Carbon offset investing focuses on funding projects that reduce greenhouse gas emissions, such as reforestation or renewable energy initiatives, helping investors counterbalance their carbon footprint. Low-carbon ETFs, on the other hand, provide diversified exposure to companies with lower carbon emissions, aiming for sustainable growth and reduced environmental risk. Explore the benefits and strategies of these investment options to align your portfolio with climate goals.

Why it is important

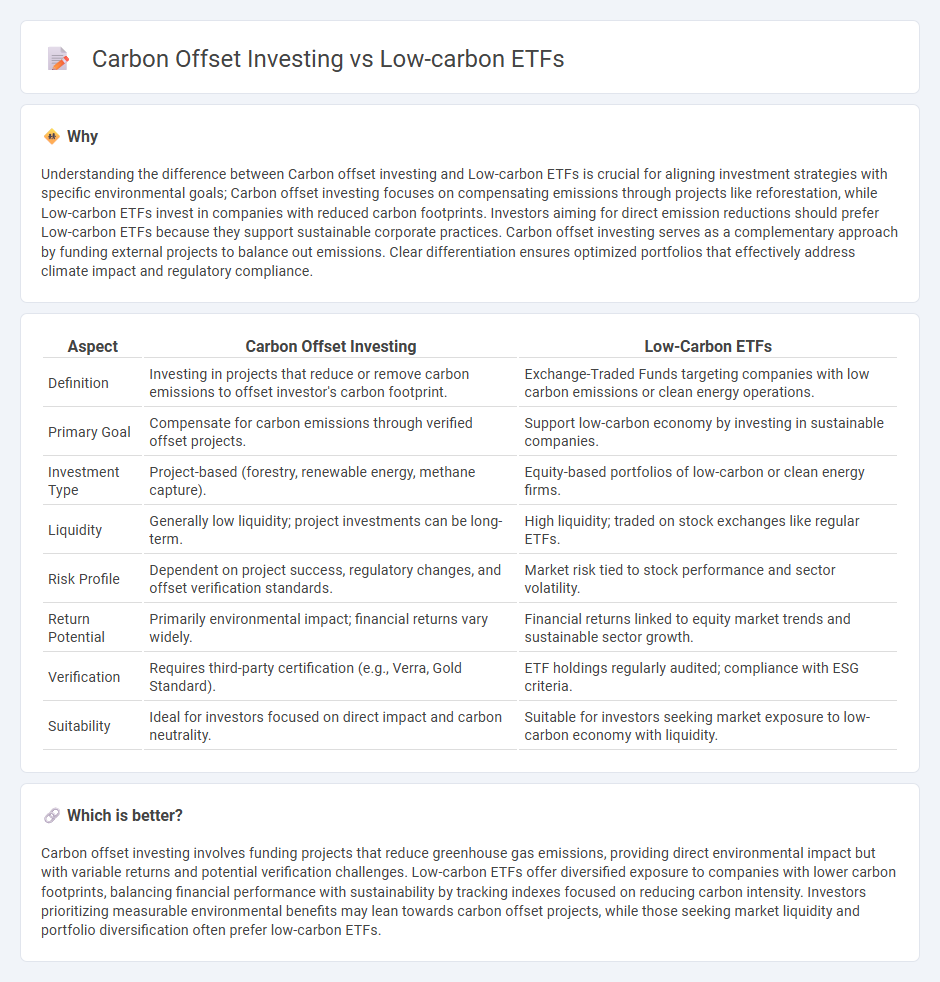

Understanding the difference between Carbon offset investing and Low-carbon ETFs is crucial for aligning investment strategies with specific environmental goals; Carbon offset investing focuses on compensating emissions through projects like reforestation, while Low-carbon ETFs invest in companies with reduced carbon footprints. Investors aiming for direct emission reductions should prefer Low-carbon ETFs because they support sustainable corporate practices. Carbon offset investing serves as a complementary approach by funding external projects to balance out emissions. Clear differentiation ensures optimized portfolios that effectively address climate impact and regulatory compliance.

