Fractionalized art investment allows individuals to own shares of high-value artworks, enabling portfolio diversification with lower capital commitment compared to traditional investments. Venture capital focuses on funding startups and emerging companies, targeting high growth potential but carrying higher risk and longer investment horizons. Explore the distinct advantages and risks of each approach to optimize your investment strategy.

Why it is important

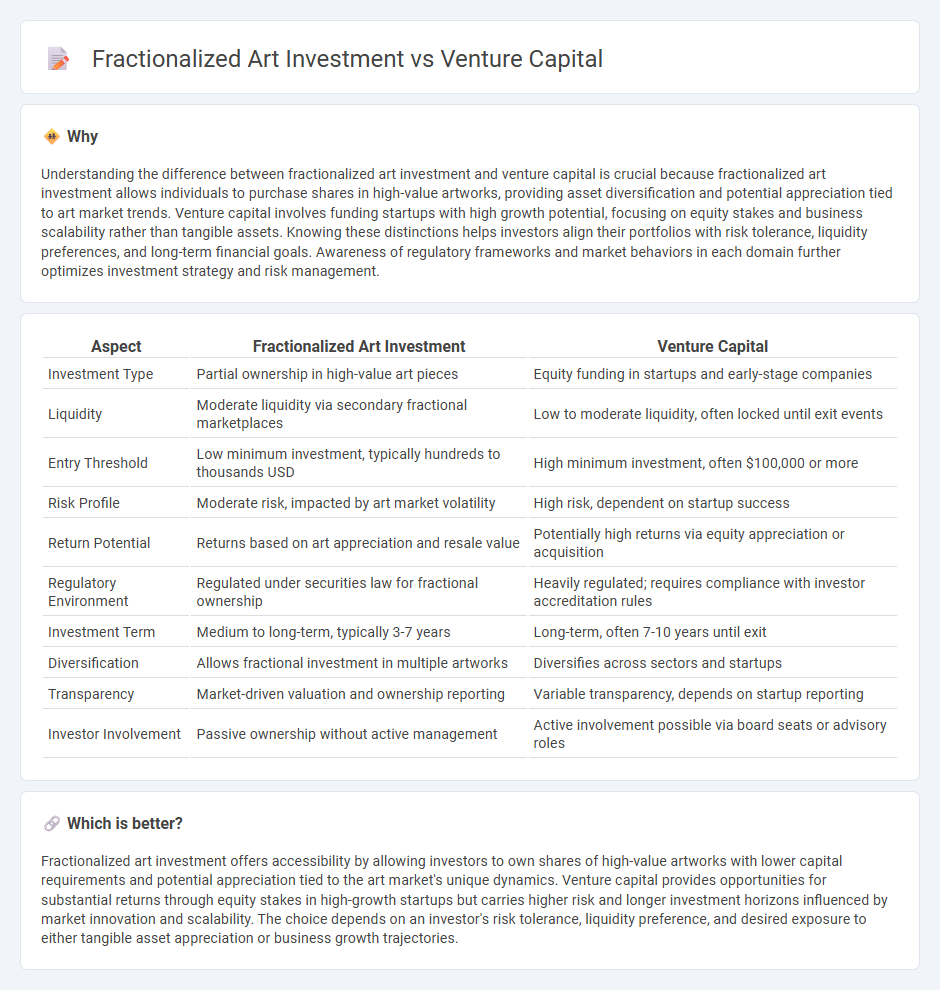

Understanding the difference between fractionalized art investment and venture capital is crucial because fractionalized art investment allows individuals to purchase shares in high-value artworks, providing asset diversification and potential appreciation tied to art market trends. Venture capital involves funding startups with high growth potential, focusing on equity stakes and business scalability rather than tangible assets. Knowing these distinctions helps investors align their portfolios with risk tolerance, liquidity preferences, and long-term financial goals. Awareness of regulatory frameworks and market behaviors in each domain further optimizes investment strategy and risk management.

Comparison Table

| Aspect | Fractionalized Art Investment | Venture Capital |

|---|---|---|

| Investment Type | Partial ownership in high-value art pieces | Equity funding in startups and early-stage companies |

| Liquidity | Moderate liquidity via secondary fractional marketplaces | Low to moderate liquidity, often locked until exit events |

| Entry Threshold | Low minimum investment, typically hundreds to thousands USD | High minimum investment, often $100,000 or more |

| Risk Profile | Moderate risk, impacted by art market volatility | High risk, dependent on startup success |

| Return Potential | Returns based on art appreciation and resale value | Potentially high returns via equity appreciation or acquisition |

| Regulatory Environment | Regulated under securities law for fractional ownership | Heavily regulated; requires compliance with investor accreditation rules |

| Investment Term | Medium to long-term, typically 3-7 years | Long-term, often 7-10 years until exit |

| Diversification | Allows fractional investment in multiple artworks | Diversifies across sectors and startups |

| Transparency | Market-driven valuation and ownership reporting | Variable transparency, depends on startup reporting |

| Investor Involvement | Passive ownership without active management | Active involvement possible via board seats or advisory roles |

Which is better?

Fractionalized art investment offers accessibility by allowing investors to own shares of high-value artworks with lower capital requirements and potential appreciation tied to the art market's unique dynamics. Venture capital provides opportunities for substantial returns through equity stakes in high-growth startups but carries higher risk and longer investment horizons influenced by market innovation and scalability. The choice depends on an investor's risk tolerance, liquidity preference, and desired exposure to either tangible asset appreciation or business growth trajectories.

Connection

Fractionalized art investment and venture capital both democratize access to high-value assets by allowing multiple investors to own diversified shares, thereby reducing individual risk and increasing liquidity. This convergence leverages blockchain technology and tokenization, enabling seamless secondary market trading and transparent ownership verification. As a result, both investment strategies attract a broader investor base while fostering innovation through capital allocation in creative industries and startups.

Key Terms

Venture capital:

Venture capital involves investing substantial funds into high-growth startups in exchange for equity, targeting technology, healthcare, and fintech sectors with potential for significant returns. This type of investment carries higher risk but offers active portfolio management, access to networking opportunities, and strategic guidance from experienced investors. Explore how venture capital can diversify your investment portfolio and accelerate innovation by learning more about its dynamics and benefits.

Equity stake

Venture capital involves acquiring significant equity stakes in startups or emerging companies, often leading to substantial ownership and decision-making power. Fractionalized art investment breaks down the ownership of high-value artworks into smaller, tradable shares, enabling investors to hold partial equity without full asset control. Explore more to understand how equity stakes vary between these innovative investment models.

Startup valuation

Startup valuation in venture capital hinges on projected growth, market potential, and equity stakes, often requiring substantial capital and diluting ownership. Fractionalized art investment allows multiple investors to own shares of high-value art assets, offering diversified portfolios with less correlation to traditional market risks and potentially lower entry costs. Explore how these distinct valuation models impact investment strategies and risk management.

Source and External Links

What is Venture Capital? - Venture capital invests in innovative startups and high-growth companies by providing risk capital, strategic guidance, and connecting entrepreneurs with resources to build successful businesses over time.

Fund your business | U.S. Small Business Administration - Venture capital offers funding to high-growth companies in exchange for equity and often active involvement in company decisions, differing from loans by focusing on long-term growth and higher risk.

What is venture capital? - Silicon Valley Bank - Venture capital is private equity that supports early-stage startups with rapid growth potential by providing capital, expertise, and management support in exchange for ownership stakes.

dowidth.com

dowidth.com