Royalty streams provide investors with passive income derived from intellectual property rights or natural resource revenues, offering consistent cash flow with lower market volatility compared to mutual funds. Mutual funds pool money from many investors to invest in diversified portfolios of stocks, bonds, or other securities, aiming for growth and income through professional management and broader market exposure. Explore the advantages and risks of royalty streams versus mutual funds to determine the best fit for your investment strategy.

Why it is important

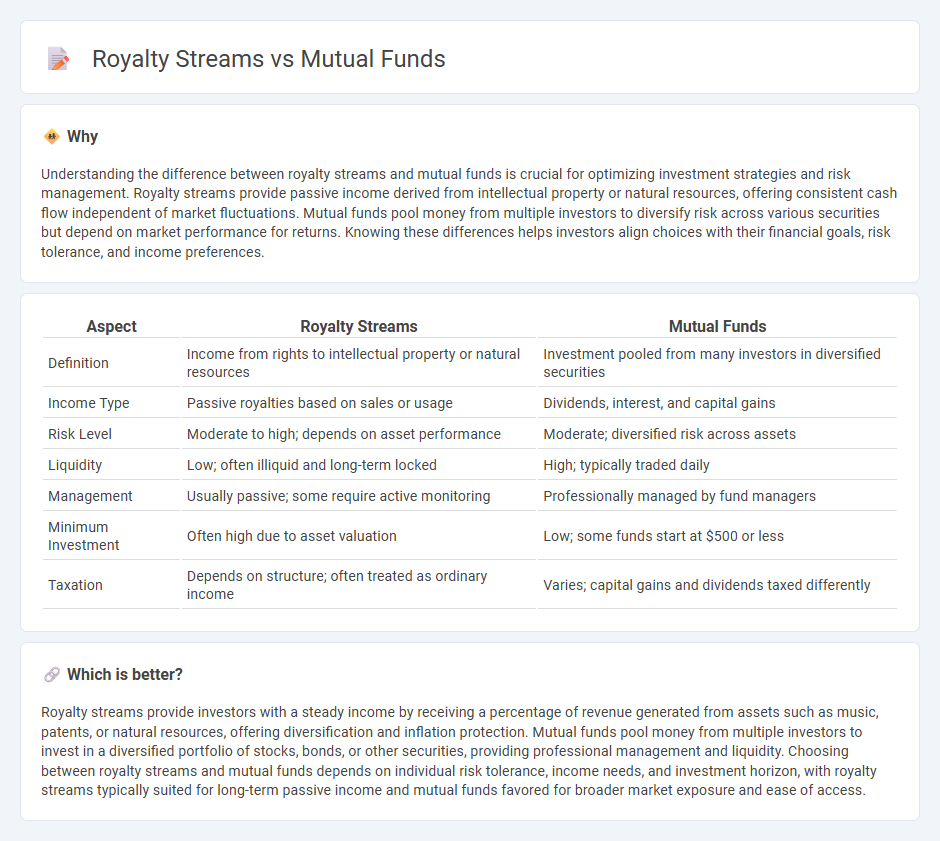

Understanding the difference between royalty streams and mutual funds is crucial for optimizing investment strategies and risk management. Royalty streams provide passive income derived from intellectual property or natural resources, offering consistent cash flow independent of market fluctuations. Mutual funds pool money from multiple investors to diversify risk across various securities but depend on market performance for returns. Knowing these differences helps investors align choices with their financial goals, risk tolerance, and income preferences.

Comparison Table

| Aspect | Royalty Streams | Mutual Funds |

|---|---|---|

| Definition | Income from rights to intellectual property or natural resources | Investment pooled from many investors in diversified securities |

| Income Type | Passive royalties based on sales or usage | Dividends, interest, and capital gains |

| Risk Level | Moderate to high; depends on asset performance | Moderate; diversified risk across assets |

| Liquidity | Low; often illiquid and long-term locked | High; typically traded daily |

| Management | Usually passive; some require active monitoring | Professionally managed by fund managers |

| Minimum Investment | Often high due to asset valuation | Low; some funds start at $500 or less |

| Taxation | Depends on structure; often treated as ordinary income | Varies; capital gains and dividends taxed differently |

Which is better?

Royalty streams provide investors with a steady income by receiving a percentage of revenue generated from assets such as music, patents, or natural resources, offering diversification and inflation protection. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, providing professional management and liquidity. Choosing between royalty streams and mutual funds depends on individual risk tolerance, income needs, and investment horizon, with royalty streams typically suited for long-term passive income and mutual funds favored for broader market exposure and ease of access.

Connection

Royalty streams provide a steady income source through intellectual property rights or natural resource exploitation, making them attractive for mutual funds seeking diversified revenue. Mutual funds can include royalty-based assets in their portfolios to stabilize returns and reduce volatility compared to traditional equity investments. This connection allows investors to benefit from consistent cash flows while spreading risk across different asset classes.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling assets across various sectors, minimizing individual investment risk through a wide range of stocks, bonds, and other securities. Royalty streams provide diversification by generating income from intellectual property or resource-based assets, often uncorrelated with traditional market movements. Explore the benefits and differences of these investment strategies to optimize your portfolio's diversification.

Passive Income

Mutual funds offer diversified investment portfolios managed by professionals, generating passive income through dividends and capital gains distributions. Royalty streams provide consistent cash flow by earning a percentage of revenue from intellectual property, such as music, patents, or real estate leases, often with less market volatility than mutual funds. Explore how combining these options can optimize your passive income strategy.

Asset Liquidity

Mutual funds offer high asset liquidity, allowing investors to buy or sell shares on any business day with minimal transaction costs, whereas royalty streams generally involve lower liquidity due to longer lock-up periods and dependence on revenue generation from underlying assets. The ability to quickly convert mutual fund holdings into cash makes them suitable for investors seeking flexible access to their capital, while royalty streams may provide steady income but limited immediate cash availability. Explore more about the comparative liquidity and investment strategies of mutual funds and royalty streams to optimize your portfolio.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment vehicles that pool money from many investors to buy a diversified portfolio of stocks, bonds, and other securities, managed by registered investment advisers, offering professional management, diversification, and daily liquidity.

Mutual fund - Wikipedia - A mutual fund is an investment fund that collects money from multiple investors to purchase a variety of securities, such as stocks, bonds, or money market instruments, and can be actively managed to outperform the market or passively managed to track an index, with open-end funds allowing investors to buy and sell shares directly with the issuer at the end-of-day net asset value.

What are mutual funds? - Fidelity Investments - Mutual funds enable investors to pool their money to buy a collection of stocks, bonds, or other securities, managed by professionals who aim to outperform a benchmark, with share prices (NAV) updated daily based on the value of the underlying assets.

dowidth.com

dowidth.com