Comparison Table

| Aspect | Carbon Offset Investing | Low-Carbon ETFs |

|---|---|---|

| Definition | Investing in projects that reduce or remove carbon emissions to offset investor's carbon footprint. | Exchange-Traded Funds targeting companies with low carbon emissions or clean energy operations. |

| Primary Goal | Compensate for carbon emissions through verified offset projects. | Support low-carbon economy by investing in sustainable companies. |

| Investment Type | Project-based (forestry, renewable energy, methane capture). | Equity-based portfolios of low-carbon or clean energy firms. |

| Liquidity | Generally low liquidity; project investments can be long-term. | High liquidity; traded on stock exchanges like regular ETFs. |

| Risk Profile | Dependent on project success, regulatory changes, and offset verification standards. | Market risk tied to stock performance and sector volatility. |

| Return Potential | Primarily environmental impact; financial returns vary widely. | Financial returns linked to equity market trends and sustainable sector growth. |

| Verification | Requires third-party certification (e.g., Verra, Gold Standard). | ETF holdings regularly audited; compliance with ESG criteria. |

| Suitability | Ideal for investors focused on direct impact and carbon neutrality. | Suitable for investors seeking market exposure to low-carbon economy with liquidity. |

Which is better?

Carbon offset investing involves funding projects that reduce greenhouse gas emissions, providing direct environmental impact but with variable returns and potential verification challenges. Low-carbon ETFs offer diversified exposure to companies with lower carbon footprints, balancing financial performance with sustainability by tracking indexes focused on reducing carbon intensity. Investors prioritizing measurable environmental benefits may lean towards carbon offset projects, while those seeking market liquidity and portfolio diversification often prefer low-carbon ETFs.

Connection

Carbon offset investing and low-carbon ETFs are linked through their focus on reducing carbon footprints and promoting sustainable practices within investment portfolios. Carbon offset investing directly finances projects that reduce or capture emissions, while low-carbon ETFs provide diversified exposure to companies with low greenhouse gas emissions or strong climate strategies. Both investment approaches align with growing investor demand for environmental responsibility and support the transition to a low-carbon economy.

Key Terms

ESG (Environmental, Social, and Governance)

Low-carbon ETFs offer diversified exposure to companies with reduced carbon footprints, aligning with Environmental, Social, and Governance (ESG) criteria by prioritizing low greenhouse gas emissions and sustainable practices. Carbon offset investing involves purchasing credits to compensate for emissions, directly supporting projects like reforestation and renewable energy that contribute to carbon neutrality goals. Explore how each strategy complements ESG objectives and drives impact in sustainable investing.

Carbon Credits

Low-carbon ETFs primarily invest in companies with reduced carbon emissions, promoting sustainable business practices through equity exposure, whereas carbon offset investing directly supports projects that generate carbon credits to neutralize emissions. Carbon credits represent quantified emission reductions verified by standards like the Verified Carbon Standard (VCS) or Gold Standard, acting as tradable certificates in global carbon markets. Explore how carbon credits function as a bridge between financial investments and tangible emission reductions to better understand their impact.

Greenhouse Gas Emissions

Low-carbon ETFs primarily reduce exposure to companies with high greenhouse gas emissions by investing in firms with lower carbon footprints, aiming to mitigate climate risk through portfolio adjustment. Carbon offset investing directly counters emissions by funding projects such as reforestation, renewable energy, or methane capture that remove or prevent greenhouse gases from entering the atmosphere. Explore the distinct mechanisms and impacts of these strategies to enhance your sustainable investment approach.

Source and External Links

Carbon Stocks & ETFs Watchlist - CarbonCredits.com - Offers a variety of low-carbon ETFs such as the BlackRock World ex U.S. Carbon Transition Readiness ETF (LCTD) that invests in mid-to-large-cap companies positioned for the low-carbon transition, and the SPDR MSCI ACWI Climate Paris Aligned ETF (NZAC) with over 1,000 low-carbon global companies focused on broad diversification and lower risk.

SMOG - VanEck Low Carbon Energy ETF | Holdings & Performance - Tracks the MVIS Global Low Carbon Energy Index and invests in renewable energy companies across technologies like wind, solar, hydrogen, electric vehicles, and energy efficiency, with a focus on clean energy revenue and $126 million in assets under management.

Low Carbon ETF List - ETF Database - Provides a comprehensive list and performance rankings of U.S.-listed low-carbon ETFs, including fund flows, returns, assets under management, and expense ratios, helping investors evaluate and compare various low-carbon investment options.

dowidth.com

dowidth.com