Wine investing platforms offer a unique alternative to traditional stock trading apps by allowing investors to diversify portfolios with tangible assets like fine wines, which historically appreciate over time due to rarity and demand. Unlike volatile stock markets, wine investments benefit from stability and cultural value, providing a hedge against economic downturns and inflation. Explore the differences between these investment options to determine which aligns best with your financial goals and risk tolerance.

Why it is important

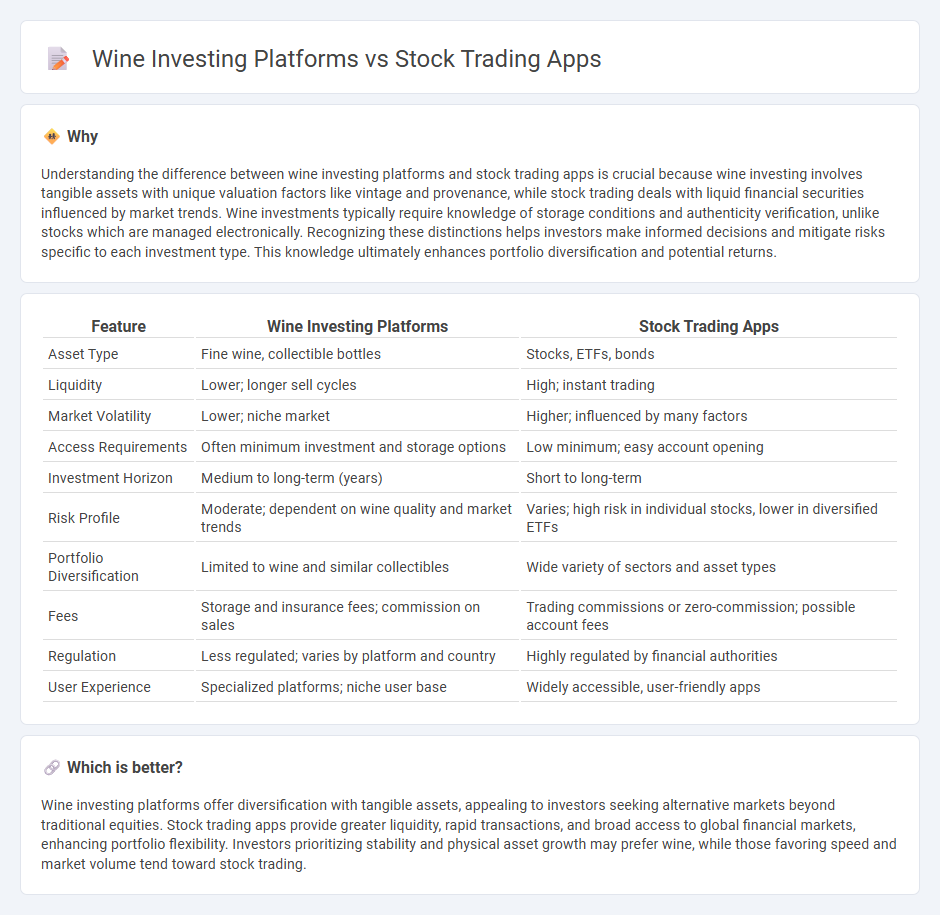

Understanding the difference between wine investing platforms and stock trading apps is crucial because wine investing involves tangible assets with unique valuation factors like vintage and provenance, while stock trading deals with liquid financial securities influenced by market trends. Wine investments typically require knowledge of storage conditions and authenticity verification, unlike stocks which are managed electronically. Recognizing these distinctions helps investors make informed decisions and mitigate risks specific to each investment type. This knowledge ultimately enhances portfolio diversification and potential returns.

Comparison Table

| Feature | Wine Investing Platforms | Stock Trading Apps |

|---|---|---|

| Asset Type | Fine wine, collectible bottles | Stocks, ETFs, bonds |

| Liquidity | Lower; longer sell cycles | High; instant trading |

| Market Volatility | Lower; niche market | Higher; influenced by many factors |

| Access Requirements | Often minimum investment and storage options | Low minimum; easy account opening |

| Investment Horizon | Medium to long-term (years) | Short to long-term |

| Risk Profile | Moderate; dependent on wine quality and market trends | Varies; high risk in individual stocks, lower in diversified ETFs |

| Portfolio Diversification | Limited to wine and similar collectibles | Wide variety of sectors and asset types |

| Fees | Storage and insurance fees; commission on sales | Trading commissions or zero-commission; possible account fees |

| Regulation | Less regulated; varies by platform and country | Highly regulated by financial authorities |

| User Experience | Specialized platforms; niche user base | Widely accessible, user-friendly apps |

Which is better?

Wine investing platforms offer diversification with tangible assets, appealing to investors seeking alternative markets beyond traditional equities. Stock trading apps provide greater liquidity, rapid transactions, and broad access to global financial markets, enhancing portfolio flexibility. Investors prioritizing stability and physical asset growth may prefer wine, while those favoring speed and market volume tend toward stock trading.

Connection

Wine investing platforms and stock trading apps are connected through their use of digital technology to facilitate asset ownership and trading, providing users with seamless access to alternative investments and traditional securities alike. Both platforms leverage real-time market data, secure transactions, and portfolio management tools, enabling investors to diversify holdings and optimize returns. The integration of blockchain and AI algorithms enhances transparency and decision-making efficiency across these investment channels.

Key Terms

**Stock trading apps:**

Stock trading apps provide real-time market data, advanced charting tools, and seamless order execution, catering to both novice and experienced investors. Features like algorithmic trading, portfolio diversification options, and integration with financial news sources enhance decision-making and risk management. Explore the top stock trading apps to maximize your investment potential and stay ahead in the financial markets.

Order Execution

Order execution speed is critical in stock trading apps, often influenced by advanced algorithms and real-time data feeds to capitalize on market volatility. Wine investing platforms emphasize authentication and provenance verification alongside timely transactions, reflecting the niche market's unique requirements. Explore how these platforms optimize order execution to better understand their operational strengths and investment benefits.

Real-Time Quotes

Stock trading apps provide investors with real-time quotes, enabling rapid decision-making based on live market data for equities, options, and ETFs. Wine investing platforms, however, often update market values less frequently, relying on auction results and expert appraisals rather than instantaneous pricing. Explore the distinct advantages of each platform to optimize your investment strategy today.

Source and External Links

Best Stock Trading Apps | 2025 Investing Guide - Business Insider - Compares top stock trading apps like E*TRADE for free trading, Webull for advanced options trading, and highlights pros and cons for each platform.

Stock Trading App for Mobile - Charles Schwab - Offers a fully featured mobile app for trading stocks, ETFs, options, and mutual funds, with robust security, real-time data, and smartwatch integration.

19 Best Apps for Investing - App Store - Curates leading investment apps including Public, Robinhood, Fidelity, Webull, E*TRADE, and Vanguard for stocks, crypto, options, and wealth management.

dowidth.com

dowidth.com