Sports memorabilia investment offers tangible assets with potential appreciation influenced by rarity, demand, and player legacy, while peer-to-peer lending provides passive income through direct borrower-funded loans with varying risk profiles and return rates. Collectors often seek unique autographed items and limited editions, whereas peer-to-peer platforms enable diversified lending portfolios with fixed interest payments. Discover more about optimizing your investment strategy by balancing collectible assets and alternative financing opportunities.

Why it is important

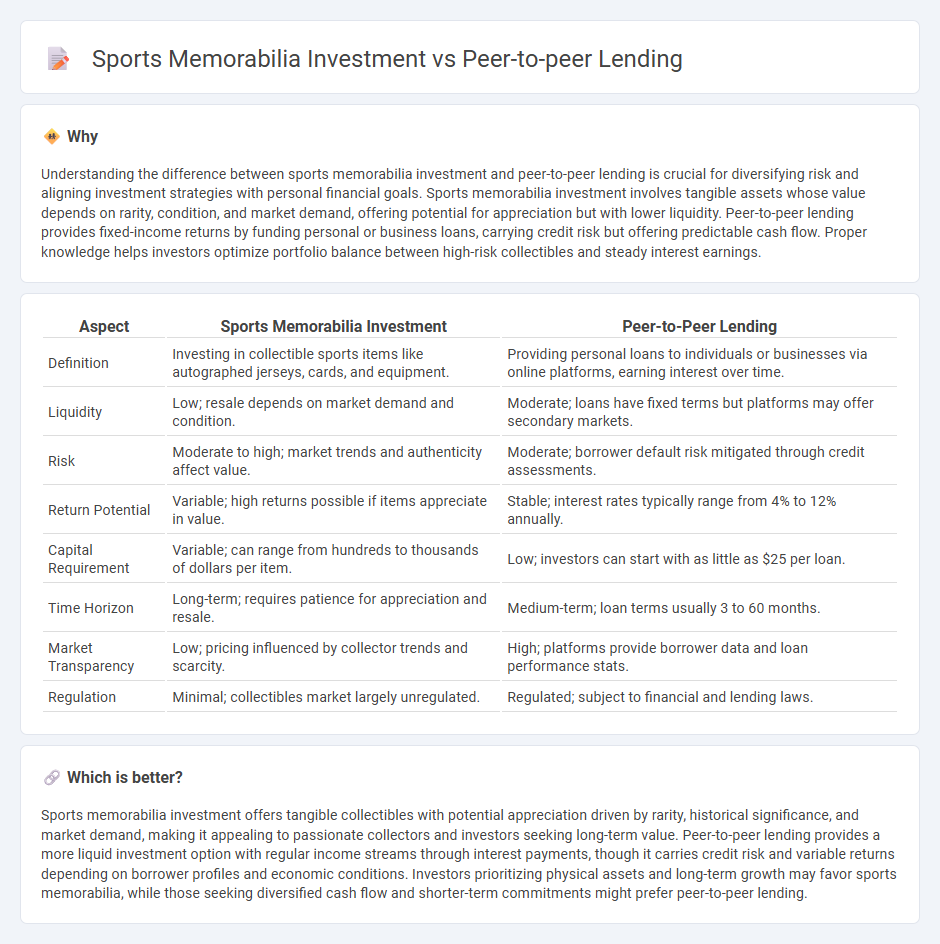

Understanding the difference between sports memorabilia investment and peer-to-peer lending is crucial for diversifying risk and aligning investment strategies with personal financial goals. Sports memorabilia investment involves tangible assets whose value depends on rarity, condition, and market demand, offering potential for appreciation but with lower liquidity. Peer-to-peer lending provides fixed-income returns by funding personal or business loans, carrying credit risk but offering predictable cash flow. Proper knowledge helps investors optimize portfolio balance between high-risk collectibles and steady interest earnings.

Comparison Table

| Aspect | Sports Memorabilia Investment | Peer-to-Peer Lending |

|---|---|---|

| Definition | Investing in collectible sports items like autographed jerseys, cards, and equipment. | Providing personal loans to individuals or businesses via online platforms, earning interest over time. |

| Liquidity | Low; resale depends on market demand and condition. | Moderate; loans have fixed terms but platforms may offer secondary markets. |

| Risk | Moderate to high; market trends and authenticity affect value. | Moderate; borrower default risk mitigated through credit assessments. |

| Return Potential | Variable; high returns possible if items appreciate in value. | Stable; interest rates typically range from 4% to 12% annually. |

| Capital Requirement | Variable; can range from hundreds to thousands of dollars per item. | Low; investors can start with as little as $25 per loan. |

| Time Horizon | Long-term; requires patience for appreciation and resale. | Medium-term; loan terms usually 3 to 60 months. |

| Market Transparency | Low; pricing influenced by collector trends and scarcity. | High; platforms provide borrower data and loan performance stats. |

| Regulation | Minimal; collectibles market largely unregulated. | Regulated; subject to financial and lending laws. |

Which is better?

Sports memorabilia investment offers tangible collectibles with potential appreciation driven by rarity, historical significance, and market demand, making it appealing to passionate collectors and investors seeking long-term value. Peer-to-peer lending provides a more liquid investment option with regular income streams through interest payments, though it carries credit risk and variable returns depending on borrower profiles and economic conditions. Investors prioritizing physical assets and long-term growth may favor sports memorabilia, while those seeking diversified cash flow and shorter-term commitments might prefer peer-to-peer lending.

Connection

Sports memorabilia investment benefits from peer-to-peer lending by providing alternative financing options for collectors and dealers seeking capital to acquire high-value items. Peer-to-peer lending platforms facilitate direct loans between investors and buyers, enhancing liquidity in the sports memorabilia market. This connection drives asset accessibility and diversification opportunities, optimizing investment portfolios with unique, appreciating collectibles.

Key Terms

**Peer-to-peer lending:**

Peer-to-peer lending offers direct loan transactions between individuals, bypassing traditional financial institutions and often providing higher returns compared to conventional savings accounts. Investors can diversify their portfolios with varying risk levels by selecting loans based on borrower profiles and credit ratings, benefiting from steady interest income. Explore more insights on how peer-to-peer lending can enhance your investment strategy.

Default Risk

Peer-to-peer lending carries a notable default risk as borrowers may fail to repay loans, impacting investor returns and necessitating rigorous credit assessment and diversification strategies. Sports memorabilia investment involves lower default risk since physical assets maintain intrinsic value, although market demand fluctuations can affect liquidity and resale value. Explore detailed comparisons to understand how default risk influences these investment options.

Interest Rate

Peer-to-peer lending typically offers interest rates ranging from 5% to 12% annually, depending on borrower creditworthiness and platform fees, providing relatively predictable cash flow. Sports memorabilia investment returns vary widely, influenced by market demand, item rarity, and condition, with potential appreciation rates sometimes exceeding 15% per year but carrying higher risk and illiquidity. Explore detailed comparisons and strategies to optimize returns across these investment options.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer lending is a method where individuals borrow and lend money directly through specialized websites, bypassing banks, offering lower eligibility requirements and potentially competitive interest rates for borrowers, and unique investment opportunities for lenders.

Peer-to-peer lending - Wikipedia - P2P lending is an online service matching lenders and borrowers, often without prior relationship, featuring unsecured or secured loans, and involving intermediation by P2P companies handling credit checks, payments, and loan servicing.

Peer to peer lending: what you need to know - Peer-to-peer lending platforms act as marketplaces connecting lenders to borrowers, with lenders earning interest but facing higher risks than savings accounts; loans can be automatically diversified across borrowers or chosen individually.

dowidth.com

dowidth.com