Investing in collectibles offers the potential for unique asset appreciation driven by rarity and cultural value, contrasting with the stability and guaranteed returns typical of savings accounts backed by FDIC insurance. While savings accounts provide liquidity and predictable interest rates, collectibles require market knowledge and carry higher risk due to market volatility. Explore the pros and cons of collectibles investment versus traditional savings to make informed financial decisions.

Why it is important

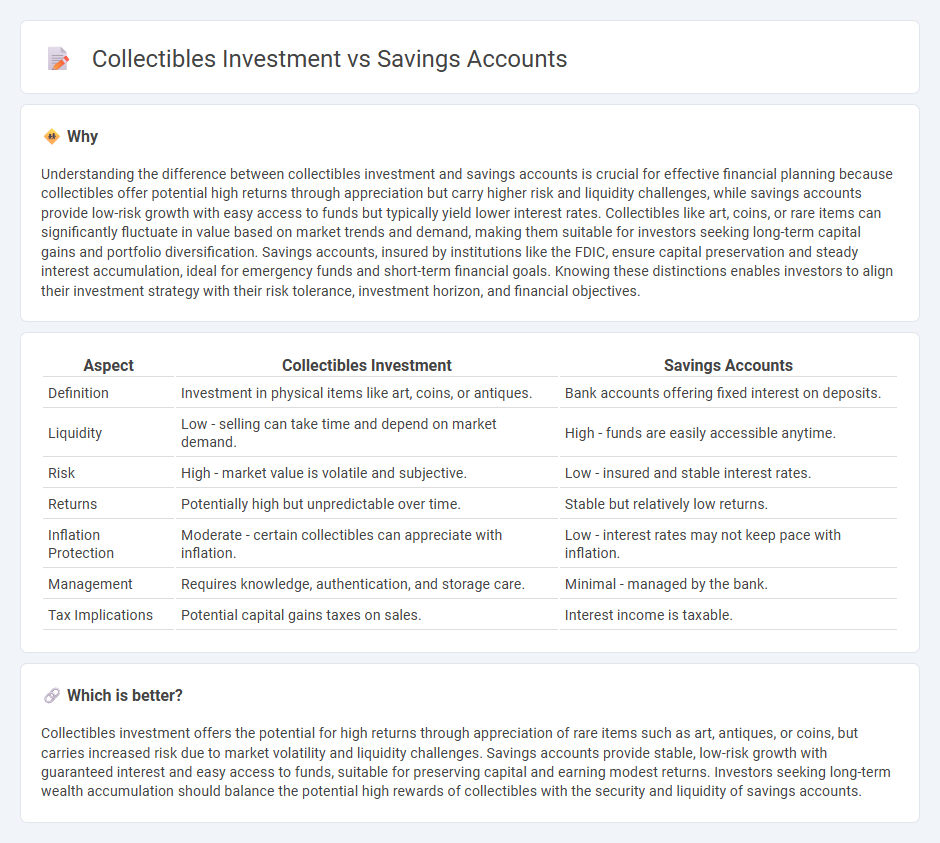

Understanding the difference between collectibles investment and savings accounts is crucial for effective financial planning because collectibles offer potential high returns through appreciation but carry higher risk and liquidity challenges, while savings accounts provide low-risk growth with easy access to funds but typically yield lower interest rates. Collectibles like art, coins, or rare items can significantly fluctuate in value based on market trends and demand, making them suitable for investors seeking long-term capital gains and portfolio diversification. Savings accounts, insured by institutions like the FDIC, ensure capital preservation and steady interest accumulation, ideal for emergency funds and short-term financial goals. Knowing these distinctions enables investors to align their investment strategy with their risk tolerance, investment horizon, and financial objectives.

Comparison Table

| Aspect | Collectibles Investment | Savings Accounts |

|---|---|---|

| Definition | Investment in physical items like art, coins, or antiques. | Bank accounts offering fixed interest on deposits. |

| Liquidity | Low - selling can take time and depend on market demand. | High - funds are easily accessible anytime. |

| Risk | High - market value is volatile and subjective. | Low - insured and stable interest rates. |

| Returns | Potentially high but unpredictable over time. | Stable but relatively low returns. |

| Inflation Protection | Moderate - certain collectibles can appreciate with inflation. | Low - interest rates may not keep pace with inflation. |

| Management | Requires knowledge, authentication, and storage care. | Minimal - managed by the bank. |

| Tax Implications | Potential capital gains taxes on sales. | Interest income is taxable. |

Which is better?

Collectibles investment offers the potential for high returns through appreciation of rare items such as art, antiques, or coins, but carries increased risk due to market volatility and liquidity challenges. Savings accounts provide stable, low-risk growth with guaranteed interest and easy access to funds, suitable for preserving capital and earning modest returns. Investors seeking long-term wealth accumulation should balance the potential high rewards of collectibles with the security and liquidity of savings accounts.

Connection

Collectibles investment offers potential for capital appreciation by acquiring rare items such as art, coins, or vintage cars, complementing traditional savings accounts that provide liquidity and lower risk. Incorporating collectibles into a diversified financial portfolio can enhance long-term wealth accumulation while savings accounts ensure stable access to funds and preserve capital. Balancing both strategies leverages the growth potential of tangible assets alongside the security and interest income from deposit accounts.

Key Terms

Liquidity

Savings accounts offer unmatched liquidity, allowing instant access to funds without penalties or delays, making them ideal for emergency cash needs. Collectibles investments, such as art, coins, or antiques, typically lack liquidity due to the niche market and time required to find buyers willing to pay fair value. Explore more about how liquidity impacts your investment strategy and financial flexibility.

Risk

Savings accounts offer low-risk investment with FDIC insurance protecting deposits up to $250,000, ensuring principal security and predictable interest earnings. Collectibles involve higher risk due to market volatility, lack of liquidity, and difficulty in accurate valuation, making them less stable compared to traditional savings vehicles. Explore further to understand how risk profiles differ between these investment options.

Return

Savings accounts offer a reliable annual percentage yield (APY) typically ranging from 0.01% to 2%, providing low-risk and liquid returns. Collectibles, such as rare coins and art, can yield unpredictable returns based on market demand and rarity, often exceeding traditional savings but with higher volatility and illiquidity. Discover more insights on balancing risk and returns between savings accounts and collectibles investments.

Source and External Links

6 Best Savings Accounts of July 2025: Up to 4.66% - NerdWallet - Lists top online savings accounts with high APY (up to 4.66%), no or low minimums, and FDIC insurance, including EverBank (4.30%), Ivy Bank (4.25%), and OMB Bank (4.56% with a $5,000 minimum).

Savings Accounts - View our best rates | Open online - U.S. Bank - Offers savings, money market, and CD options with relationship rates up to 3.50% APY, monthly fees, and varying minimum deposit requirements; APYs may differ by location.

Chase Savings Accounts: Compare & Apply Today - Provides interest-bearing savings with autosave features, online/mobile access, relationship rates for select accounts, and branch/ATM access; fees and rates vary by account type.

dowidth.com

dowidth.com