Sneaker flipping offers a dynamic, high-risk investment opportunity rooted in the fast-growing streetwear market, with potential for substantial short-term profits through marketplace resale. Mutual funds provide a diversified portfolio managed by financial professionals, ideal for those seeking steady growth and reduced investment risk over time. Explore the advantages and disadvantages of both to determine which investment strategy aligns with your financial goals.

Why it is important

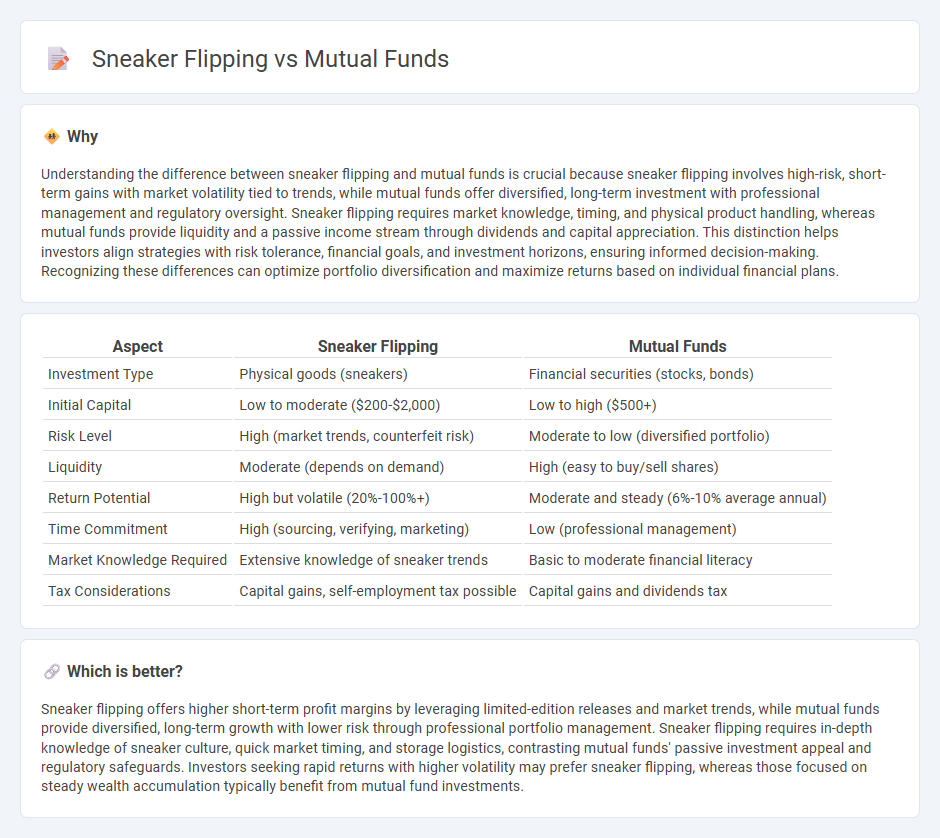

Understanding the difference between sneaker flipping and mutual funds is crucial because sneaker flipping involves high-risk, short-term gains with market volatility tied to trends, while mutual funds offer diversified, long-term investment with professional management and regulatory oversight. Sneaker flipping requires market knowledge, timing, and physical product handling, whereas mutual funds provide liquidity and a passive income stream through dividends and capital appreciation. This distinction helps investors align strategies with risk tolerance, financial goals, and investment horizons, ensuring informed decision-making. Recognizing these differences can optimize portfolio diversification and maximize returns based on individual financial plans.

Comparison Table

| Aspect | Sneaker Flipping | Mutual Funds |

|---|---|---|

| Investment Type | Physical goods (sneakers) | Financial securities (stocks, bonds) |

| Initial Capital | Low to moderate ($200-$2,000) | Low to high ($500+) |

| Risk Level | High (market trends, counterfeit risk) | Moderate to low (diversified portfolio) |

| Liquidity | Moderate (depends on demand) | High (easy to buy/sell shares) |

| Return Potential | High but volatile (20%-100%+) | Moderate and steady (6%-10% average annual) |

| Time Commitment | High (sourcing, verifying, marketing) | Low (professional management) |

| Market Knowledge Required | Extensive knowledge of sneaker trends | Basic to moderate financial literacy |

| Tax Considerations | Capital gains, self-employment tax possible | Capital gains and dividends tax |

Which is better?

Sneaker flipping offers higher short-term profit margins by leveraging limited-edition releases and market trends, while mutual funds provide diversified, long-term growth with lower risk through professional portfolio management. Sneaker flipping requires in-depth knowledge of sneaker culture, quick market timing, and storage logistics, contrasting mutual funds' passive investment appeal and regulatory safeguards. Investors seeking rapid returns with higher volatility may prefer sneaker flipping, whereas those focused on steady wealth accumulation typically benefit from mutual fund investments.

Connection

Sneaker flipping generates quick capital gains by buying limited-edition shoes and reselling them at higher prices, resembling the short-term trading strategies seen in some mutual funds. Both activities rely on market demand trends and investor behavior to maximize returns within specific timeframes. Understanding consumer sentiment in sneaker culture parallels analyzing market indicators in mutual funds, linking alternative asset appreciation with traditional investment vehicles.

Key Terms

Diversification (Mutual funds)

Mutual funds offer diversification by pooling investments across various asset classes, reducing individual risk and enhancing portfolio stability. In contrast, sneaker flipping is a niche market with higher volatility and limited diversification opportunities. Discover how diversification in mutual funds can safeguard your investments and provide steady growth potential.

Liquidity (Sneaker flipping)

Sneaker flipping offers high liquidity compared to mutual funds, allowing investors to quickly buy and resell limited-edition sneakers in dynamic secondary markets. Unlike mutual funds that may require redemption periods of several days to access cash, sneaker flipping provides immediate cash flow opportunities through peer-to-peer platforms and auction sites. Explore how sneaker flipping can enhance your investment portfolio liquidity by learning more about market trends and trading strategies.

Risk tolerance

Mutual funds offer diversified investment portfolios managed by professionals, reducing risk through asset allocation across stocks, bonds, and other securities, making them suitable for moderate to low risk tolerance investors. Sneaker flipping involves buying limited edition sneakers and reselling them at a premium, carrying high market volatility and unpredictable demand, appealing to those with a high-risk tolerance and keen market insight. Discover more about aligning your investment choices with your risk tolerance to maximize returns.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment companies that pool money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities, managed by professional investment advisers, offering features like diversification, liquidity, and low minimum investments.

Mutual fund - Wikipedia - A mutual fund is an investment vehicle that aggregates capital from multiple investors to purchase a diversified mix of securities, with options including actively managed funds, index funds, and various asset classes, all regulated and required to disclose performance and fee information.

Mutual Funds | FINRA.org - Mutual funds are open-end investment companies that allow investors to buy shares representing partial ownership in a pooled portfolio, with profits from dividends, interest, and capital gains distributed to shareholders, subject to various fees and SEC regulation.

dowidth.com

dowidth.com