Fractional ownership allows investors to purchase a specific share of a property, providing direct equity and potential rental income, while real estate investment trusts (REITs) offer exposure to diversified real estate portfolios through publicly traded shares, emphasizing liquidity and professional management. Fractional ownership is ideal for those seeking tangible assets and control, whereas REITs suit investors looking for passive income and ease of trading. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

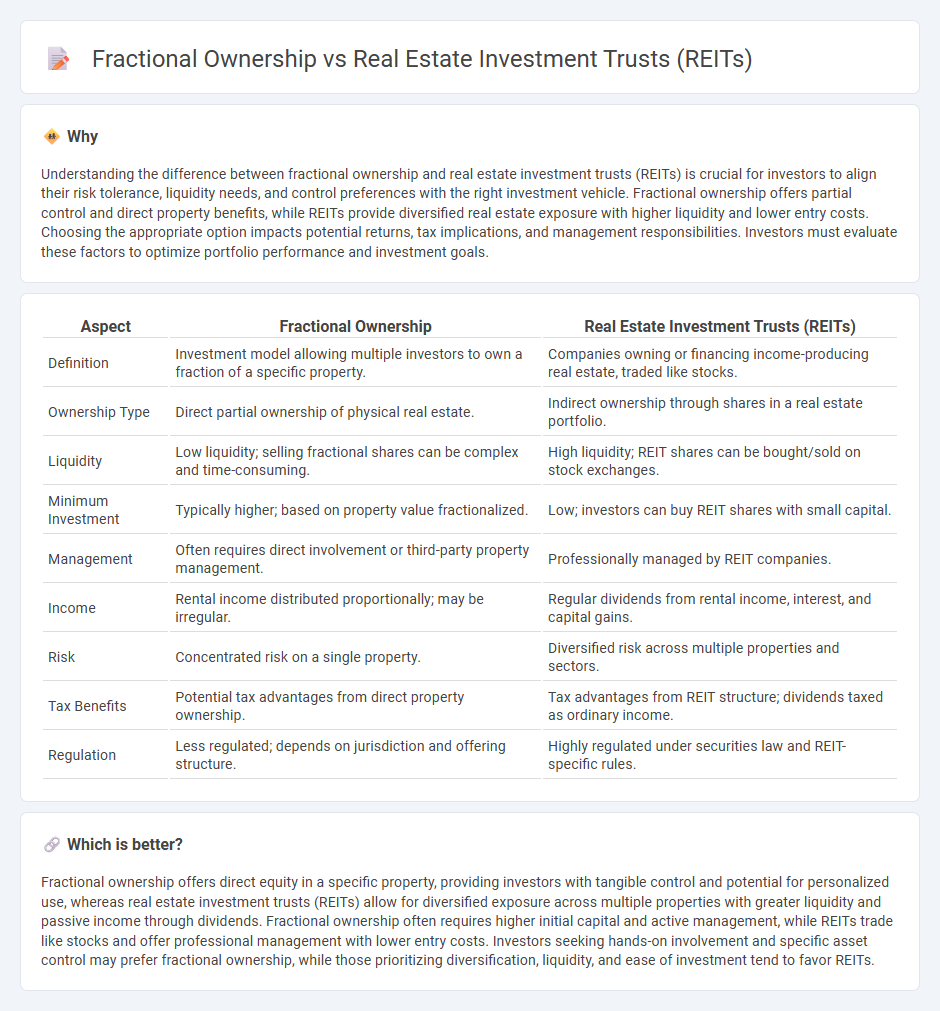

Understanding the difference between fractional ownership and real estate investment trusts (REITs) is crucial for investors to align their risk tolerance, liquidity needs, and control preferences with the right investment vehicle. Fractional ownership offers partial control and direct property benefits, while REITs provide diversified real estate exposure with higher liquidity and lower entry costs. Choosing the appropriate option impacts potential returns, tax implications, and management responsibilities. Investors must evaluate these factors to optimize portfolio performance and investment goals.

Comparison Table

| Aspect | Fractional Ownership | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Investment model allowing multiple investors to own a fraction of a specific property. | Companies owning or financing income-producing real estate, traded like stocks. |

| Ownership Type | Direct partial ownership of physical real estate. | Indirect ownership through shares in a real estate portfolio. |

| Liquidity | Low liquidity; selling fractional shares can be complex and time-consuming. | High liquidity; REIT shares can be bought/sold on stock exchanges. |

| Minimum Investment | Typically higher; based on property value fractionalized. | Low; investors can buy REIT shares with small capital. |

| Management | Often requires direct involvement or third-party property management. | Professionally managed by REIT companies. |

| Income | Rental income distributed proportionally; may be irregular. | Regular dividends from rental income, interest, and capital gains. |

| Risk | Concentrated risk on a single property. | Diversified risk across multiple properties and sectors. |

| Tax Benefits | Potential tax advantages from direct property ownership. | Tax advantages from REIT structure; dividends taxed as ordinary income. |

| Regulation | Less regulated; depends on jurisdiction and offering structure. | Highly regulated under securities law and REIT-specific rules. |

Which is better?

Fractional ownership offers direct equity in a specific property, providing investors with tangible control and potential for personalized use, whereas real estate investment trusts (REITs) allow for diversified exposure across multiple properties with greater liquidity and passive income through dividends. Fractional ownership often requires higher initial capital and active management, while REITs trade like stocks and offer professional management with lower entry costs. Investors seeking hands-on involvement and specific asset control may prefer fractional ownership, while those prioritizing diversification, liquidity, and ease of investment tend to favor REITs.

Connection

Fractional ownership enables multiple investors to purchase shares in a single property, reducing individual capital requirements and increasing access to real estate markets. Real Estate Investment Trusts (REITs) function as pooled investment vehicles, aggregating capital from numerous investors to buy, manage, and sell income-producing properties. Both fractional ownership and REITs provide scalable real estate investment opportunities, offering liquidity, diversification, and passive income streams without the burden of full property management.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer higher liquidity compared to fractional ownership due to their shares being publicly traded on stock exchanges, allowing investors to buy and sell assets quickly. Fractional ownership, while providing direct property exposure, often involves longer transaction times and limited secondary market options, reducing liquidity. Explore detailed comparisons of liquidity metrics and investment flexibility between REITs and fractional ownership to make informed investment decisions.

Diversification

Real Estate Investment Trusts (REITs) offer investors diversification by pooling capital to invest in a broad portfolio of income-generating properties across various sectors and geographic locations, reducing risk exposure. Fractional ownership provides targeted diversification by allowing investors to own a portion of specific properties, but it typically results in a more concentrated portfolio with niche market risks. Explore how each investment type aligns with your diversification goals to make informed real estate investment decisions.

Ownership Structure

Real estate investment trusts (REITs) offer investors indirect ownership through shares in a company that owns and manages a diversified portfolio of real estate assets, providing liquidity and professional management. Fractional ownership grants investors direct equity interest in a specific property, allowing for a tangible stake and potential decision-making influence but often with less liquidity. Explore the nuances of each ownership structure to determine which aligns with your investment goals and risk tolerance.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and often operates income-producing real estate such as apartments, offices, shopping centers, and hotels, providing investors access to real estate markets and typically paying out most of their income as dividends to avoid corporate tax.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies owning or financing income-producing real estate, modeled after mutual funds, that offer investors regular income, diversification, and capital appreciation, and many trade publicly on stock exchanges.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-generating real estate assets such as office buildings, hotels, and warehouses, providing a way to earn income from commercial properties without buying them outright, with publicly traded and non-traded REITs available.

dowidth.com

dowidth.com