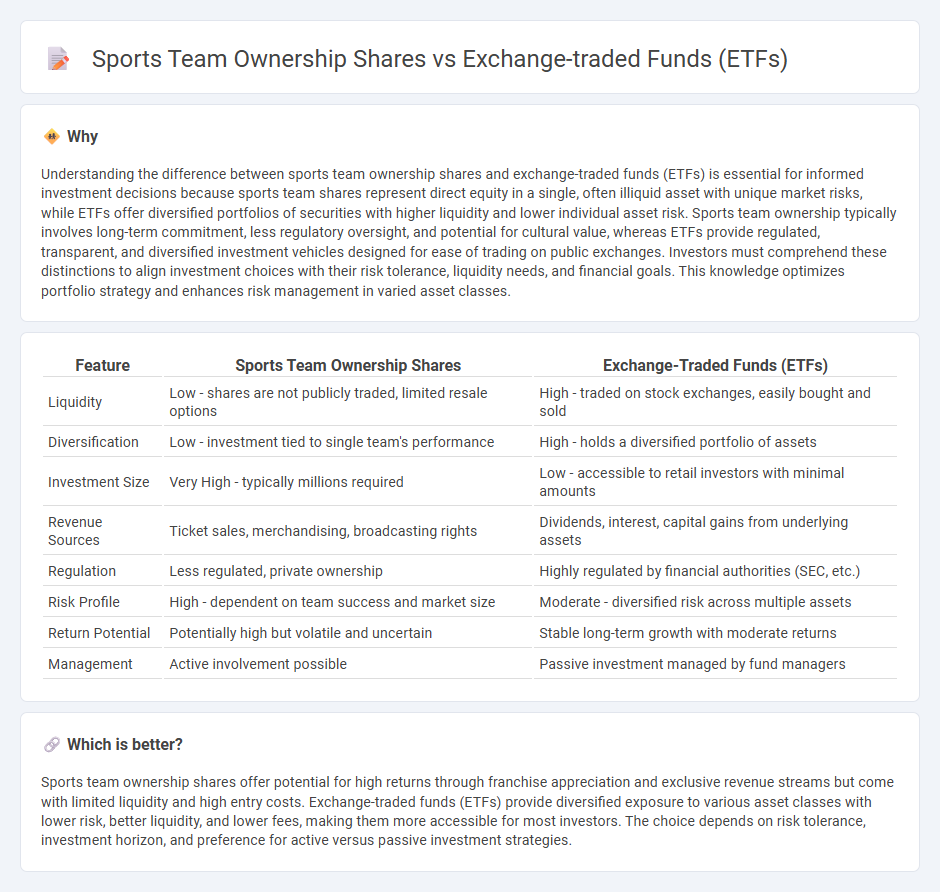

Understanding the difference between sports team ownership shares and exchange-traded funds (ETFs) is essential for informed investment decisions because sports team shares represent direct equity in a single, often illiquid asset with unique market risks, while ETFs offer diversified portfolios of securities with higher liquidity and lower individual asset risk. Sports team ownership typically involves long-term commitment, less regulatory oversight, and potential for cultural value, whereas ETFs provide regulated, transparent, and diversified investment vehicles designed for ease of trading on public exchanges. Investors must comprehend these distinctions to align investment choices with their risk tolerance, liquidity needs, and financial goals. This knowledge optimizes portfolio strategy and enhances risk management in varied asset classes.

Comparison Table

| Feature | Sports Team Ownership Shares | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Liquidity | Low - shares are not publicly traded, limited resale options | High - traded on stock exchanges, easily bought and sold |

| Diversification | Low - investment tied to single team's performance | High - holds a diversified portfolio of assets |

| Investment Size | Very High - typically millions required | Low - accessible to retail investors with minimal amounts |

| Revenue Sources | Ticket sales, merchandising, broadcasting rights | Dividends, interest, capital gains from underlying assets |

| Regulation | Less regulated, private ownership | Highly regulated by financial authorities (SEC, etc.) |

| Risk Profile | High - dependent on team success and market size | Moderate - diversified risk across multiple assets |

| Return Potential | Potentially high but volatile and uncertain | Stable long-term growth with moderate returns |

| Management | Active involvement possible | Passive investment managed by fund managers |

Which is better?

Sports team ownership shares offer potential for high returns through franchise appreciation and exclusive revenue streams but come with limited liquidity and high entry costs. Exchange-traded funds (ETFs) provide diversified exposure to various asset classes with lower risk, better liquidity, and lower fees, making them more accessible for most investors. The choice depends on risk tolerance, investment horizon, and preference for active versus passive investment strategies.

Connection

Sports team ownership shares and Exchange-Traded Funds (ETFs) intersect through investment diversification and asset liquidity. Ownership shares in sports teams represent equity stakes that can be included in specialized ETFs targeting sports-related assets or entertainment sectors. ETFs provide investors with exposure to sports franchises' financial performance while offering the benefits of tradability, portfolio diversification, and reduced risk compared to direct ownership.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity, allowing investors to buy and sell shares on stock exchanges throughout the trading day with minimal price impact. In contrast, sports team ownership shares are typically illiquid, as these investments are private, often require lengthy approval processes for transfers, and lack a centralized marketplace. Explore the nuances of liquidity differences between ETFs and sports team ownership to make informed investment decisions.

Valuation

Exchange-traded funds (ETFs) are valued based on the net asset value (NAV) of their underlying securities, providing transparent, market-driven pricing that reflects real-time supply and demand. In contrast, sports team ownership shares often lack standardized valuation metrics as they are not publicly traded, relying on appraisals, revenue streams, and market comparables, which can lead to significant valuation disparities. Explore the nuances of valuation methodologies to better understand how these investment types differ in liquidity and price discovery.

Regulation

Exchange-traded funds (ETFs) are regulated investment products overseen by entities like the SEC, ensuring transparency, liquidity, and investor protection under strict compliance frameworks such as the Investment Company Act of 1940. Sports team ownership shares, often structured as private equity or direct ownership stakes, face less standardized regulation and are subject to league-specific rules, antitrust laws, and private contractual agreements, limiting public access and liquidity. Explore the complexities of regulatory environments shaping ETFs and sports team ownership shares to make informed investment decisions.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are investment funds that trade on stock exchanges, pooling money from many investors to buy a diversified portfolio of stocks, bonds, or other assets, with each share representing partial ownership of the fund's holdings.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification benefits of mutual funds, offering access to a wide range of asset classes at generally lower costs than actively managed funds.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investment vehicles that track indices or are actively managed, trade on exchanges throughout the day, and use a unique creation/redemption process involving authorized participants to maintain liquidity.

dowidth.com

dowidth.com