Vintage sneaker portfolios offer unique asset diversification by capitalizing on limited-edition releases and cultural trends, often yielding high returns due to scarcity and collector demand. Blue-chip stock portfolios provide stability and consistent growth through investments in well-established companies with strong market reputations and reliable dividends. Explore detailed comparisons to understand which investment strategy aligns with your financial goals.

Why it is important

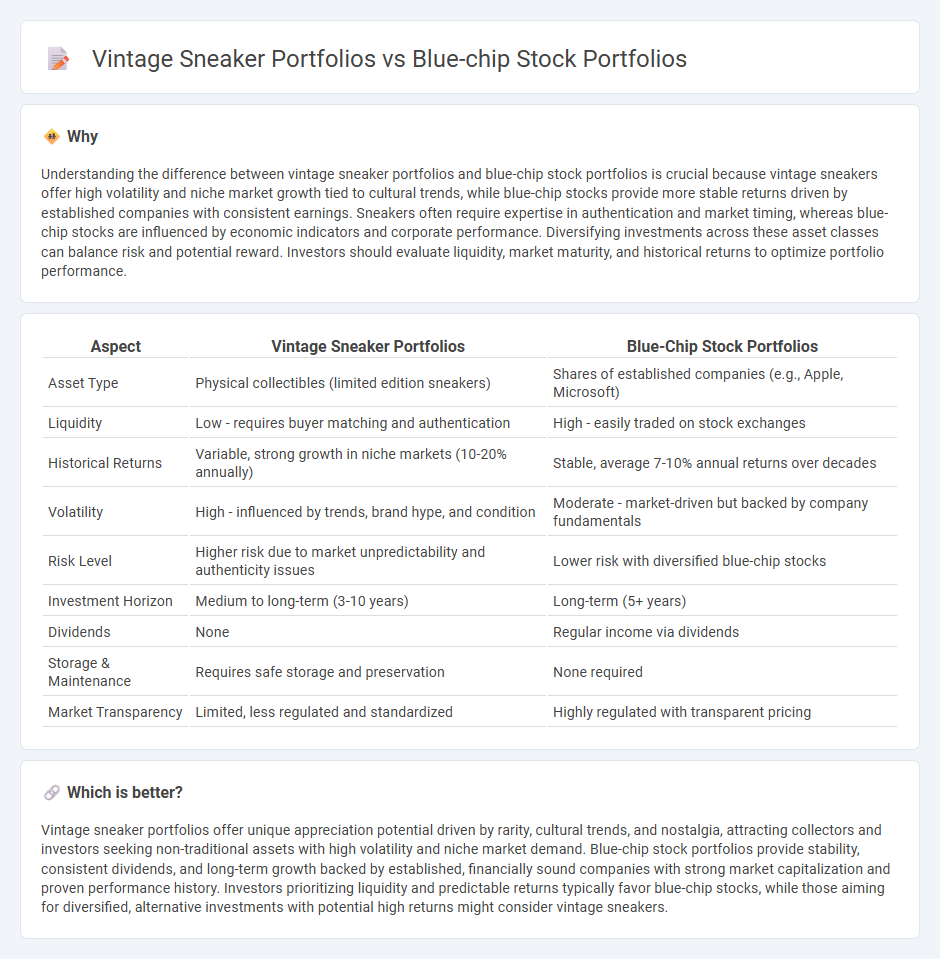

Understanding the difference between vintage sneaker portfolios and blue-chip stock portfolios is crucial because vintage sneakers offer high volatility and niche market growth tied to cultural trends, while blue-chip stocks provide more stable returns driven by established companies with consistent earnings. Sneakers often require expertise in authentication and market timing, whereas blue-chip stocks are influenced by economic indicators and corporate performance. Diversifying investments across these asset classes can balance risk and potential reward. Investors should evaluate liquidity, market maturity, and historical returns to optimize portfolio performance.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Blue-Chip Stock Portfolios |

