Wine funds offer investors an alternative asset class with potential for portfolio diversification and appreciation tied to rare vintage values, while Real Estate Investment Trusts (REITs) provide liquidity, regular income through dividends, and exposure to commercial or residential property markets. Both investment vehicles carry distinct risk profiles influenced by market demand, economic cycles, and regulatory frameworks. Discover the comparative benefits and risks of wine funds versus REITs to optimize your investment strategy.

Why it is important

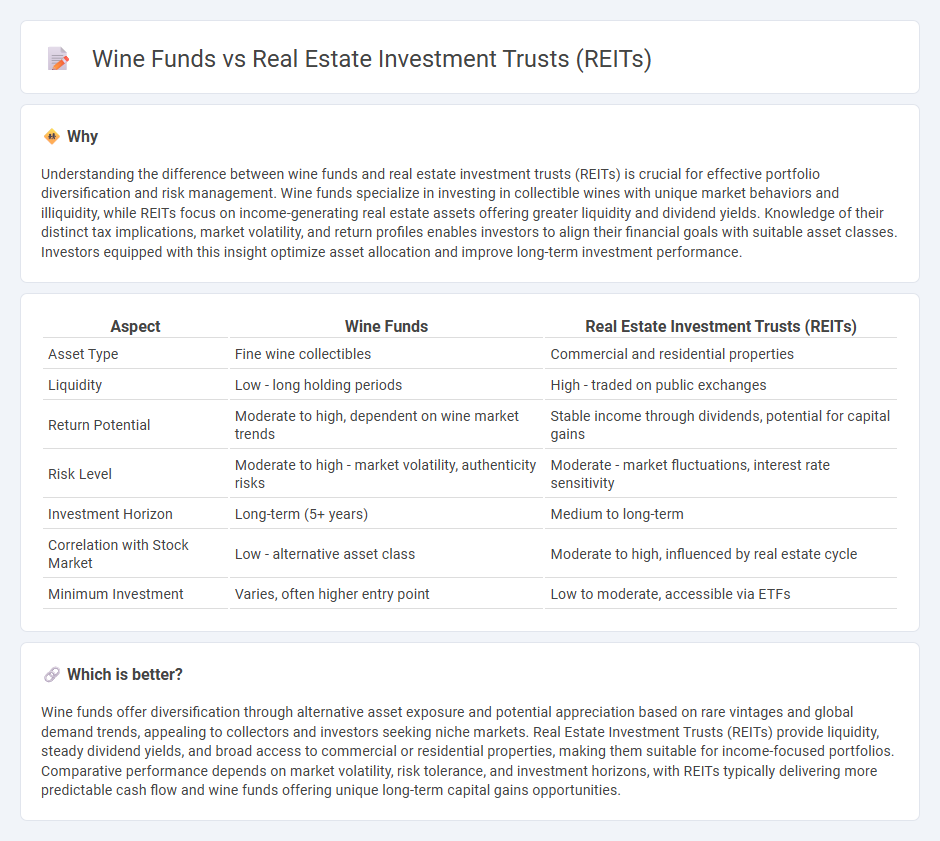

Understanding the difference between wine funds and real estate investment trusts (REITs) is crucial for effective portfolio diversification and risk management. Wine funds specialize in investing in collectible wines with unique market behaviors and illiquidity, while REITs focus on income-generating real estate assets offering greater liquidity and dividend yields. Knowledge of their distinct tax implications, market volatility, and return profiles enables investors to align their financial goals with suitable asset classes. Investors equipped with this insight optimize asset allocation and improve long-term investment performance.

Comparison Table

| Aspect | Wine Funds | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Asset Type | Fine wine collectibles | Commercial and residential properties |

| Liquidity | Low - long holding periods | High - traded on public exchanges |

| Return Potential | Moderate to high, dependent on wine market trends | Stable income through dividends, potential for capital gains |

| Risk Level | Moderate to high - market volatility, authenticity risks | Moderate - market fluctuations, interest rate sensitivity |

| Investment Horizon | Long-term (5+ years) | Medium to long-term |

| Correlation with Stock Market | Low - alternative asset class | Moderate to high, influenced by real estate cycle |

| Minimum Investment | Varies, often higher entry point | Low to moderate, accessible via ETFs |

Which is better?

Wine funds offer diversification through alternative asset exposure and potential appreciation based on rare vintages and global demand trends, appealing to collectors and investors seeking niche markets. Real Estate Investment Trusts (REITs) provide liquidity, steady dividend yields, and broad access to commercial or residential properties, making them suitable for income-focused portfolios. Comparative performance depends on market volatility, risk tolerance, and investment horizons, with REITs typically delivering more predictable cash flow and wine funds offering unique long-term capital gains opportunities.

Connection

Wine funds and Real Estate Investment Trusts (REITs) both offer alternative investment opportunities that diversify traditional portfolios by focusing on tangible assets. Wine funds invest in collectible wines aiming for capital appreciation, while REITs generate income through property ownership and management, providing liquidity and regular dividends. Both asset classes appeal to investors seeking to hedge against market volatility and inflation through physical asset-backed securities.

Key Terms

Liquidity

Real Estate Investment Trusts (REITs) offer higher liquidity compared to wine funds due to their public market listings, enabling investors to buy and sell shares with ease. Wine funds typically have longer lock-in periods and less frequent secondary markets, making them relatively illiquid investments. Explore detailed comparisons to understand the full impact of liquidity on your portfolio choices.

Asset Diversification

Real estate investment trusts (REITs) offer asset diversification by providing exposure to various property sectors such as commercial, residential, and industrial real estate, which can mitigate risk across different markets. Wine funds diversify portfolios by investing in a range of fine wines from multiple regions and vintages, offering an alternative tangible asset class less correlated with traditional financial markets. Explore the benefits and risks of each investment vehicle to determine which aligns best with your diversification strategy.

Regulatory Structure

Real estate investment trusts (REITs) operate under strict regulatory frameworks such as the Internal Revenue Code Sections 856-859, requiring them to distribute at least 90% of taxable income as dividends and comply with asset and income tests, ensuring transparency and investor protection. Wine funds, by contrast, face less standardized regulatory oversight, often categorized under alternative investments with regulations varying by jurisdiction and typically subject to fewer disclosure requirements. Explore the regulatory nuances and risks involved in REITs and wine funds to make informed investment decisions.

Source and External Links

Real estate investment trust - A REIT is a company that owns and often operates income-producing real estate, including commercial and residential properties, and is structured to provide tax advantages by paying most income as dividends to shareholders.

What's a REIT (Real Estate Investment Trust)? - REITs are companies that own, operate, or finance income-producing real estate and typically trade on major stock exchanges, offering investors regular income, diversification, and capital appreciation.

Real Estate Investment Trusts (REITs) - REITs allow individuals to invest in large-scale commercial real estate by owning shares in companies that operate income-producing properties without developing them for resale; they can be publicly traded or non-traded under SEC registration.

dowidth.com

dowidth.com