Fractional real estate investing allows individuals to purchase partial ownership in physical properties, enabling portfolio diversification with lower capital requirements. Real estate notes investing involves buying debt secured by real estate, offering predictable income streams through loan repayments without direct property management. Explore the benefits and risks of both strategies to determine which aligns with your investment goals.

Why it is important

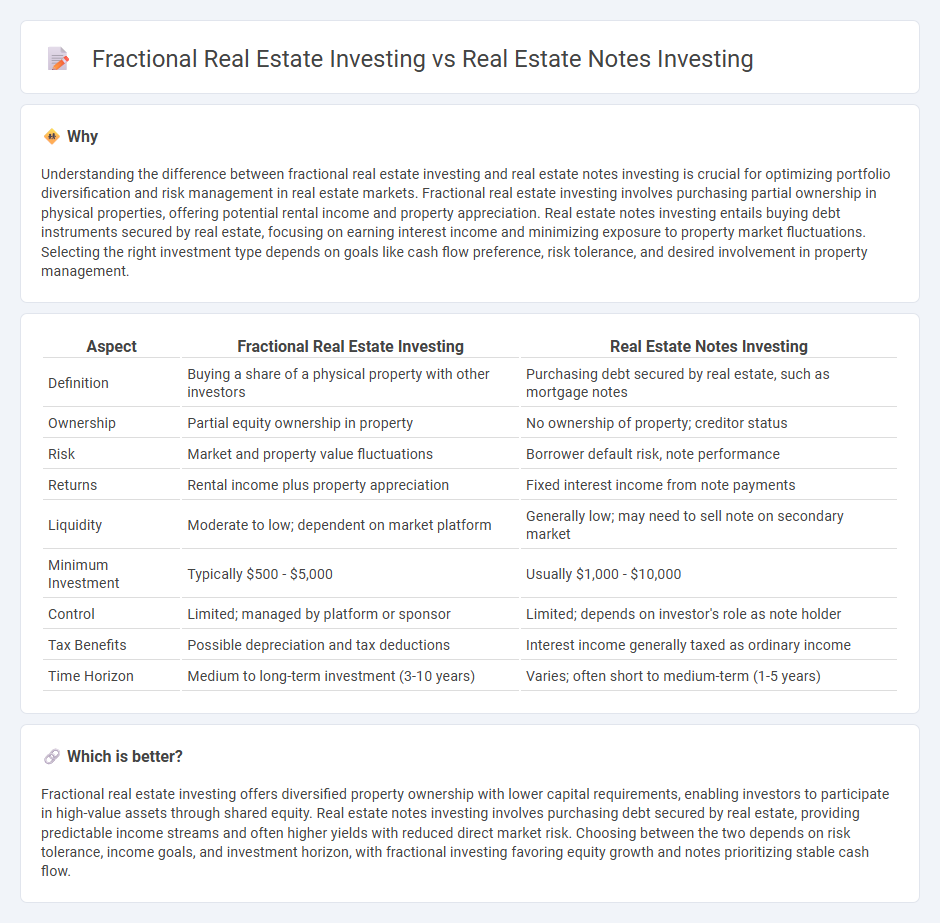

Understanding the difference between fractional real estate investing and real estate notes investing is crucial for optimizing portfolio diversification and risk management in real estate markets. Fractional real estate investing involves purchasing partial ownership in physical properties, offering potential rental income and property appreciation. Real estate notes investing entails buying debt instruments secured by real estate, focusing on earning interest income and minimizing exposure to property market fluctuations. Selecting the right investment type depends on goals like cash flow preference, risk tolerance, and desired involvement in property management.

Comparison Table

| Aspect | Fractional Real Estate Investing | Real Estate Notes Investing |

|---|---|---|

| Definition | Buying a share of a physical property with other investors | Purchasing debt secured by real estate, such as mortgage notes |

| Ownership | Partial equity ownership in property | No ownership of property; creditor status |

| Risk | Market and property value fluctuations | Borrower default risk, note performance |

| Returns | Rental income plus property appreciation | Fixed interest income from note payments |

| Liquidity | Moderate to low; dependent on market platform | Generally low; may need to sell note on secondary market |

| Minimum Investment | Typically $500 - $5,000 | Usually $1,000 - $10,000 |

| Control | Limited; managed by platform or sponsor | Limited; depends on investor's role as note holder |

| Tax Benefits | Possible depreciation and tax deductions | Interest income generally taxed as ordinary income |

| Time Horizon | Medium to long-term investment (3-10 years) | Varies; often short to medium-term (1-5 years) |

Which is better?

Fractional real estate investing offers diversified property ownership with lower capital requirements, enabling investors to participate in high-value assets through shared equity. Real estate notes investing involves purchasing debt secured by real estate, providing predictable income streams and often higher yields with reduced direct market risk. Choosing between the two depends on risk tolerance, income goals, and investment horizon, with fractional investing favoring equity growth and notes prioritizing stable cash flow.

Connection

Fractional real estate investing and real estate notes investing both offer accessible entry points into the real estate market by allowing investors to purchase smaller, manageable interests rather than whole properties. Investors in fractional real estate often benefit from shared ownership in physical properties, whereas real estate notes involve purchasing debt secured by real estate, generating income from loan repayments. Both strategies provide diversification and liquidity advantages compared to traditional full-property ownership, appealing to investors seeking lower capital commitments and varied income streams.

Key Terms

Mortgage Note

Mortgage note investing involves purchasing debt secured by real estate, yielding consistent income from borrower payments and potential profit through note discounting. Fractional real estate investing allows multiple investors to own portions of a property, diversifying risk and sharing rental or appreciation returns. Explore the differences to determine which mortgage note investment strategy aligns best with your financial goals.

Equity Share

Real estate notes investing involves purchasing debt secured by real estate, offering regular interest payments and lower equity risk, while fractional real estate investing provides partial ownership in properties, allowing investors to benefit directly from property appreciation and rental income. Equity share in fractional investing grants investors a proportional claim to property earnings and asset value, aligning returns with actual property performance. Explore deeper insights into equity share dynamics and investment strategies in real estate.

Cash Flow

Real estate notes investing generates consistent cash flow through interest payments secured by property mortgages, providing predictable monthly income with lower management responsibilities compared to direct property ownership. Fractional real estate investing offers cash flow derived from rental income proportionate to the investor's ownership share, but it can be influenced by property management efficiency, vacancies, and market fluctuations. Explore detailed comparisons to understand which cash flow strategy aligns best with your investment goals.

Source and External Links

How to Buy Real Estate Notes in 6 Steps + When To Purchase - Real estate note investing involves purchasing existing mortgage notes to earn passive income and potential high returns, but requires careful research and risk management.

Mastering Real Estate and Mortgage Note Investing - Buying real estate notes means becoming the lender on an existing mortgage, offering a way to profit from interest payments or reselling the note at a profit, often at a discount.

Mortgage Note Investing Guide - Investors can purchase both performing and non-performing real estate notes from banks, brokers, or online marketplaces, but should expect a learning curve and the need for ongoing asset management.

dowidth.com

dowidth.com