|---|---|---|

| Asset Type | Physical collectibles (limited edition sneakers) | Shares of established companies (e.g., Apple, Microsoft) |

| Liquidity | Low - requires buyer matching and authentication | High - easily traded on stock exchanges |

| Historical Returns | Variable, strong growth in niche markets (10-20% annually) | Stable, average 7-10% annual returns over decades |

| Volatility | High - influenced by trends, brand hype, and condition | Moderate - market-driven but backed by company fundamentals |

| Risk Level | Higher risk due to market unpredictability and authenticity issues | Lower risk with diversified blue-chip stocks |

| Investment Horizon | Medium to long-term (3-10 years) | Long-term (5+ years) |

| Dividends | None | Regular income via dividends |

| Storage & Maintenance | Requires safe storage and preservation | None required |

| Market Transparency | Limited, less regulated and standardized | Highly regulated with transparent pricing |

Which is better?

Vintage sneaker portfolios offer unique appreciation potential driven by rarity, cultural trends, and nostalgia, attracting collectors and investors seeking non-traditional assets with high volatility and niche market demand. Blue-chip stock portfolios provide stability, consistent dividends, and long-term growth backed by established, financially sound companies with strong market capitalization and proven performance history. Investors prioritizing liquidity and predictable returns typically favor blue-chip stocks, while those aiming for diversified, alternative investments with potential high returns might consider vintage sneakers.

Connection

Vintage sneaker portfolios and blue-chip stock portfolios both serve as alternative investment vehicles that capitalize on market trends and cultural value appreciation. While blue-chip stocks offer stability and dividends from established corporations like Apple and Microsoft, vintage sneakers provide high liquidity through resale markets driven by limited releases and influencer demand. Diversifying with these assets allows investors to balance traditional financial growth with high-potential, niche collectibles exhibiting strong historical appreciation rates.

Key Terms

Diversification

Blue-chip stock portfolios consist of shares from established companies with stable earnings and strong market positions, providing long-term financial security and moderate risk. Vintage sneaker portfolios involve investing in rare, collectible footwear that can yield significant returns but with higher market volatility and liquidity challenges. Explore detailed strategies to balance diversification between traditional equities and alternative assets for optimized investment outcomes.

Liquidity

Blue-chip stock portfolios exhibit high liquidity, allowing investors to quickly buy or sell shares in established companies such as Apple, Microsoft, or Johnson & Johnson, facilitating efficient capital allocation and risk management. Vintage sneaker portfolios, in contrast, often lack comparable liquidity due to niche demand and limited availability of rare models like the Air Jordan 1 or Yeezy Boost, resulting in longer transaction times and potentially higher transaction costs. Explore detailed strategies to balance liquidity and returns in diverse investment portfolios.

Valuation

Blue-chip stock portfolios attract investors with stable earnings, strong dividends, and established market value, offering reliable long-term valuations based on financial fundamentals. Vintage sneaker portfolios derive value from rarity, brand heritage, and cultural relevance, leading to highly variable and subjective appraisal methods. Explore detailed comparisons to understand the valuation dynamics in both asset classes.

Source and External Links

10 Best Blue-Chip Stocks to Buy for the Long Term - Morningstar - Provides a list of top blue-chip stocks with strong fundamentals and growth potential, including companies like Bristol-Myers Squibb and Amazon, highlighting their market capitalization, valuation, and dividend yields.

7 Best-Performing Blue-Chip Stocks for July 2025 - NerdWallet - Explains that blue-chip stocks are large, well-established companies with strong financials, typically part of major indexes like the S&P 500, and often pay dividends, making them reliable long-term investment options.

Best Blue Chip Stocks: 21 Hedge Fund Top Picks - Kiplinger - Discusses how hedge funds favor large, liquid blue-chip stocks, especially from indexes like the Dow Jones, for their stability and institutional investment appeal during volatile market periods.

dowidth.com

dowidth.com