Vintage luxury handbags funds capitalize on the growing demand for iconic designer pieces from brands such as Hermes and Chanel, offering investors potential high returns through rare and limited-edition items. Rare watch funds focus on timepieces from prestigious manufacturers like Rolex and Patek Philippe, leveraging scarcity and brand heritage to drive value appreciation. Explore the distinctive advantages and risks of these niche investment avenues to determine which aligns with your portfolio goals.

Why it is important

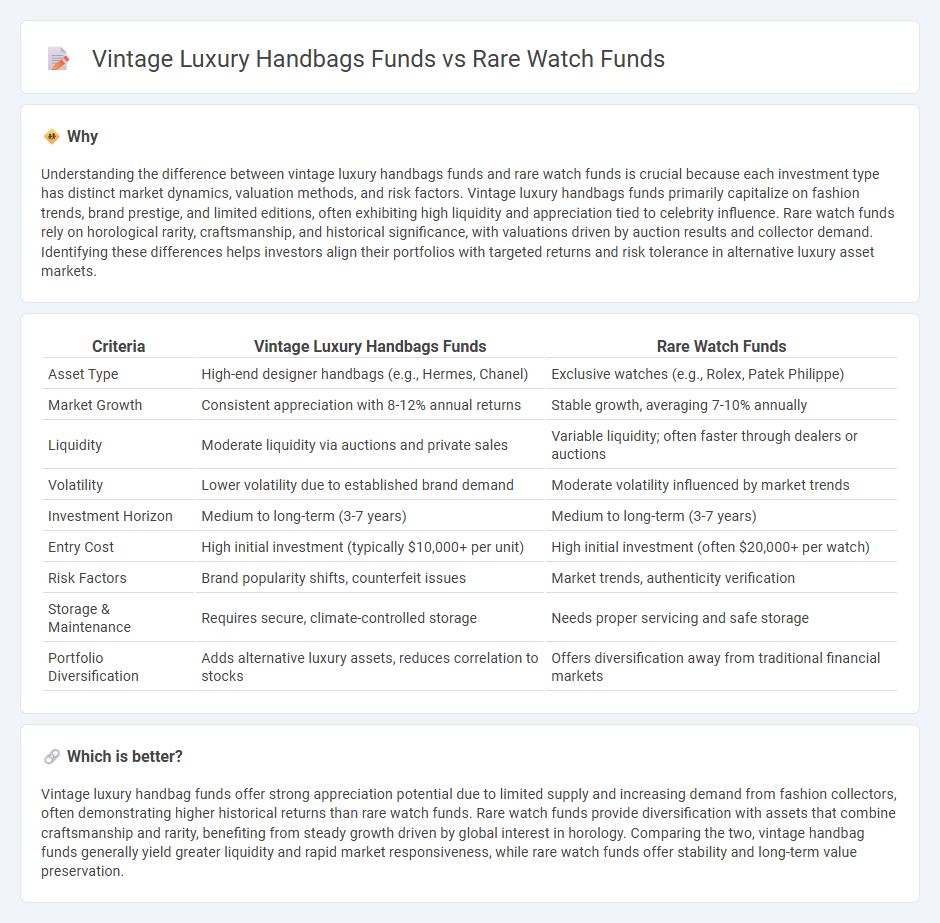

Understanding the difference between vintage luxury handbags funds and rare watch funds is crucial because each investment type has distinct market dynamics, valuation methods, and risk factors. Vintage luxury handbags funds primarily capitalize on fashion trends, brand prestige, and limited editions, often exhibiting high liquidity and appreciation tied to celebrity influence. Rare watch funds rely on horological rarity, craftsmanship, and historical significance, with valuations driven by auction results and collector demand. Identifying these differences helps investors align their portfolios with targeted returns and risk tolerance in alternative luxury asset markets.

