Sports memorabilia trading offers tangible assets with potential for emotional and historical value appreciation, appealing to collectors and niche investors. Stock market investing provides liquidity, diversification, and potential for long-term wealth growth through equities and bonds. Explore the unique advantages and risks of both investment methods to make informed financial decisions.

Why it is important

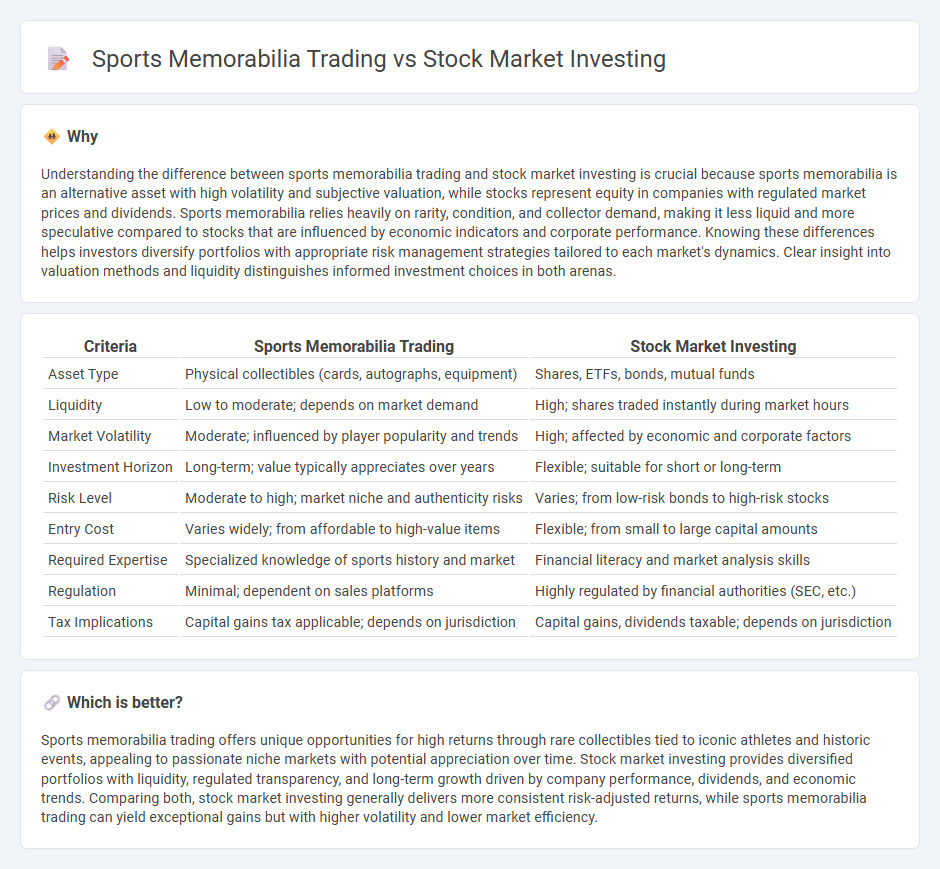

Understanding the difference between sports memorabilia trading and stock market investing is crucial because sports memorabilia is an alternative asset with high volatility and subjective valuation, while stocks represent equity in companies with regulated market prices and dividends. Sports memorabilia relies heavily on rarity, condition, and collector demand, making it less liquid and more speculative compared to stocks that are influenced by economic indicators and corporate performance. Knowing these differences helps investors diversify portfolios with appropriate risk management strategies tailored to each market's dynamics. Clear insight into valuation methods and liquidity distinguishes informed investment choices in both arenas.

Comparison Table

| Criteria | Sports Memorabilia Trading | Stock Market Investing |

|---|---|---|

| Asset Type | Physical collectibles (cards, autographs, equipment) | Shares, ETFs, bonds, mutual funds |

| Liquidity | Low to moderate; depends on market demand | High; shares traded instantly during market hours |

| Market Volatility | Moderate; influenced by player popularity and trends | High; affected by economic and corporate factors |

| Investment Horizon | Long-term; value typically appreciates over years | Flexible; suitable for short or long-term |

| Risk Level | Moderate to high; market niche and authenticity risks | Varies; from low-risk bonds to high-risk stocks |

| Entry Cost | Varies widely; from affordable to high-value items | Flexible; from small to large capital amounts |

| Required Expertise | Specialized knowledge of sports history and market | Financial literacy and market analysis skills |

| Regulation | Minimal; dependent on sales platforms | Highly regulated by financial authorities (SEC, etc.) |

| Tax Implications | Capital gains tax applicable; depends on jurisdiction | Capital gains, dividends taxable; depends on jurisdiction |

Which is better?

Sports memorabilia trading offers unique opportunities for high returns through rare collectibles tied to iconic athletes and historic events, appealing to passionate niche markets with potential appreciation over time. Stock market investing provides diversified portfolios with liquidity, regulated transparency, and long-term growth driven by company performance, dividends, and economic trends. Comparing both, stock market investing generally delivers more consistent risk-adjusted returns, while sports memorabilia trading can yield exceptional gains but with higher volatility and lower market efficiency.

Connection

Sports memorabilia trading and stock market investing both involve asset valuation, market demand fluctuations, and risk management strategies. Investors analyze historical trends and collector interest to determine the potential appreciation of memorabilia, similar to evaluating company performance and market conditions in stock investments. Both markets require thorough research, timing, and understanding of market psychology to maximize returns and minimize losses.

Key Terms

**Stock market investing:**

Stock market investing offers diversified opportunities to build wealth through equities, bonds, and ETFs, with historic average returns around 7-10% annually adjusted for inflation. It benefits from liquidity, regulatory oversight, and extensive market data facilitating informed decision-making and risk management. Explore comprehensive strategies and market insights to maximize your investment potential.

Diversification

Stock market investing offers diversification through exposure to various sectors, industries, and asset classes, reducing risk by spreading investments across multiple stocks, bonds, and ETFs. Sports memorabilia trading, while potentially profitable, typically involves concentrated risk due to its niche market and limited liquidity. Explore in-depth strategies to balance risk and growth by understanding diversification in both investment avenues.

Dividend

Stock market investing offers dividend income, providing consistent cash flow from company profits distributed to shareholders, while sports memorabilia trading relies mostly on capital appreciation with less predictable or no dividends. Dividends contribute to portfolio stability and can be reinvested to compound returns over time, making stocks attractive for income-focused investors. Explore how dividend strategies impact long-term wealth growth in various asset classes.

Source and External Links

Stocks | Investor.gov - Stocks are securities giving ownership in a company, and can be bought through direct stock plans, dividend reinvestment plans, brokers, or stock funds, each with their own mechanisms and fees.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - Investing in stocks involves opening an online brokerage account, funding it, and selecting stocks or stock-based funds, with options available even for small budgets including fractional shares and ETFs.

The Basics of Investing In Stocks - Stocks represent ownership shares in a company, and you can buy them directly from companies, by reinvesting dividends, through brokers, or by purchasing stock funds.

dowidth.com

dowidth.com