Whisky cask investment offers a tangible asset with potential value appreciation driven by aging and market demand, while rare coin investment relies on historical significance, rarity, and condition to determine worth. Both investment types provide unique opportunities for portfolio diversification and long-term growth, but require specialized knowledge for informed decision-making. Explore the distinct benefits and risks of whisky casks versus rare coins to discover the best fit for your investment strategy.

Why it is important

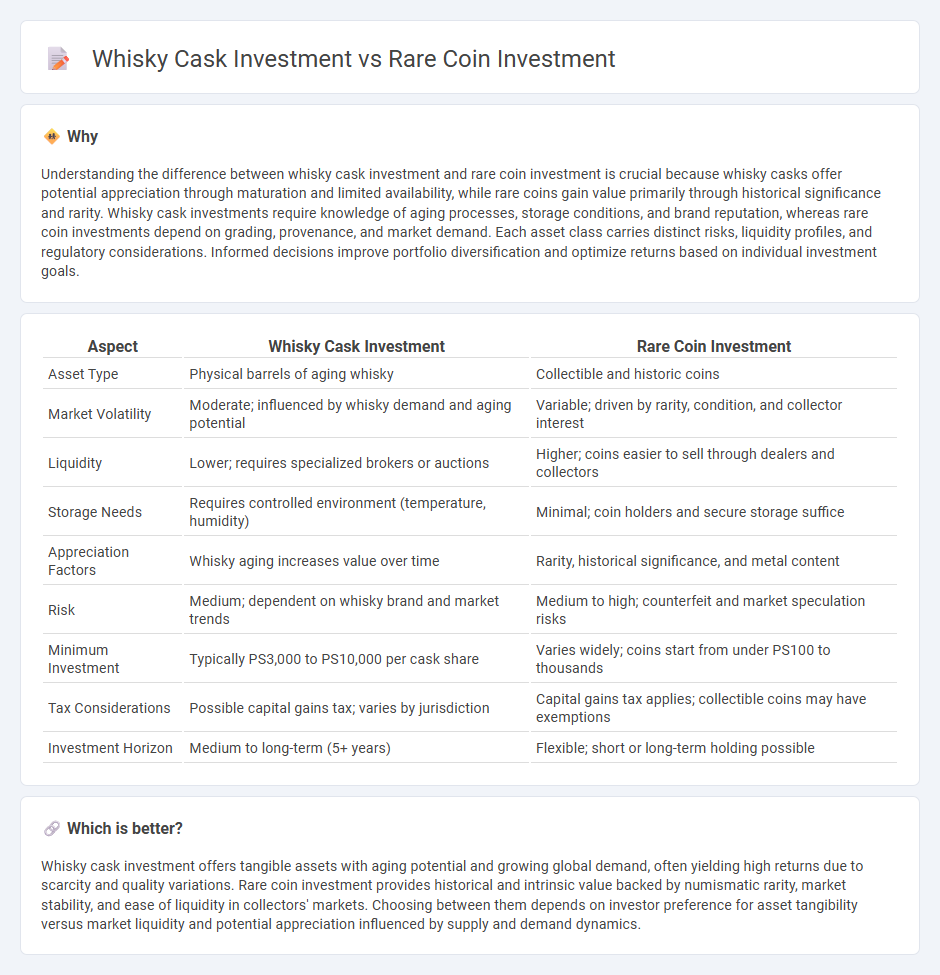

Understanding the difference between whisky cask investment and rare coin investment is crucial because whisky casks offer potential appreciation through maturation and limited availability, while rare coins gain value primarily through historical significance and rarity. Whisky cask investments require knowledge of aging processes, storage conditions, and brand reputation, whereas rare coin investments depend on grading, provenance, and market demand. Each asset class carries distinct risks, liquidity profiles, and regulatory considerations. Informed decisions improve portfolio diversification and optimize returns based on individual investment goals.

Comparison Table

| Aspect | Whisky Cask Investment | Rare Coin Investment |

|---|---|---|

| Asset Type | Physical barrels of aging whisky | Collectible and historic coins |

| Market Volatility | Moderate; influenced by whisky demand and aging potential | Variable; driven by rarity, condition, and collector interest |

| Liquidity | Lower; requires specialized brokers or auctions | Higher; coins easier to sell through dealers and collectors |

| Storage Needs | Requires controlled environment (temperature, humidity) | Minimal; coin holders and secure storage suffice |

| Appreciation Factors | Whisky aging increases value over time | Rarity, historical significance, and metal content |

| Risk | Medium; dependent on whisky brand and market trends | Medium to high; counterfeit and market speculation risks |

| Minimum Investment | Typically PS3,000 to PS10,000 per cask share | Varies widely; coins start from under PS100 to thousands |

| Tax Considerations | Possible capital gains tax; varies by jurisdiction | Capital gains tax applies; collectible coins may have exemptions |

| Investment Horizon | Medium to long-term (5+ years) | Flexible; short or long-term holding possible |

Which is better?

Whisky cask investment offers tangible assets with aging potential and growing global demand, often yielding high returns due to scarcity and quality variations. Rare coin investment provides historical and intrinsic value backed by numismatic rarity, market stability, and ease of liquidity in collectors' markets. Choosing between them depends on investor preference for asset tangibility versus market liquidity and potential appreciation influenced by supply and demand dynamics.

Connection

Whisky cask investment and rare coin investment both represent alternative asset classes appealing to collectors and investors seeking tangible, non-traditional portfolios. These investments share characteristics such as historical value appreciation, limited supply, and the impact of rarity on market demand. Fluctuations in global economic conditions and collector interest influence the valuation trends of both whisky casks and rare coins.

Key Terms

Rare coin investment:

Rare coin investment offers tangible assets with historical and numismatic value, often appreciating due to scarcity and market demand. Coins graded by professional services like PCGS or NGC provide transparency and liquidity in the collectibles market. Explore how rare coin portfolios can diversify your investment strategy and preserve wealth.

Numismatic value

Rare coin investment centers on numismatic value, where the coin's historical significance, rarity, condition, and demand among collectors drive its worth. Whisky cask investment primarily depends on the aging process, brand reputation, and market trends but lacks the intrinsic historical and collectible appeal of numismatic items. Explore detailed comparisons to understand which alternative asset aligns best with your investment goals.

Grading certification

Grading certification plays a crucial role in rare coin investment by providing authenticated verification of a coin's condition, rarity, and market value, thereby enhancing liquidity and investor confidence. In whisky cask investment, while certification focuses on provenance, age, and cask quality, official grading standards are less standardized compared to numismatic grading, impacting valuation transparency. Discover detailed insights on how grading certification influences market performance in both asset classes.

Source and External Links

Investing in Rare Coins - Rare coins are collectible alternative assets that can appreciate in value, offering diversification from traditional markets but come with unique risks such as fraud, forgery, and market volatility.

Rare Coins, Currency & Bullion Archives - Investing in rare coins combines collecting with potential financial growth, leveraging their historical significance, ease of authentication, liquidity, and strong historical performance as tangible assets.

Rare Coins For Sale - Rare coins are valued for their age, design, scarcity, and demand, with reputable dealers offering certified inventory and expert advice for buyers seeking to invest in top-tier numismatic assets.

dowidth.com

dowidth.com