Comparison Table

| Criteria | Vintage Luxury Handbags Funds | Rare Watch Funds |

|---|---|---|

| Asset Type | High-end designer handbags (e.g., Hermes, Chanel) | Exclusive watches (e.g., Rolex, Patek Philippe) |

| Market Growth | Consistent appreciation with 8-12% annual returns | Stable growth, averaging 7-10% annually |

| Liquidity | Moderate liquidity via auctions and private sales | Variable liquidity; often faster through dealers or auctions |

| Volatility | Lower volatility due to established brand demand | Moderate volatility influenced by market trends |

| Investment Horizon | Medium to long-term (3-7 years) | Medium to long-term (3-7 years) |

| Entry Cost | High initial investment (typically $10,000+ per unit) | High initial investment (often $20,000+ per watch) |

| Risk Factors | Brand popularity shifts, counterfeit issues | Market trends, authenticity verification |

| Storage & Maintenance | Requires secure, climate-controlled storage | Needs proper servicing and safe storage |

| Portfolio Diversification | Adds alternative luxury assets, reduces correlation to stocks | Offers diversification away from traditional financial markets |

Which is better?

Vintage luxury handbag funds offer strong appreciation potential due to limited supply and increasing demand from fashion collectors, often demonstrating higher historical returns than rare watch funds. Rare watch funds provide diversification with assets that combine craftsmanship and rarity, benefiting from steady growth driven by global interest in horology. Comparing the two, vintage handbag funds generally yield greater liquidity and rapid market responsiveness, while rare watch funds offer stability and long-term value preservation.

Connection

Vintage luxury handbag funds and rare watch funds share a common investment strategy centered on tangible, high-value collectibles that appreciate due to rarity and brand prestige. Both asset classes leverage market demand trends, historical significance, and limited supply dynamics to generate returns, appealing to investors seeking diversification beyond traditional equities. Their connection lies in the growing alternative investment market where passion-driven assets provide both financial growth and aesthetic appreciation.

Key Terms

Asset Authentication

Asset authentication in rare watch funds relies heavily on expert verification of serial numbers, provenance documentation, and often advanced technologies like X-ray fluorescence to confirm metal purity. In contrast, vintage luxury handbags funds emphasize material authenticity, stitching patterns, and brand-specific stamps, leveraging AI-driven image analysis for defect and counterfeit detection. Explore deeper insights into the nuanced authentication processes defining these niche investment avenues.

Market Liquidity

Rare watch funds benefit from higher market liquidity due to growing global collector interest and ease of authentication, enabling faster transactions and more transparent pricing compared to vintage luxury handbags funds. Vintage luxury handbag funds face challenges with less consistent market demand and slower resale processes, impacting liquidity and investor returns. Explore more about liquidity dynamics to make informed investment decisions in these niche luxury asset classes.

Provenance Documentation

Provenance documentation plays a critical role in both rare watch funds and vintage luxury handbags funds by authenticating the history and legitimacy of each item, thereby enhancing investment value and minimizing fraud risks. Rare watch funds often prioritize detailed service records, original certificates, and manufacturer archives, while vintage luxury handbags funds emphasize receipts, inclusion of original dust bags, and serial number verification. Explore more about how provenance documentation impacts investment strategies across these collectible asset classes.

Source and External Links

How to Invest in Watches - Morpher - Watch funds or alternative investment funds allow investors to gain fractional ownership in curated portfolios of rare and investment-grade watches managed by experts, covering categories like queue-cutting, limited editions, provenance, and price advantage timepieces.

The Beginner's Guide to Watch Investing: How to Get Started - Kubera - Watch investing funds pool money to buy and sell watches as assets, managed by professionals who diversify investments across brands and models, including fractional ownership options to invest in high-value watches at lower entry costs.

Watch Investment Funds: Show Me The Money - Quill & Pad - Collectible watch funds like the Precious Time Fund and South Korean Piece fund enable investors to buy shares in portfolios of sought-after watches such as collectible Rolexes, offering relatively low minimum investments and transparency in holdings.

dowidth.com

dowidth.com