Wine investing offers the potential for long-term value appreciation through the acquisition of rare and collectible vintages that improve with age and limited supply. Comic book investing capitalizes on the rarity and cultural significance of vintage issues, with values driven by condition, demand, and iconic characters. Explore the unique factors and market dynamics behind these distinctive investment opportunities to determine which aligns best with your portfolio goals.

Why it is important

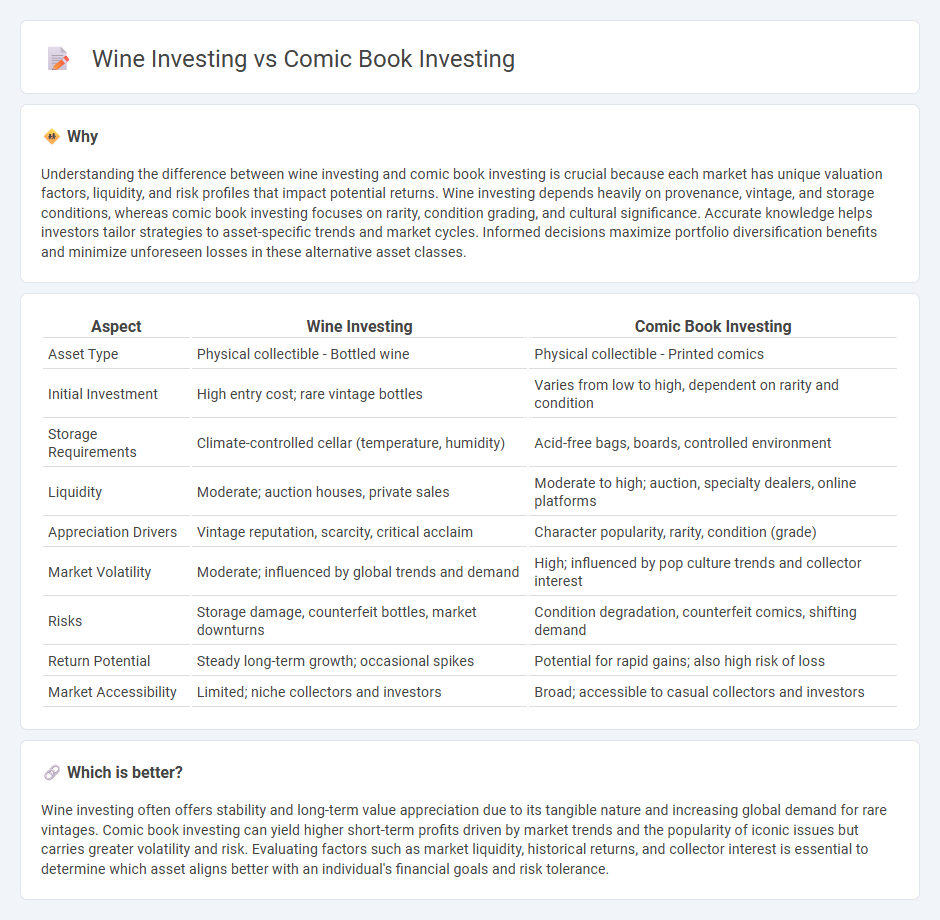

Understanding the difference between wine investing and comic book investing is crucial because each market has unique valuation factors, liquidity, and risk profiles that impact potential returns. Wine investing depends heavily on provenance, vintage, and storage conditions, whereas comic book investing focuses on rarity, condition grading, and cultural significance. Accurate knowledge helps investors tailor strategies to asset-specific trends and market cycles. Informed decisions maximize portfolio diversification benefits and minimize unforeseen losses in these alternative asset classes.

Comparison Table

| Aspect | Wine Investing | Comic Book Investing |

|---|---|---|

| Asset Type | Physical collectible - Bottled wine | Physical collectible - Printed comics |

| Initial Investment | High entry cost; rare vintage bottles | Varies from low to high, dependent on rarity and condition |

| Storage Requirements | Climate-controlled cellar (temperature, humidity) | Acid-free bags, boards, controlled environment |

| Liquidity | Moderate; auction houses, private sales | Moderate to high; auction, specialty dealers, online platforms |

| Appreciation Drivers | Vintage reputation, scarcity, critical acclaim | Character popularity, rarity, condition (grade) |

| Market Volatility | Moderate; influenced by global trends and demand | High; influenced by pop culture trends and collector interest |

| Risks | Storage damage, counterfeit bottles, market downturns | Condition degradation, counterfeit comics, shifting demand |

| Return Potential | Steady long-term growth; occasional spikes | Potential for rapid gains; also high risk of loss |

| Market Accessibility | Limited; niche collectors and investors | Broad; accessible to casual collectors and investors |

Which is better?

Wine investing often offers stability and long-term value appreciation due to its tangible nature and increasing global demand for rare vintages. Comic book investing can yield higher short-term profits driven by market trends and the popularity of iconic issues but carries greater volatility and risk. Evaluating factors such as market liquidity, historical returns, and collector interest is essential to determine which asset aligns better with an individual's financial goals and risk tolerance.

Connection

Wine investing and comic book investing both thrive on rarity and cultural significance, where limited editions and vintage appeal drive value appreciation. Collectors rely on provenance and condition, with specialized markets offering liquidity through auctions and private sales. These asset classes benefit from passionate communities that sustain demand and create long-term investment potential.

Key Terms

**Comic book investing:**

Comic book investing offers unique opportunities through limited-edition issues, first appearances of iconic characters, and graded condition rarity, often resulting in significant appreciation over time. The market for vintage comics like Action Comics #1 or Amazing Fantasy #15 remains robust, driven by collectors and pop culture demand. Explore how to maximize returns with strategic comic book investments by learning more about valuation, trends, and preservation techniques.

Grading

Comic book investing relies heavily on grading systems such as the CGC scale, which assesses condition factors like centering, color, and wear to determine a comic's value, often resulting in significant price differences between grades. Wine investing depends on vintage, provenance, and condition, with expert grading and certifications verifying authenticity and quality, directly influencing the market price and collectibility. Explore the detailed grading criteria and market impact to better understand which investment aligns with your collecting goals.

Key Issues

Comic book investing involves assessing rarity, condition grading, and market trends driven by pop culture and film adaptations, while wine investing centers on provenance, vintage quality, and storage conditions essential for appreciation. Both require specialized knowledge, but comic books offer quicker liquidity compared to the long-term maturation required in fine wine assets. Explore deeper insights into valuation methods and risk management to enhance your investment strategy.

Source and External Links

I buy comics as an investment... - CGC Chat Boards - Comic book investing carries significant long-term risk, especially as current core buyer demographics age, but can be profitable with skill in selecting and timing sales of key issues.

CBSI Comics | Comic Book Speculation and Investing - This resource highlights potentially undervalued comics for investment and offers guides on key issues and current market trends to help investors make informed choices.

COMICSHEATINGUP - Informed Comic Book Speculation and Pop ... - A weekly updated site that picks comic books with the best potential for market appreciation, aided by data on hot sales and trends from marketplaces like eBay.

dowidth.com

dowidth.com