Tax lien certificates grant investors a secured claim against a property for unpaid taxes, offering interest payments upon redemption, while tax deeds provide ownership of the property itself after tax foreclosure sales. Understanding the differences in risk, return potential, and legal procedures is crucial for strategic investment decisions. Explore more to determine which tax investment aligns with your financial goals.

Why it is important

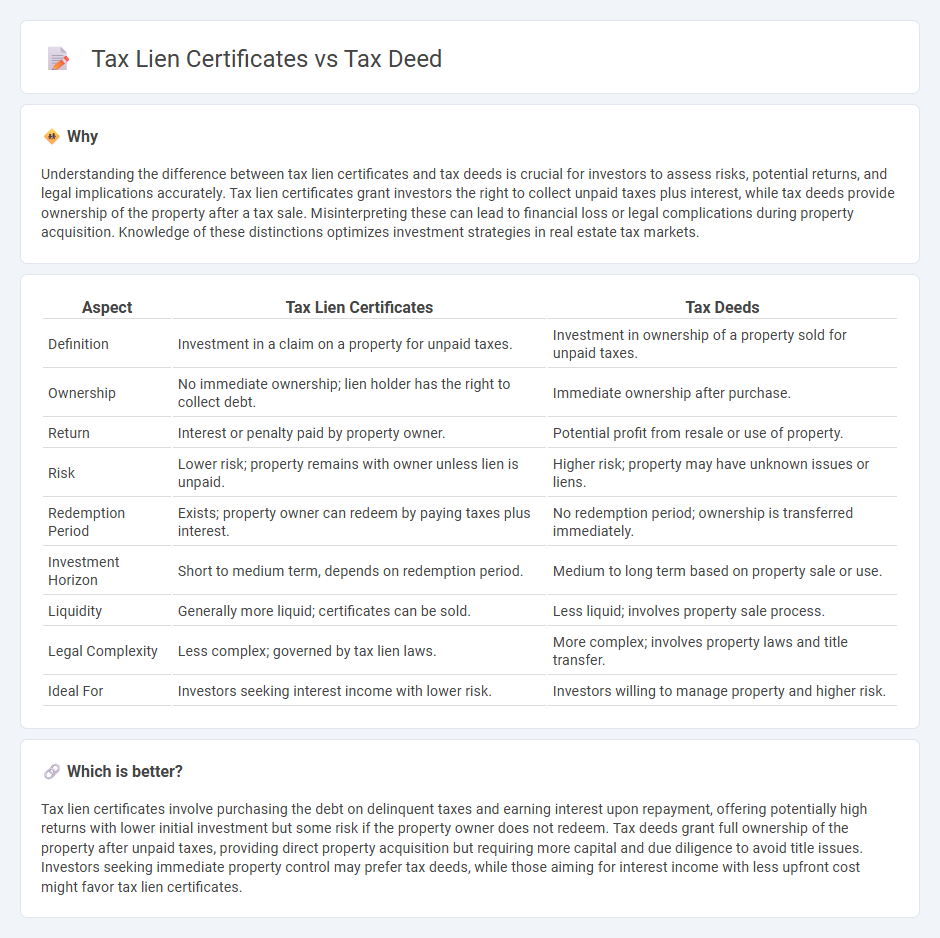

Understanding the difference between tax lien certificates and tax deeds is crucial for investors to assess risks, potential returns, and legal implications accurately. Tax lien certificates grant investors the right to collect unpaid taxes plus interest, while tax deeds provide ownership of the property after a tax sale. Misinterpreting these can lead to financial loss or legal complications during property acquisition. Knowledge of these distinctions optimizes investment strategies in real estate tax markets.

Comparison Table

| Aspect | Tax Lien Certificates | Tax Deeds |

|---|---|---|

| Definition | Investment in a claim on a property for unpaid taxes. | Investment in ownership of a property sold for unpaid taxes. |

| Ownership | No immediate ownership; lien holder has the right to collect debt. | Immediate ownership after purchase. |

| Return | Interest or penalty paid by property owner. | Potential profit from resale or use of property. |

| Risk | Lower risk; property remains with owner unless lien is unpaid. | Higher risk; property may have unknown issues or liens. |

| Redemption Period | Exists; property owner can redeem by paying taxes plus interest. | No redemption period; ownership is transferred immediately. |

| Investment Horizon | Short to medium term, depends on redemption period. | Medium to long term based on property sale or use. |

| Liquidity | Generally more liquid; certificates can be sold. | Less liquid; involves property sale process. |

| Legal Complexity | Less complex; governed by tax lien laws. | More complex; involves property laws and title transfer. |

| Ideal For | Investors seeking interest income with lower risk. | Investors willing to manage property and higher risk. |

Which is better?

Tax lien certificates involve purchasing the debt on delinquent taxes and earning interest upon repayment, offering potentially high returns with lower initial investment but some risk if the property owner does not redeem. Tax deeds grant full ownership of the property after unpaid taxes, providing direct property acquisition but requiring more capital and due diligence to avoid title issues. Investors seeking immediate property control may prefer tax deeds, while those aiming for interest income with less upfront cost might favor tax lien certificates.

Connection

Tax lien certificates represent claims against a property for unpaid taxes, allowing investors to earn interest by paying the delinquent tax amount on behalf of the property owner. If the property owner fails to settle the debt within a specified redemption period, investors holding tax lien certificates may initiate the process to acquire a tax deed, granting them full ownership of the property. Tax deed sales occur when properties with unpaid taxes are auctioned, transferring ownership to the highest bidder and finalizing the connection between tax lien certificates and tax deeds in real estate investment strategies.

Key Terms

Ownership Rights

Tax deed ownership grants the property title after the government sells it due to unpaid taxes, offering full property rights to the buyer. Tax lien certificates provide a legal claim on the property for unpaid taxes but do not confer ownership until foreclosure occurs. Explore how these differences impact investment strategies and property control in tax-related real estate.

Redemption Period

A tax deed grants ownership of a property after the government sells it due to unpaid taxes, typically with no redemption period, meaning the previous owner loses all rights once the deed is issued. Tax lien certificates represent a claim against the property for unpaid taxes, allowing investors to collect interest or potentially foreclose if the lien is unpaid during the redemption period, which varies by state but often ranges from six months to three years. Explore detailed state-specific rules and strategies to maximize returns in tax deed and tax lien investments.

Auction Process

Tax deed auctions grant full ownership of properties with outstanding taxes, where bidders compete to purchase real estate at public sales often held by county governments. Tax lien certificate auctions sell liens placed on properties for unpaid taxes, allowing investors to earn interest but not ownership unless the debt remains unpaid after a redemption period. Explore detailed differences in auction procedures and investment outcomes for tax deeds and tax lien certificates to enhance portfolio strategies.

Source and External Links

Tax deed properties: What they are and how to invest - A tax deed is a legal document that transfers ownership of a property when taxes on it go unpaid and the property is foreclosed; unlike a tax lien, which is a claim allowing collection of unpaid taxes plus interest, a tax deed confers property ownership after auction.

Tax Deeds | Polk County Clerk, FL - Tax deed sales happen monthly by public auction after a tax certificate holder requests the sale when taxes remain unpaid for a minimum of two years, transferring ownership if the certificate is not redeemed.

Tax Deeds / Auctions - Brevard County, Florida - Unpaid property taxes lead to tax certificate sales at auction, and if certificates are not redeemed within two years, the certificate holder may initiate a tax deed auction to transfer ownership of the property.

dowidth.com

dowidth.com