Whiskey barrel investment offers a unique opportunity to capitalize on the growing demand for aged spirits, with barrels appreciating in value as the whiskey matures over time. Timberland investment provides long-term asset growth through sustainable forestry operations, generating income via timber sales and potential land appreciation. Explore detailed comparisons to determine which alternative investment best aligns with your financial goals.

Why it is important

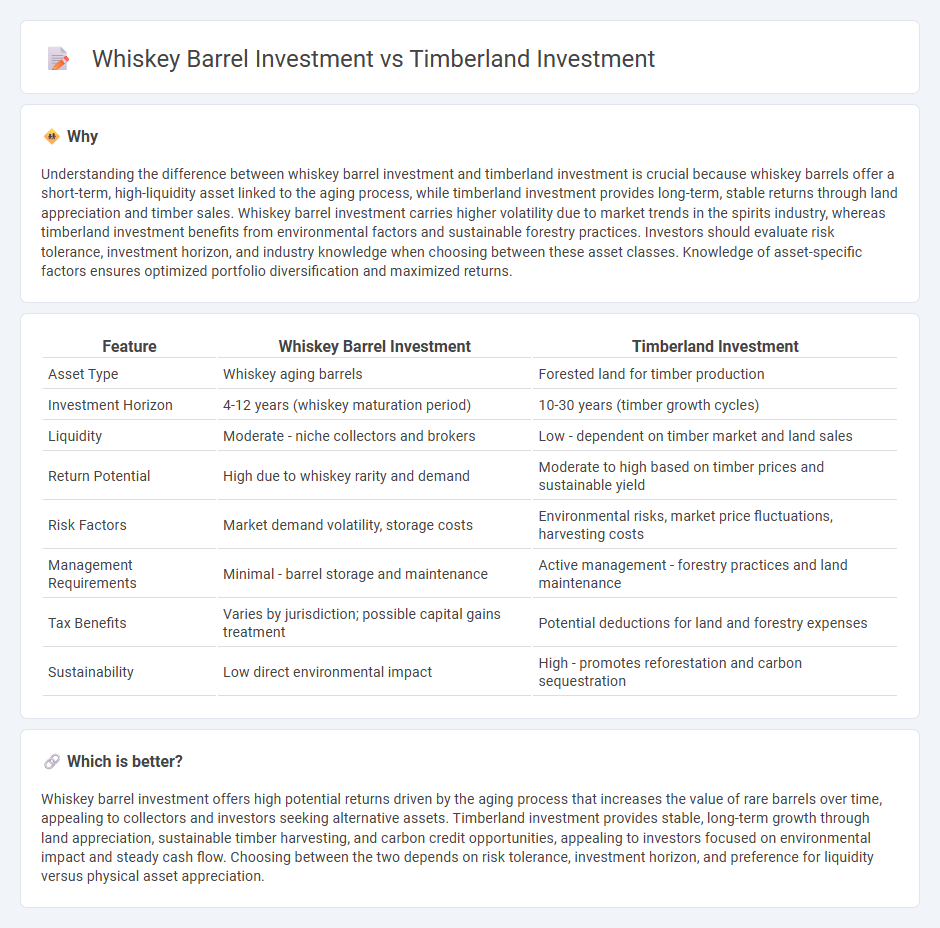

Understanding the difference between whiskey barrel investment and timberland investment is crucial because whiskey barrels offer a short-term, high-liquidity asset linked to the aging process, while timberland investment provides long-term, stable returns through land appreciation and timber sales. Whiskey barrel investment carries higher volatility due to market trends in the spirits industry, whereas timberland investment benefits from environmental factors and sustainable forestry practices. Investors should evaluate risk tolerance, investment horizon, and industry knowledge when choosing between these asset classes. Knowledge of asset-specific factors ensures optimized portfolio diversification and maximized returns.

Comparison Table

| Feature | Whiskey Barrel Investment | Timberland Investment |

|---|---|---|

| Asset Type | Whiskey aging barrels | Forested land for timber production |

| Investment Horizon | 4-12 years (whiskey maturation period) | 10-30 years (timber growth cycles) |

| Liquidity | Moderate - niche collectors and brokers | Low - dependent on timber market and land sales |

| Return Potential | High due to whiskey rarity and demand | Moderate to high based on timber prices and sustainable yield |

| Risk Factors | Market demand volatility, storage costs | Environmental risks, market price fluctuations, harvesting costs |

| Management Requirements | Minimal - barrel storage and maintenance | Active management - forestry practices and land maintenance |

| Tax Benefits | Varies by jurisdiction; possible capital gains treatment | Potential deductions for land and forestry expenses |

| Sustainability | Low direct environmental impact | High - promotes reforestation and carbon sequestration |

Which is better?

Whiskey barrel investment offers high potential returns driven by the aging process that increases the value of rare barrels over time, appealing to collectors and investors seeking alternative assets. Timberland investment provides stable, long-term growth through land appreciation, sustainable timber harvesting, and carbon credit opportunities, appealing to investors focused on environmental impact and steady cash flow. Choosing between the two depends on risk tolerance, investment horizon, and preference for liquidity versus physical asset appreciation.

Connection

Whiskey barrel investment and timberland investment are connected through their shared reliance on natural resource appreciation and long-term asset growth. Both asset classes benefit from the aging process--whiskey barrels increase in value as the spirit matures, while timberland appreciates as trees grow and are harvested sustainably. Investors leverage these tangible assets for portfolio diversification, capitalizing on the cyclical demand in luxury spirits and the sustainable timber market.

Key Terms

Asset Liquidity

Timberland investments generally offer moderate liquidity as they can be sold through real estate markets or timber sales, but transactions may take time due to the specialized nature and location of the land. Whiskey barrel investments often provide higher liquidity, especially with popular brands and limited editions that can be traded in secondary markets or auctioned more quickly. Explore deeper insights into timberland and whiskey barrel asset liquidity to make informed investment decisions.

Maturation Period

Timberland investment typically offers long-term growth with asset appreciation occurring over decades as trees mature, often requiring 20-30 years for optimal timber value. Whiskey barrel investment matures faster, generally within 3 to 12 years, as whiskey ages and increases in value during its maturation in oak barrels. Explore the intricacies of maturation periods in both investments to determine which aligns best with your financial goals.

Yield Stability

Timberland investment offers yield stability through consistent land appreciation, timber growth, and sustainable harvesting cycles, providing predictable cash flow over time. Whiskey barrel investment carries higher volatility with potential for significant gains during barrel aging but is influenced by market demand, brand popularity, and aging duration. Explore detailed comparisons to understand which asset aligns with your yield stability goals.

Source and External Links

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investment involves buying trees in managed plantations or natural forests, offering portfolio diversification due to biological growth and low correlation with traditional asset classes.

Timberland | Institutional - Manulife Investment Management - Timberland investments provide strong financial returns, inflation protection, and environmental benefits such as carbon sequestration, with growing opportunities in carbon markets alongside timber production.

Timberland - J.P. Morgan Asset Management - Investing in sustainably managed timberland delivers regular income, inflation hedging, portfolio diversification, and positive climate impact through carbon storage and ecosystem services.

dowidth.com

dowidth.com