Fractional real estate allows investors to purchase partial ownership of physical properties, providing direct exposure to real estate assets with relatively lower capital requirements. Crowdfunding platforms pool funds from multiple investors to finance real estate projects, offering diversified investment opportunities through online platforms with varying minimum contributions. Explore the key differences between fractional real estate and crowdfunding platforms to determine which investment strategy aligns with your financial goals.

Why it is important

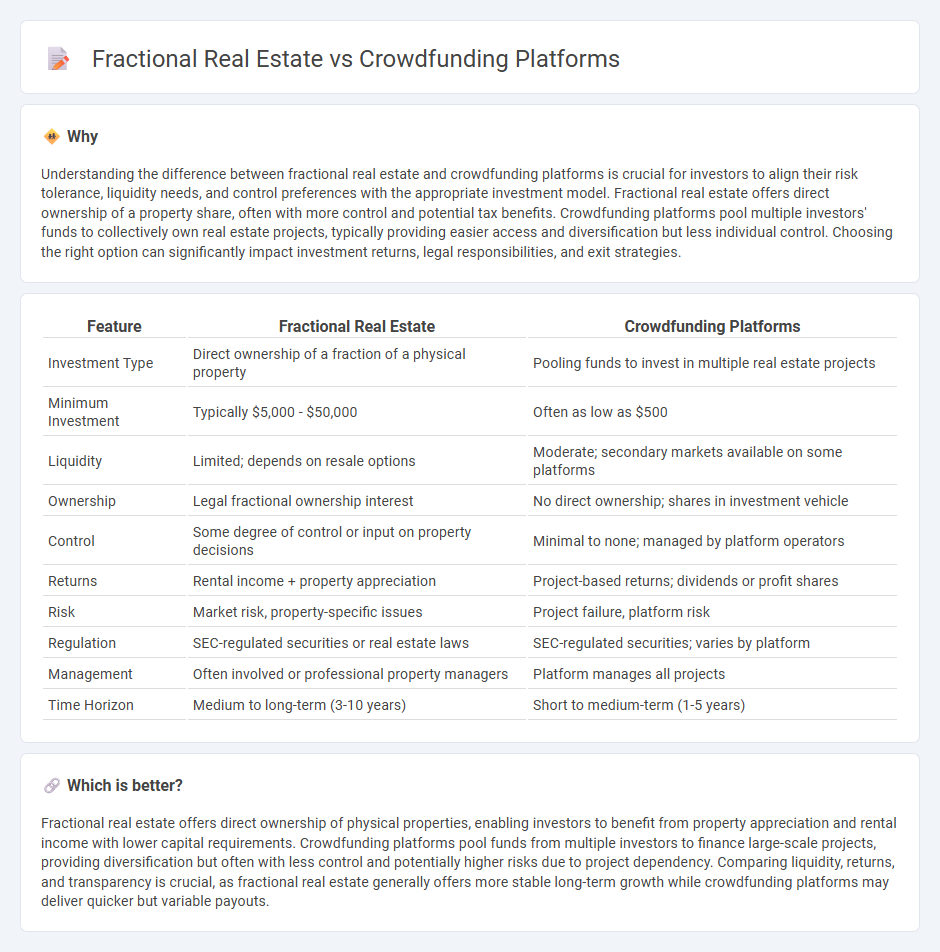

Understanding the difference between fractional real estate and crowdfunding platforms is crucial for investors to align their risk tolerance, liquidity needs, and control preferences with the appropriate investment model. Fractional real estate offers direct ownership of a property share, often with more control and potential tax benefits. Crowdfunding platforms pool multiple investors' funds to collectively own real estate projects, typically providing easier access and diversification but less individual control. Choosing the right option can significantly impact investment returns, legal responsibilities, and exit strategies.

Comparison Table

| Feature | Fractional Real Estate | Crowdfunding Platforms |

|---|---|---|

| Investment Type | Direct ownership of a fraction of a physical property | Pooling funds to invest in multiple real estate projects |

| Minimum Investment | Typically $5,000 - $50,000 | Often as low as $500 |

| Liquidity | Limited; depends on resale options | Moderate; secondary markets available on some platforms |

| Ownership | Legal fractional ownership interest | No direct ownership; shares in investment vehicle |

| Control | Some degree of control or input on property decisions | Minimal to none; managed by platform operators |

| Returns | Rental income + property appreciation | Project-based returns; dividends or profit shares |

| Risk | Market risk, property-specific issues | Project failure, platform risk |

| Regulation | SEC-regulated securities or real estate laws | SEC-regulated securities; varies by platform |

| Management | Often involved or professional property managers | Platform manages all projects |

| Time Horizon | Medium to long-term (3-10 years) | Short to medium-term (1-5 years) |

Which is better?

Fractional real estate offers direct ownership of physical properties, enabling investors to benefit from property appreciation and rental income with lower capital requirements. Crowdfunding platforms pool funds from multiple investors to finance large-scale projects, providing diversification but often with less control and potentially higher risks due to project dependency. Comparing liquidity, returns, and transparency is crucial, as fractional real estate generally offers more stable long-term growth while crowdfunding platforms may deliver quicker but variable payouts.

Connection

Fractional real estate and crowdfunding platforms revolutionize investment by allowing multiple investors to pool resources and buy shares in properties, increasing accessibility and diversifying portfolios. These platforms leverage technology to democratize real estate ownership, enabling smaller investments and providing liquidity in traditionally illiquid markets. By connecting individual investors with real estate opportunities, fractional ownership via crowdfunding facilitates diversified, scalable investment strategies with reduced entry barriers.

Key Terms

Ownership Structure

Crowdfunding platforms offer investors pooled ownership in real estate projects, often resulting in undivided joint interests, whereas fractional real estate grants direct ownership of specific property shares, providing clearer title and control. Crowdfunding typically allows smaller minimum investments with diversified risk, while fractional ownership demands higher capital but offers greater transparency and potential for individual asset appreciation. Explore detailed comparisons to understand which investment structure aligns best with your financial goals and ownership preferences.

Minimum Investment

Crowdfunding platforms often require a minimum investment ranging from $100 to $1,000, making real estate access more affordable for individual investors. Fractional real estate typically demands higher minimum investments, often starting at $10,000 or more, reflecting ownership in specific properties rather than a share in a fund. Explore detailed comparisons and investment strategies to discover which approach aligns best with your financial goals.

Liquidity

Crowdfunding platforms offer investors the ability to pool funds for real estate projects, but liquidity can be limited due to long lock-up periods and secondary market restrictions. Fractional real estate investments often provide higher liquidity by allowing owners to buy and sell shares more freely on established secondary marketplaces. Explore detailed comparisons to understand which investment option aligns with your liquidity preferences.

Source and External Links

GoFundMe - The global leader in personal and nonprofit crowdfunding, trusted by over 100 million people for a wide variety of causes, with no fee to start fundraising and secure donation processing.

Kickstarter - A leading reward-based crowdfunding platform for creative projects, requiring projects to reach their funding goal to receive funds, with a higher project success rate than many competitors.

Fundable - A U.S.-based platform focused on helping startups raise capital from accredited investors online, featuring tools for fundraising management and investor outreach.

dowidth.com

dowidth.com