Royalty streams provide investors with a consistent income by receiving a percentage of revenue generated by a company's product or service, offering lower risk and steady cash flow compared to traditional equity investments. Private equity involves acquiring ownership stakes in private companies, aiming for high returns through value creation and exit strategies, but comes with higher risk and longer investment horizons. Explore the key differences between royalty streams and private equity to determine which investment aligns with your financial goals.

Why it is important

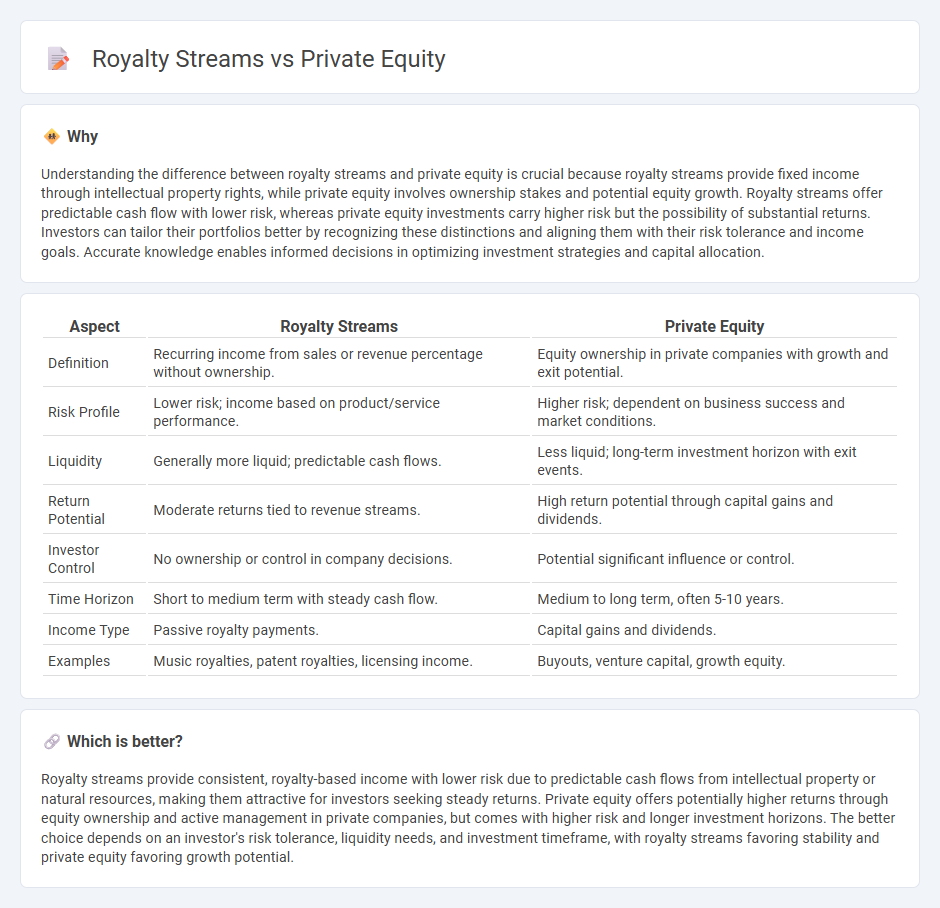

Understanding the difference between royalty streams and private equity is crucial because royalty streams provide fixed income through intellectual property rights, while private equity involves ownership stakes and potential equity growth. Royalty streams offer predictable cash flow with lower risk, whereas private equity investments carry higher risk but the possibility of substantial returns. Investors can tailor their portfolios better by recognizing these distinctions and aligning them with their risk tolerance and income goals. Accurate knowledge enables informed decisions in optimizing investment strategies and capital allocation.

Comparison Table

| Aspect | Royalty Streams | Private Equity |

|---|---|---|

| Definition | Recurring income from sales or revenue percentage without ownership. | Equity ownership in private companies with growth and exit potential. |

| Risk Profile | Lower risk; income based on product/service performance. | Higher risk; dependent on business success and market conditions. |

| Liquidity | Generally more liquid; predictable cash flows. | Less liquid; long-term investment horizon with exit events. |

| Return Potential | Moderate returns tied to revenue streams. | High return potential through capital gains and dividends. |

| Investor Control | No ownership or control in company decisions. | Potential significant influence or control. |

| Time Horizon | Short to medium term with steady cash flow. | Medium to long term, often 5-10 years. |

| Income Type | Passive royalty payments. | Capital gains and dividends. |

| Examples | Music royalties, patent royalties, licensing income. | Buyouts, venture capital, growth equity. |

Which is better?

Royalty streams provide consistent, royalty-based income with lower risk due to predictable cash flows from intellectual property or natural resources, making them attractive for investors seeking steady returns. Private equity offers potentially higher returns through equity ownership and active management in private companies, but comes with higher risk and longer investment horizons. The better choice depends on an investor's risk tolerance, liquidity needs, and investment timeframe, with royalty streams favoring stability and private equity favoring growth potential.

Connection

Royalty streams offer private equity firms a steady income source by acquiring rights to future revenue generated from intellectual property or natural resources. Private equity investments in royalty streams provide diversified cash flow and risk mitigation compared to traditional equity stakes. This connection enhances portfolio stability and long-term returns for private equity investors.

Key Terms

Equity Ownership

Private equity involves acquiring significant equity ownership, granting investors control and potential influence over a company's strategic decisions and profit distribution. In contrast, royalty streams provide investors with ongoing income based on sales or revenue without equity ownership or control rights. Explore the differences further to understand which investment aligns best with your financial goals.

Cash Flow Rights

Private equity investments provide ownership stakes with potential capital gains and cash flow rights through dividends, whereas royalty streams grant investors predictable, ongoing revenue based on a percentage of sales or production without equity ownership. Cash flow rights in private equity depend on the company's profitability and dividend policies, while royalty streams offer more stable and transparent income, often preferred for risk-averse investors. Explore further to understand which cash flow structure aligns best with your investment strategy.

Exit Strategy

Private equity investments typically target a lucrative exit strategy through a sale or initial public offering (IPO), maximizing returns within a defined timeframe. Royalty streams offer ongoing passive income without the pressure of a traditional exit, providing steady cash flow tied to revenue performance. Explore how these distinct exit strategies impact investment risk and return profiles for informed decision-making.

Source and External Links

Private equity - Wikipedia - Private equity involves investment firms raising capital from institutional investors to acquire equity stakes in companies--often using a mix of debt and equity--with the goal of improving operations and generating returns, typically over a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity provides medium to long-term capital to unquoted, potentially high-growth companies in exchange for an ownership stake, with funds sourced from institutional investors globally and a focus on delivering outperformance relative to public markets.

Private Equity Funds | Investor.gov - Private equity funds are pooled investment vehicles managed by private equity firms that take controlling or minority positions in companies, actively engaging in management to increase value, typically over a long-term horizon without the same disclosure requirements as public funds.

dowidth.com

dowidth.com