Carbon credit trading enables investors to buy and sell emissions allowances to reduce their carbon footprint, while socially responsible investing (SRI) focuses on supporting companies with ethical, environmental, and social governance criteria. Both strategies aim to generate financial returns alongside positive environmental or social impact, appealing to investors prioritizing sustainability. Explore the key benefits and differences between carbon credit trading and socially responsible investing to make informed investment decisions.

Why it is important

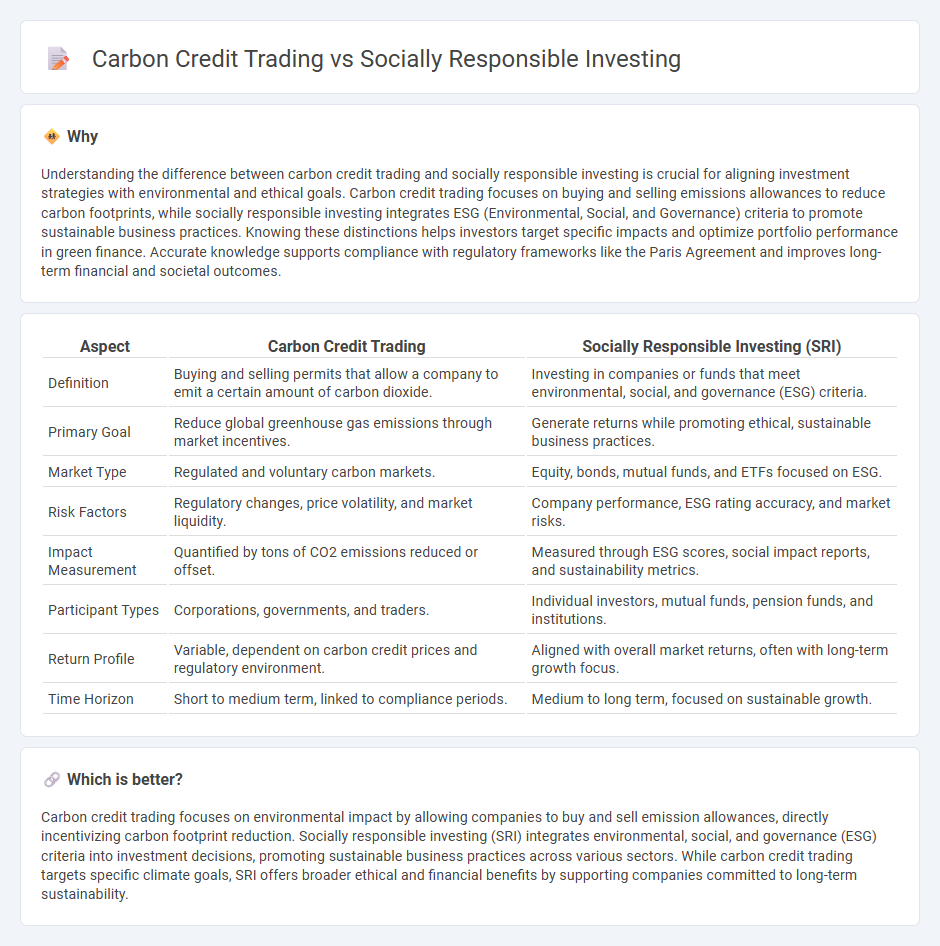

Understanding the difference between carbon credit trading and socially responsible investing is crucial for aligning investment strategies with environmental and ethical goals. Carbon credit trading focuses on buying and selling emissions allowances to reduce carbon footprints, while socially responsible investing integrates ESG (Environmental, Social, and Governance) criteria to promote sustainable business practices. Knowing these distinctions helps investors target specific impacts and optimize portfolio performance in green finance. Accurate knowledge supports compliance with regulatory frameworks like the Paris Agreement and improves long-term financial and societal outcomes.

Comparison Table

| Aspect | Carbon Credit Trading | Socially Responsible Investing (SRI) |

|---|---|---|

| Definition | Buying and selling permits that allow a company to emit a certain amount of carbon dioxide. | Investing in companies or funds that meet environmental, social, and governance (ESG) criteria. |

| Primary Goal | Reduce global greenhouse gas emissions through market incentives. | Generate returns while promoting ethical, sustainable business practices. |

| Market Type | Regulated and voluntary carbon markets. | Equity, bonds, mutual funds, and ETFs focused on ESG. |

| Risk Factors | Regulatory changes, price volatility, and market liquidity. | Company performance, ESG rating accuracy, and market risks. |

| Impact Measurement | Quantified by tons of CO2 emissions reduced or offset. | Measured through ESG scores, social impact reports, and sustainability metrics. |

| Participant Types | Corporations, governments, and traders. | Individual investors, mutual funds, pension funds, and institutions. |

| Return Profile | Variable, dependent on carbon credit prices and regulatory environment. | Aligned with overall market returns, often with long-term growth focus. |

| Time Horizon | Short to medium term, linked to compliance periods. | Medium to long term, focused on sustainable growth. |

Which is better?

Carbon credit trading focuses on environmental impact by allowing companies to buy and sell emission allowances, directly incentivizing carbon footprint reduction. Socially responsible investing (SRI) integrates environmental, social, and governance (ESG) criteria into investment decisions, promoting sustainable business practices across various sectors. While carbon credit trading targets specific climate goals, SRI offers broader ethical and financial benefits by supporting companies committed to long-term sustainability.

Connection

Carbon credit trading drives investment toward companies reducing greenhouse gas emissions, aligning financial returns with environmental impact. Socially responsible investing (SRI) prioritizes assets that meet ethical, social, and environmental criteria, often incorporating carbon credit portfolios to enhance sustainability goals. Both strategies leverage market mechanisms to allocate capital in ways that promote ecological balance and corporate accountability.

Key Terms

**Socially Responsible Investing:**

Socially Responsible Investing (SRI) integrates environmental, social, and governance (ESG) criteria into investment decisions to promote ethical and sustainable business practices. SRI strategies prioritize companies with strong social impact, reduced environmental footprints, and robust governance structures, aiming to generate financial returns alongside positive societal outcomes. Explore how SRI frameworks can align your investment portfolio with global sustainability goals.

ESG (Environmental, Social, Governance)

Socially responsible investing (SRI) prioritizes companies with strong ESG performance by integrating environmental, social, and governance criteria into portfolio decisions to promote sustainable and ethical practices. Carbon credit trading facilitates the reduction of greenhouse gas emissions by allowing businesses to buy and sell emission allowances, directly addressing environmental impact within the ESG framework. Explore how these strategies complement each other to drive corporate sustainability and environmental stewardship.

Negative Screening

Negative screening in socially responsible investing (SRI) involves excluding companies or sectors that engage in environmentally harmful practices, aligning portfolios with ethical values. Carbon credit trading, by contrast, allows firms to offset emissions through market-based mechanisms rather than eliminating investments in polluting entities. Explore the nuances of negative screening and its impact on sustainable finance to deepen your understanding.

Source and External Links

Socially Responsible Investing | Green America - Socially responsible investing (SRI) integrates values with investment decisions by selecting companies with strong environmental, social, and governance (ESG) records and avoiding those with poor practices.

Socially responsible investing - Wikipedia - SRI is an investment strategy that considers financial returns alongside ethical, social, and environmental goals, often focusing on ESG criteria and avoiding harmful industries such as fossil fuels or tobacco.

What Is Socially Responsible Investing (SRI) and How to Get Started - SRI aims to generate social change alongside financial returns, has grown in popularity, and offers increasingly affordable options through sustainable mutual funds and ETFs.

dowidth.com

dowidth.com