Wine funds offer a unique alternative investment by combining passion with potential returns through investing in collectible wines that appreciate over time, while index funds provide diversified exposure to the stock market with lower fees and historically stable growth. Unlike the volatility of stock markets, wine fund performance depends on rarity, vintage quality, and global demand trends. Explore the comparative benefits and risks of wine funds versus index funds to determine which aligns better with your investment strategy.

Why it is important

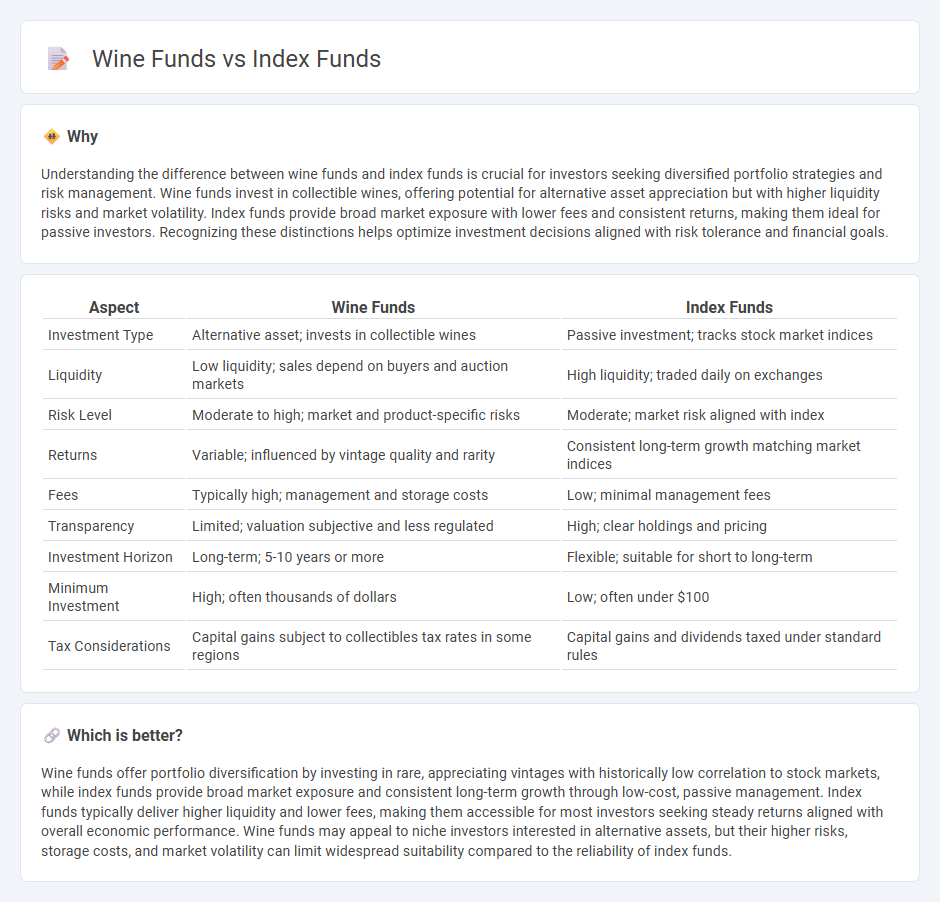

Understanding the difference between wine funds and index funds is crucial for investors seeking diversified portfolio strategies and risk management. Wine funds invest in collectible wines, offering potential for alternative asset appreciation but with higher liquidity risks and market volatility. Index funds provide broad market exposure with lower fees and consistent returns, making them ideal for passive investors. Recognizing these distinctions helps optimize investment decisions aligned with risk tolerance and financial goals.

Comparison Table

| Aspect | Wine Funds | Index Funds |

|---|---|---|

| Investment Type | Alternative asset; invests in collectible wines | Passive investment; tracks stock market indices |

| Liquidity | Low liquidity; sales depend on buyers and auction markets | High liquidity; traded daily on exchanges |

| Risk Level | Moderate to high; market and product-specific risks | Moderate; market risk aligned with index |

| Returns | Variable; influenced by vintage quality and rarity | Consistent long-term growth matching market indices |

| Fees | Typically high; management and storage costs | Low; minimal management fees |

| Transparency | Limited; valuation subjective and less regulated | High; clear holdings and pricing |

| Investment Horizon | Long-term; 5-10 years or more | Flexible; suitable for short to long-term |

| Minimum Investment | High; often thousands of dollars | Low; often under $100 |

| Tax Considerations | Capital gains subject to collectibles tax rates in some regions | Capital gains and dividends taxed under standard rules |

Which is better?

Wine funds offer portfolio diversification by investing in rare, appreciating vintages with historically low correlation to stock markets, while index funds provide broad market exposure and consistent long-term growth through low-cost, passive management. Index funds typically deliver higher liquidity and lower fees, making them accessible for most investors seeking steady returns aligned with overall economic performance. Wine funds may appeal to niche investors interested in alternative assets, but their higher risks, storage costs, and market volatility can limit widespread suitability compared to the reliability of index funds.

Connection

Wine funds and index funds are connected through their shared goal of portfolio diversification and risk management. Both investment vehicles allow investors to allocate capital across multiple assets--wine funds focus on rare and collectible wines, while index funds track a broad market index such as the S&P 500. This strategic diversification helps reduce volatility and optimize returns by balancing traditional equities with alternative tangible assets.

Key Terms

Diversification

Index funds offer broad diversification by investing in a wide range of stocks across various sectors and markets, reducing individual asset risk. Wine funds provide diversification within the alternative asset class of fine wines, which often have low correlation with traditional financial markets. Explore more about how these diversification strategies can fit different investment goals.

Liquidity

Index funds offer high liquidity, allowing investors to buy or sell shares quickly through stock exchanges during market hours. In contrast, wine funds have limited liquidity due to the physical nature of the asset and longer holding periods required to realize potential gains. Explore the differences in liquidity further to make informed investment decisions.

Valuation

Index funds offer diversified exposure by tracking broad market indices, providing relatively stable valuations based on market capitalization and earnings metrics. Wine funds invest in rare and collectible wines, where valuation depends on age, provenance, market demand, and scarcity, often resulting in less volatile but less liquid assets. Explore detailed comparisons to understand how valuation dynamics influence investment returns and risk profiles in each fund type.

Source and External Links

Index Funds | Investor.gov - Index funds are mutual funds or ETFs designed to track the returns of a market index like the S&P 500, using all or a sample of the securities in the index, often weighted by market capitalization.

What is an index fund? - Vanguard - An index fund tracks a specific benchmark like the S&P 500 by buying all or a representative sample of the stocks or bonds in that index, providing diversified exposure with the goal of matching the benchmark's performance.

Index fund - Wikipedia - Index funds are passively managed mutual funds or ETFs designed to replicate a benchmark's performance, favored for their low management effort and tendency to outperform actively managed funds over time.

dowidth.com

dowidth.com