Tax lien certificates provide investors with secured claims against property tax debts, offering high-interest returns backed by government authority. Syndications pool funds from multiple investors to collectively purchase large-scale real estate, enabling access to diversified assets and professional management. Explore the benefits and risks of each investment strategy to determine the best fit for your portfolio.

Why it is important

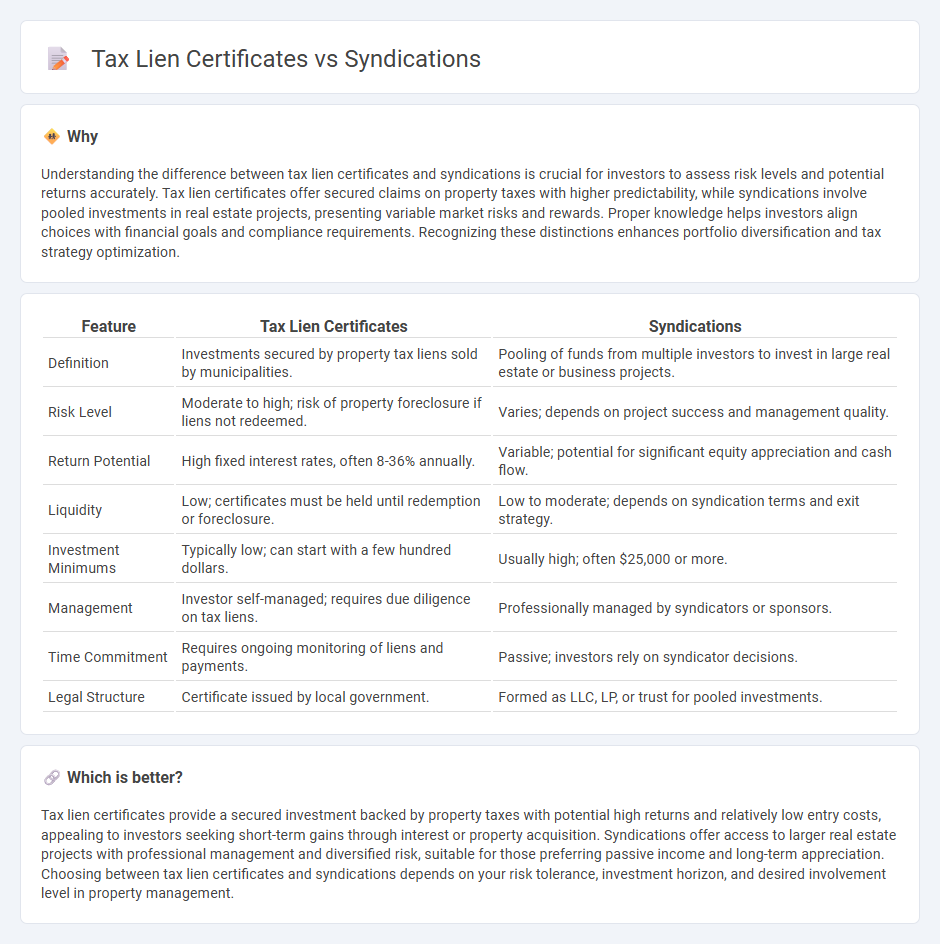

Understanding the difference between tax lien certificates and syndications is crucial for investors to assess risk levels and potential returns accurately. Tax lien certificates offer secured claims on property taxes with higher predictability, while syndications involve pooled investments in real estate projects, presenting variable market risks and rewards. Proper knowledge helps investors align choices with financial goals and compliance requirements. Recognizing these distinctions enhances portfolio diversification and tax strategy optimization.

Comparison Table

| Feature | Tax Lien Certificates | Syndications |

|---|---|---|

| Definition | Investments secured by property tax liens sold by municipalities. | Pooling of funds from multiple investors to invest in large real estate or business projects. |

| Risk Level | Moderate to high; risk of property foreclosure if liens not redeemed. | Varies; depends on project success and management quality. |

| Return Potential | High fixed interest rates, often 8-36% annually. | Variable; potential for significant equity appreciation and cash flow. |

| Liquidity | Low; certificates must be held until redemption or foreclosure. | Low to moderate; depends on syndication terms and exit strategy. |

| Investment Minimums | Typically low; can start with a few hundred dollars. | Usually high; often $25,000 or more. |

| Management | Investor self-managed; requires due diligence on tax liens. | Professionally managed by syndicators or sponsors. |

| Time Commitment | Requires ongoing monitoring of liens and payments. | Passive; investors rely on syndicator decisions. |

| Legal Structure | Certificate issued by local government. | Formed as LLC, LP, or trust for pooled investments. |

Which is better?

Tax lien certificates provide a secured investment backed by property taxes with potential high returns and relatively low entry costs, appealing to investors seeking short-term gains through interest or property acquisition. Syndications offer access to larger real estate projects with professional management and diversified risk, suitable for those preferring passive income and long-term appreciation. Choosing between tax lien certificates and syndications depends on your risk tolerance, investment horizon, and desired involvement level in property management.

Connection

Tax lien certificates and syndications are connected through collective investment strategies that allow multiple investors to pool resources for purchasing tax liens. Syndications enable investors to access diversified portfolios of tax lien certificates, reducing individual risk while maximizing returns from property tax defaults. This collaborative approach streamlines management and distribution of profits among stakeholders within the tax lien market.

Key Terms

Equity Ownership

Equity ownership in syndications involves acquiring a direct or indirect share in real estate assets, allowing investors to benefit from property appreciation and cash flow distributions, whereas tax lien certificates represent a secured claim on delinquent property taxes with potential interest earnings but no ownership rights. Syndications typically require higher capital contributions and offer long-term growth opportunities, while tax lien certificates provide a more fixed income approach with the risk of property foreclosure only if liens remain unpaid. Explore detailed comparisons to understand which investment aligns better with your financial goals and risk tolerance.

Property Lien

Property lien syndications pool investor resources to acquire bulk tax lien certificates, enhancing diversification and potential returns. Tax lien certificates represent a legal claim against properties with unpaid taxes, enabling investors to collect interest or foreclose on liens if debts remain unpaid. Explore the detailed nuances of property lien investment strategies to optimize portfolio growth and risk management.

Passive Income

Syndications and tax lien certificates offer distinct pathways for generating passive income, with syndications providing equity stakes in large real estate projects managed by experienced sponsors, while tax lien certificates involve purchasing liens on delinquent properties that yield interest or potential property acquisition. Syndications typically require higher capital but can deliver steady cash flow and long-term appreciation, whereas tax lien certificates allow for lower upfront investment and quick returns through interest payments or property acquisition at a discount. Explore these investment strategies to determine which aligns best with your passive income goals and risk tolerance.

Source and External Links

SYNDICATION | definition in the Cambridge English Dictionary - Syndication is the act of selling newspaper or magazine articles, photographs, television shows, etc., to other organizations so they can be published or broadcast in multiple places.

Loan Syndications | Live Oak Bank - Loan syndications involve a group of lenders collectively funding a single loan, sharing risk and providing greater flexibility and capital to businesses.

AN INTRODUCTION TO REAL ESTATE SYNDICATION - Real estate syndication pools money from multiple investors to invest in specific real estate opportunities, commonly structured as one-class or two-class equity arrangements.

dowidth.com

dowidth.com