Royalty streaming provides investors with ongoing revenue by purchasing rights to a percentage of future sales, often in industries like mining and entertainment. Lease financing allows businesses to acquire assets through scheduled payments while preserving capital and enabling asset use without ownership transfer. Explore the detailed benefits and risks of each investment strategy to determine the best fit for your portfolio.

Why it is important

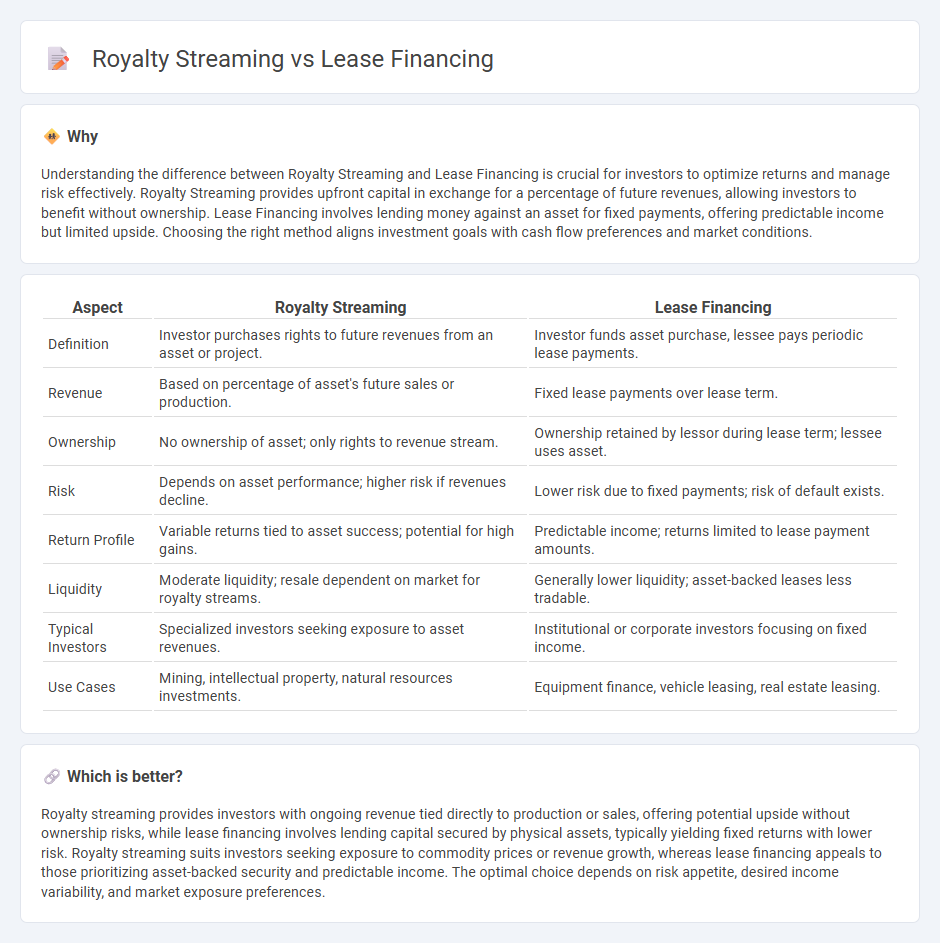

Understanding the difference between Royalty Streaming and Lease Financing is crucial for investors to optimize returns and manage risk effectively. Royalty Streaming provides upfront capital in exchange for a percentage of future revenues, allowing investors to benefit without ownership. Lease Financing involves lending money against an asset for fixed payments, offering predictable income but limited upside. Choosing the right method aligns investment goals with cash flow preferences and market conditions.

Comparison Table

| Aspect | Royalty Streaming | Lease Financing |

|---|---|---|

| Definition | Investor purchases rights to future revenues from an asset or project. | Investor funds asset purchase, lessee pays periodic lease payments. |

| Revenue | Based on percentage of asset's future sales or production. | Fixed lease payments over lease term. |

| Ownership | No ownership of asset; only rights to revenue stream. | Ownership retained by lessor during lease term; lessee uses asset. |

| Risk | Depends on asset performance; higher risk if revenues decline. | Lower risk due to fixed payments; risk of default exists. |

| Return Profile | Variable returns tied to asset success; potential for high gains. | Predictable income; returns limited to lease payment amounts. |

| Liquidity | Moderate liquidity; resale dependent on market for royalty streams. | Generally lower liquidity; asset-backed leases less tradable. |

| Typical Investors | Specialized investors seeking exposure to asset revenues. | Institutional or corporate investors focusing on fixed income. |

| Use Cases | Mining, intellectual property, natural resources investments. | Equipment finance, vehicle leasing, real estate leasing. |

Which is better?

Royalty streaming provides investors with ongoing revenue tied directly to production or sales, offering potential upside without ownership risks, while lease financing involves lending capital secured by physical assets, typically yielding fixed returns with lower risk. Royalty streaming suits investors seeking exposure to commodity prices or revenue growth, whereas lease financing appeals to those prioritizing asset-backed security and predictable income. The optimal choice depends on risk appetite, desired income variability, and market exposure preferences.

Connection

Royalty streaming and lease financing both provide alternative investment models allowing investors to gain exposure to revenue-generating assets without ownership risk. Royalty streaming involves purchasing rights to future revenue streams from assets like natural resources or intellectual property, while lease financing generates income through asset leasing agreements. Both methods prioritize cash flow stability and asset-backed returns, attracting investors seeking diversification beyond traditional equity or debt investments.

Key Terms

Asset ownership

Lease financing provides lessees with operational control of assets without transferring ownership, while royalty streaming involves investors purchasing rights to revenue generated from those assets without holding title to the physical property. Lease financing typically requires asset maintenance responsibilities to remain with the owner, whereas royalty streaming focuses on financial returns linked directly to asset performance. Discover more about how these financing methods impact asset ownership and investment strategy.

Payment structure

Lease financing involves fixed, scheduled payments over a predetermined period, providing predictable cash flow for asset use. Royalty streaming payments fluctuate based on revenue or production volumes, aligning investor returns with asset performance. Explore the detailed benefits of each payment structure to determine the best financial strategy for your investment goals.

Duration of agreement

Lease financing agreements typically span shorter durations, often ranging from three to ten years, providing flexibility and periodic renegotiation opportunities for asset utilization. Royalty streaming contracts, in contrast, usually extend over longer terms, sometimes matching the life of the underlying asset or production, ensuring sustained revenue participation throughout. Explore a deeper comparison of lease financing and royalty streaming durations to tailor your investment strategy.

Source and External Links

Lease Financing : Meaning, Advantages and Disadvantages - Lease financing is a medium to long-term financing where an asset owner (lessor) grants another party (lessee) the right to use the asset in exchange for periodic payments, with ownership retained by the lessor or possibly transferred after the lease period ends.

Finance lease - Wikipedia - A finance lease (or capital lease) involves a finance company owning an asset while the lessee uses it, pays installments, and typically assumes most economic risks and rewards, often with the option to own the asset at lease end.

Lease financing: What is it? | Credibly - Lease financing allows businesses to use assets without purchase, spreading cost over time and retaining ownership control without equity dilution.

dowidth.com

dowidth.com